- United States

- /

- Other Utilities

- /

- NYSE:ED

Is Con Edison Fairly Priced After Grid Modernization Push And Five Year 55.4% Gain

Reviewed by Bailey Pemberton

- If you are wondering whether Consolidated Edison still looks sensible at today's price, or if the steady dividend giant is quietly getting expensive, you are in the right place to break down what the numbers really say.

- The stock has eased slightly in the short term, slipping about 2.0% over the last week and 0.6% over the last month, but it is still up 8.8% year to date and roughly 55.4% over five years. That pattern points to a sturdier long term story than recent noise suggests.

- Recent headlines have focused on Con Ed's ongoing grid modernization projects and its push into cleaner energy infrastructure. Both of these require heavy upfront investment but can support regulated returns over time. At the same time, regulatory developments around New York's energy transition and cost recovery have kept investors debating how much growth, and risk, is actually priced into the shares.

- On our framework the stock scores a 4 out of 6 on valuation, suggesting it screens as undervalued on most, but not all, of the key checks we run. Next we will walk through those different valuation approaches in detail, then finish with a more holistic way to think about what Con Ed might really be worth.

Find out why Consolidated Edison's 2.8% return over the last year is lagging behind its peers.

Approach 1: Consolidated Edison Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what a stock is worth by projecting all future dividends a company is expected to pay and discounting them back to today, then comparing that value with the current share price.

For Consolidated Edison, the model starts with an annual dividend per share of $3.61 and a return on equity of about 8.5%. The payout ratio sits near 59%, which suggests the dividend is substantial but still leaves room for reinvestment. From these inputs, the DDM assumes long term dividend growth of roughly 3.3%, slightly capped from the underlying 3.5% expected growth to stay conservative.

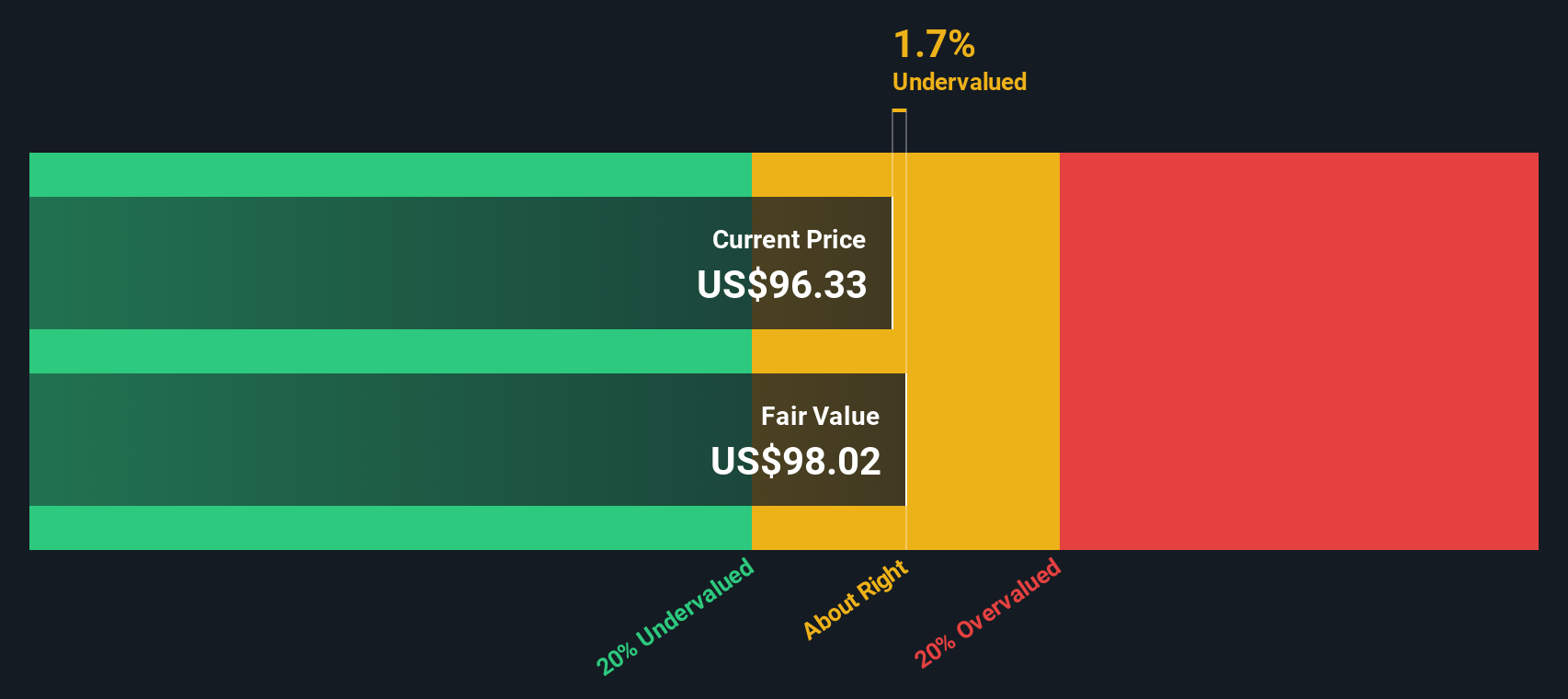

Using those dividend and growth assumptions, the model arrives at an intrinsic value of roughly $97.60 per share. That is only about 0.8% above the current market price, which implies the stock is effectively trading at what the dividend stream is worth on a reasonable, steady growth outlook.

Result: ABOUT RIGHT

Consolidated Edison is fairly valued according to our Dividend Discount Model (DDM), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Consolidated Edison Price vs Earnings

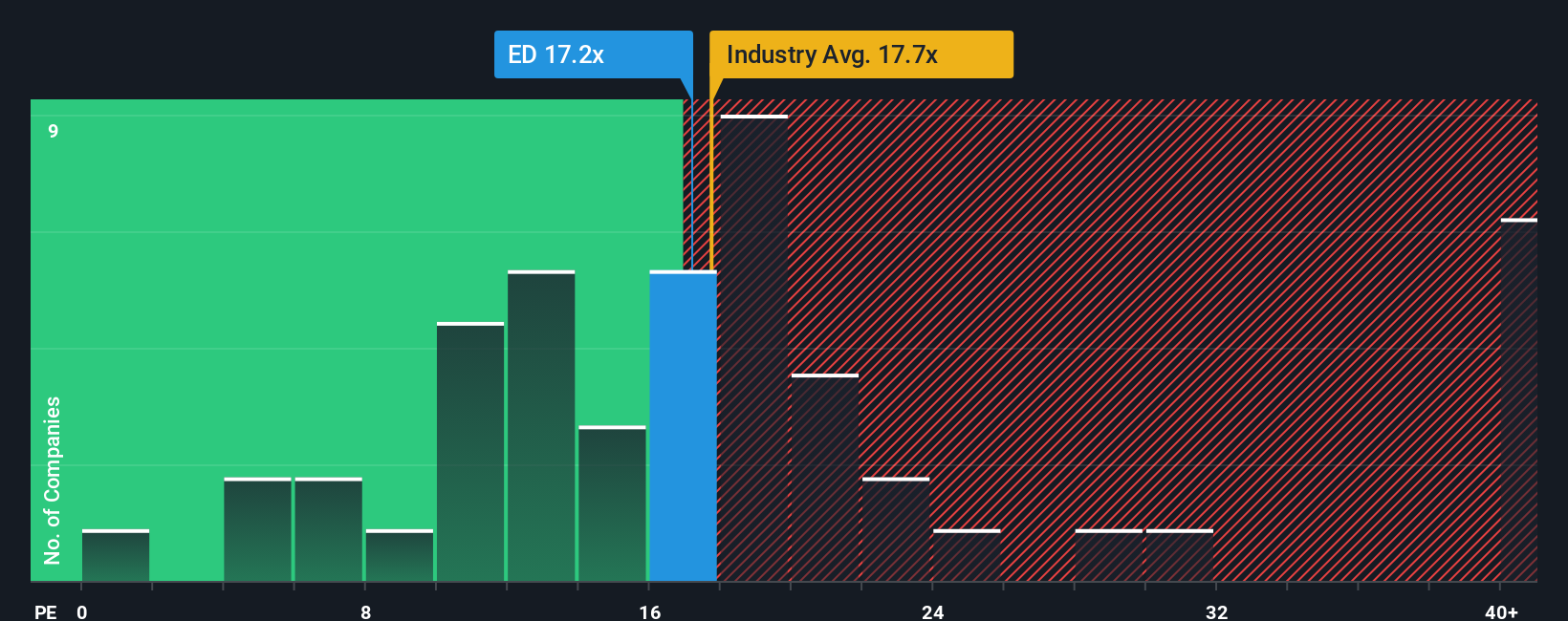

For a stable, profitable utility like Consolidated Edison, the price-to-earnings (PE) ratio is a natural way to think about valuation, because it directly links what investors are paying to the profits the business is already generating.

In broad terms, faster earnings growth and lower perceived risk justify a higher PE, while slower growth, more leverage or regulatory uncertainty usually cap how much investors are willing to pay. Utilities tend to sit in the moderate growth, lower risk bucket, so their PE ratios often cluster in a relatively tight range.

Con Ed currently trades on a PE of about 17.2x, slightly below the integrated utilities industry average of around 17.7x and meaningfully below the broader peer group near 20.9x. Simply Wall St takes this a step further with its Fair Ratio, which estimates what PE the stock should command given its specific growth outlook, profitability, industry, size and risk profile. That Fair Ratio for Consolidated Edison is a higher 23.6x, implying that, on a fundamentals-adjusted basis rather than a simple peer comparison, the shares look too cheap rather than too expensive.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Consolidated Edison Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Consolidated Edison with the numbers behind it.

A Narrative is your story about the company, translated into assumptions for future revenue, earnings and margins, which then flow into a financial forecast and, ultimately, a fair value estimate. On Simply Wall St, Narratives live in the Community page, where millions of investors can quickly build or tweak these stories using accessible tools, instead of complex spreadsheets. Narratives can help you frame your decisions by constantly comparing your Fair Value to the current Price, and they automatically update as new information, such as earnings results or major grid investment news, comes in. For example, one Consolidated Edison Narrative might assume slow growth and tight regulation, leading to a relatively low fair value, while another Narrative assumes faster clean energy expansion with supportive regulators, resulting in a much higher fair value and a stronger case for owning the stock today.

Do you think there's more to the story for Consolidated Edison? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ED

Consolidated Edison

Through its subsidiaries, engages in the regulated electric, gas, and steam delivery businesses in the United States.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026