- United States

- /

- Electric Utilities

- /

- NYSE:FE

Reassessing FirstEnergy’s Valuation After Its Recent Share Price Strength

Reviewed by Simply Wall St

FirstEnergy (FE) has quietly outperformed many utility peers over the past year, and that strength is drawing fresh attention as investors reassess defensive stocks in a choppy interest-rate backdrop.

See our latest analysis for FirstEnergy.

At around $44.26 per share, FirstEnergy’s roughly 11% year to date share price return and robust five year total shareholder return above 80% signal momentum that still looks supported by improving growth and a steadier risk backdrop.

If this kind of steady compounding appeals to you, it could be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

Yet with shares still trading below consensus targets despite solid earnings growth, investors face a key question: Is FirstEnergy quietly undervalued, or is the market already baking in most of its future upside?

Most Popular Narrative Narrative: 12% Undervalued

With FirstEnergy last closing at $44.26 versus a narrative fair value near $50, the gap points to upside if its growth and grid plans play out.

Large-scale infrastructure modernization and grid hardening initiatives, including the $28 billion investment plan through 2029 and a 15% CAGR in transmission rate base, enable higher returns on equity, improved reliability, and ultimately enhance net margins and earnings growth.

Curious how a regulated utility earns a double digit uplift in value without explosive growth? The secret lies in a powerful mix of expanding rate base, rising margins, and a future earnings multiple usually reserved for market favorites. Want to see exactly how those assumptions stack up over the next few years, and what they imply for cash generation and shareholder returns?

Result: Fair Value of $50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating distributed energy adoption and lingering legal or regulatory overhangs could weigh on demand growth, margin expansion, and ultimately valuation re-rating.

Find out about the key risks to this FirstEnergy narrative.

Another View: Cash Flows Tell a Different Story

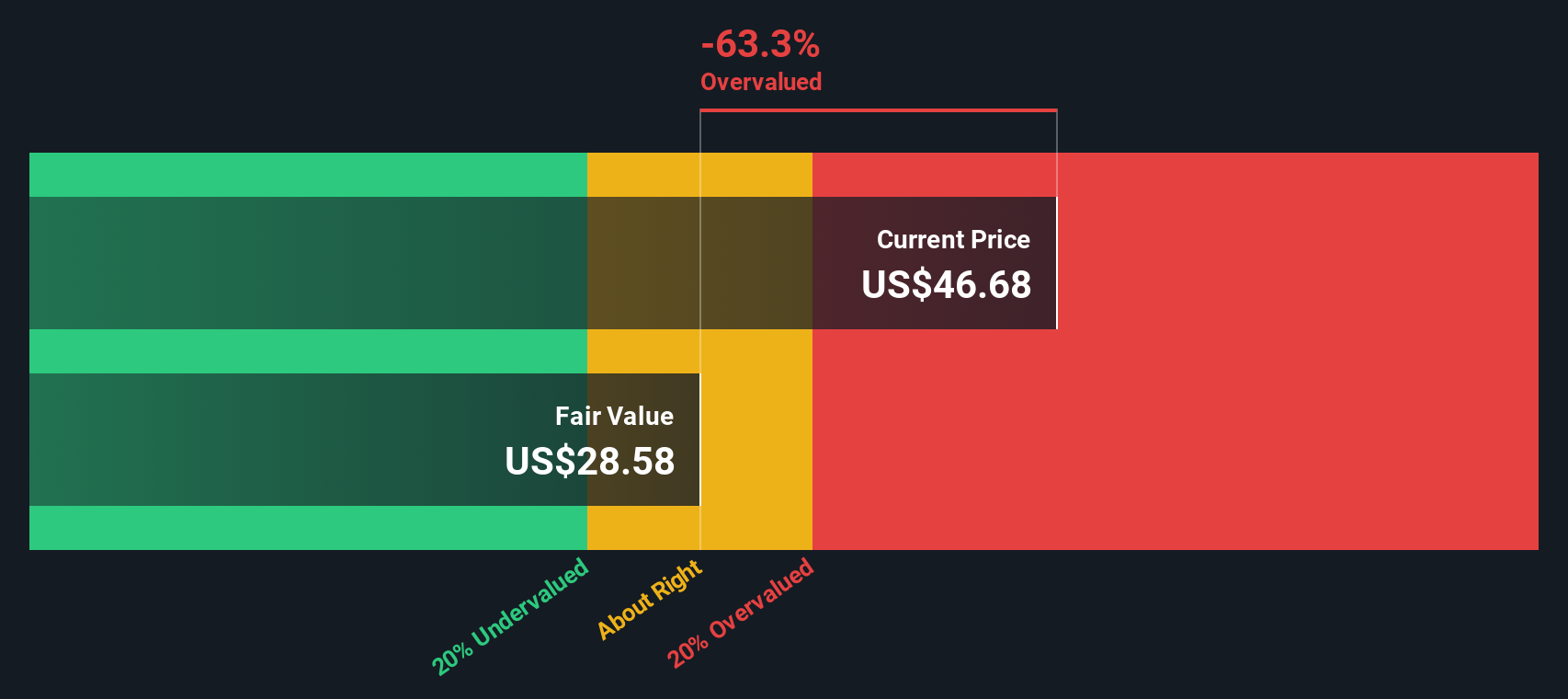

Our DCF model is far less upbeat than the narrative fair value, suggesting FirstEnergy’s shares are trading above an estimated fair value of about $28. That implies the current price bakes in much stronger cash generation than our base case, which raises the risk of disappointment if growth cools.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FirstEnergy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FirstEnergy Narrative

If you see the story differently, or simply prefer digging into the numbers yourself, you can build a complete narrative in minutes with Do it your way.

A great starting point for your FirstEnergy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover fresh ideas before the crowd and keep your watchlist working as hard as you do.

- Capitalize on mispriced potential by scanning these 907 undervalued stocks based on cash flows that may offer stronger upside relative to their current market expectations.

- Ride structural growth trends by targeting these 30 healthcare AI stocks that blend innovation, recurring demand and powerful data advantages.

- Turn volatility into an ally by focusing on these 80 cryptocurrency and blockchain stocks positioned to benefit from expanding blockchain adoption and digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FE

FirstEnergy

Engages in the generation, distribution, and transmission of electricity in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)