- United States

- /

- Other Utilities

- /

- NYSE:DTE

DTE Energy (NYSE:DTE) Powers 23,000 Homes With New 100MW Polaris Solar Park

Reviewed by Simply Wall St

DTE Energy (NYSE:DTE) recently completed the construction of the Polaris Solar Park, a significant milestone in its renewable energy expansion efforts. This venture highlights the company's commitment to sustainable practices, aiming to power over 23,000 homes with clean energy. Alongside this, DTE reported robust Q1 2025 earnings, with sales rising significantly compared to the previous year. Furthermore, the dividend announcement and ongoing projects have likely contributed to stable investor confidence. Within the broader context, as market indices like the S&P 500 edged upward, DTE's stock posted a modest 1.7% gain over the last quarter, aligning with general market movements.

The completion of the Polaris Solar Park underscores DTE Energy's ongoing commitment to renewable energy, potentially impacting future revenue and earnings by positioning the company favorably within the growing sustainable energy sector. This investment complements their efforts in grid modernization, which is anticipated to enhance reliability and reduce operational costs. Nevertheless, such high capital investments introduce risks, particularly regarding dependency on regulatory incentives and approvals.

Over the last five years, DTE Energy's total shareholder return, which includes both share price growth and dividends, was 73.16%. This is significant relative to the company's recent one-year performance, where it exceeded both the US Integrated Utilities industry and US market benchmarks with 1-year returns surpassing these indices. Despite recent positive quarterly gains, the company's stock was relatively stable over the last quarter.

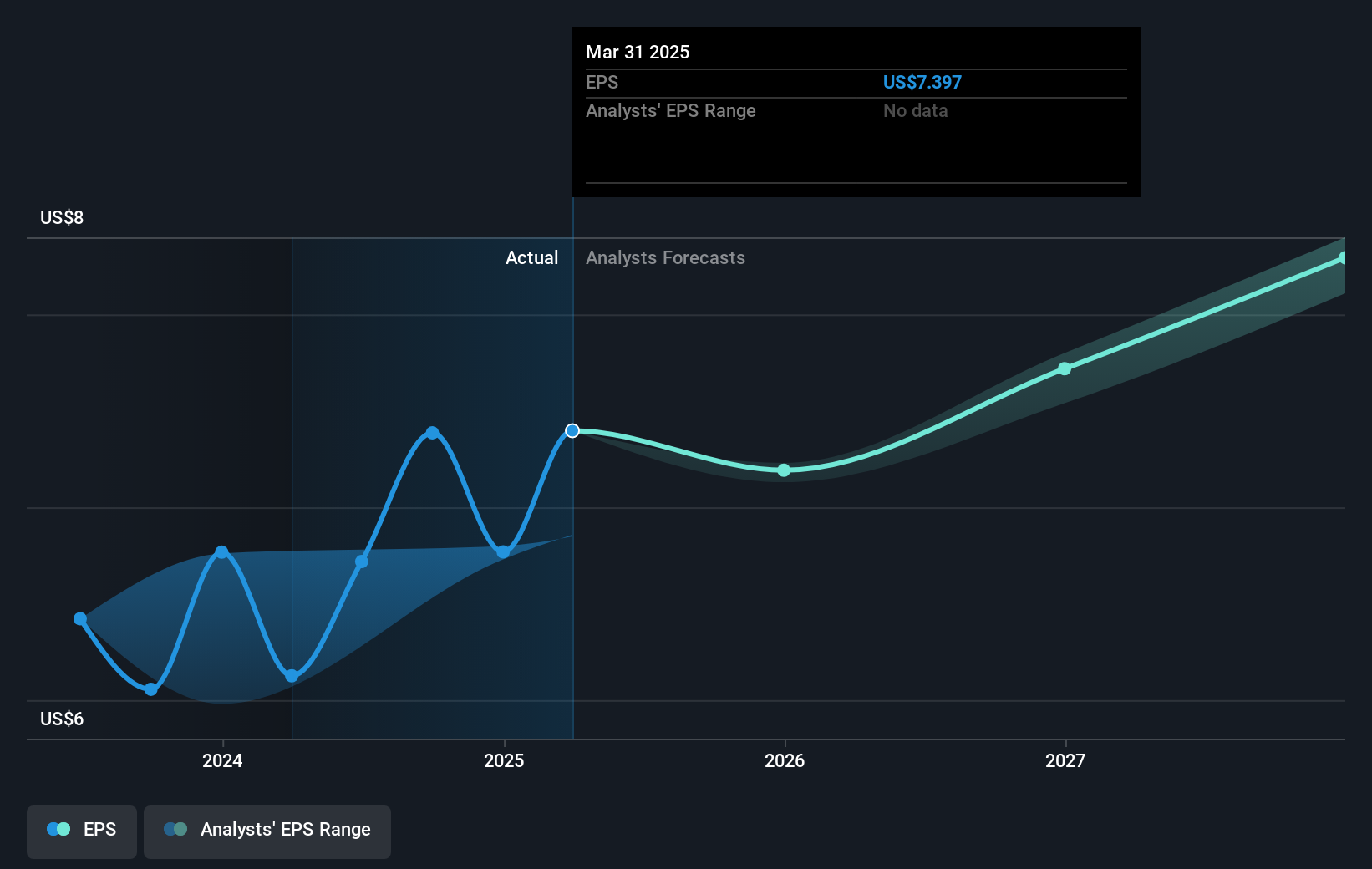

This strategic focus on infrastructure and clean energy could support analyst forecasts that project revenue growth to US$14.3 billion and earnings to US$1.8 billion by 2028. Assuming these projections hold, current trading at 6.3% below fair value might present a potential alignment with the consensus price target of US$140.78. The relatively small 2.2% price movement towards the target reflects an analyst agreement on the company's fair pricing given the structured growth trajectory and achievable margins. However, these remain subject to various external and internal factors influencing DTE's financial ecosystem.

Examine DTE Energy's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTE

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)