- United States

- /

- Water Utilities

- /

- NYSE:CWT

Should California Water Service Group’s (CWT) $370 Million Debt Raise Change How Investors View Its Balance Sheet?

Reviewed by Sasha Jovanovic

- On October 1, 2025, California Water Service Group completed the sale of US$170 million in senior unsecured notes and US$200 million in first mortgage bonds in private placement transactions, both receiving strong S&P Global ratings and accruing semi-annual interest.

- This debt financing provides the company with enhanced financial flexibility for refinancing and general corporate purposes, underpinned by robust credit ratings and a focus on balance sheet strength.

- We'll examine how this sizable debt issuance, earmarked for refinancing and new initiatives, impacts the company's long-term investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

California Water Service Group Investment Narrative Recap

For investors considering California Water Service Group, the key belief is in the company’s ability to drive long-term growth by expanding its regulated asset base and securing timely rate relief, even as regulatory risk remains elevated. The recent US$370 million debt issuance, while reinforcing balance sheet strength, has little immediate impact on the ongoing California General Rate Case process, the primary near-term catalyst and the largest source of business uncertainty.

The company’s upcoming Q3 2025 earnings announcement stands out as particularly relevant, since management’s commentary could provide updates on the use of new capital, rate case progress, and cost recovery for PFAS treatment investments, which are essential to the company’s earnings outlook. Investors closely watch these updates for any changes to the timing or outcome of rate approval, given how pivotal it is for revenue and cash flow.

However, in contrast to recent optimism, future profitability could still face pressure if regulatory delays persist beyond the current expectations, investors should be aware of ...

Read the full narrative on California Water Service Group (it's free!)

California Water Service Group's narrative projects $1.1 billion revenue and $187.9 million earnings by 2028. This requires 3.9% yearly revenue growth and a $52.1 million earnings increase from $135.8 million today.

Uncover how California Water Service Group's forecasts yield a $55.50 fair value, a 17% upside to its current price.

Exploring Other Perspectives

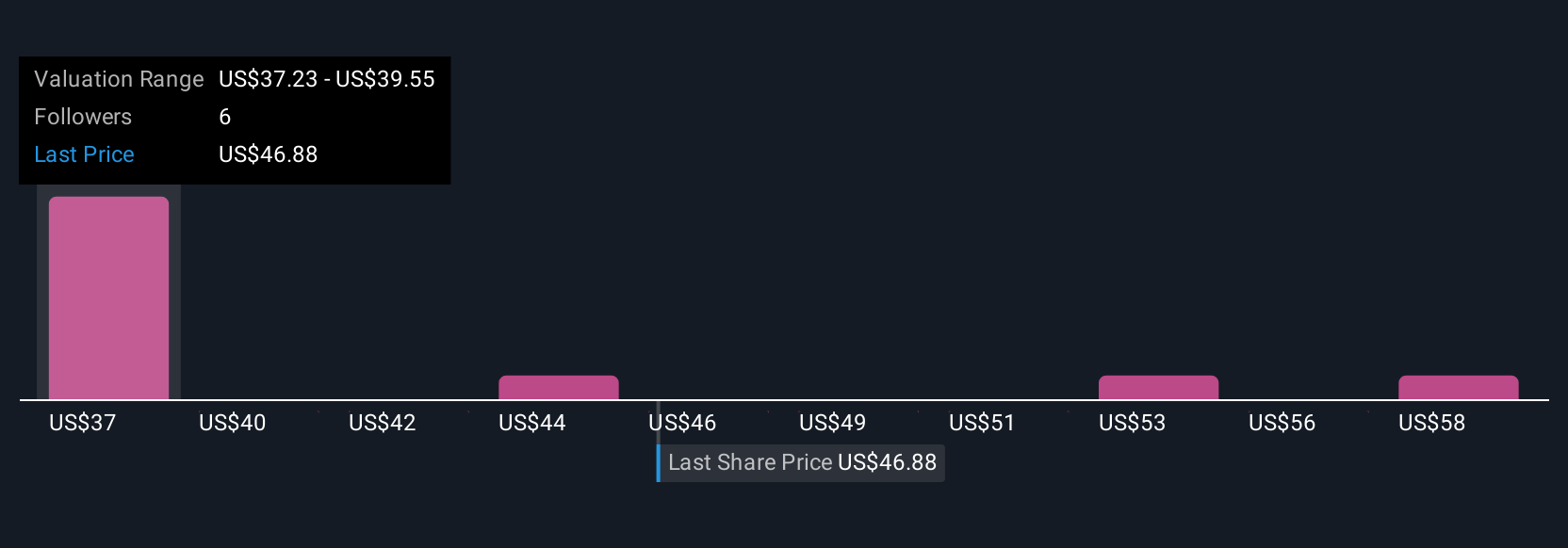

Four members of the Simply Wall St Community suggest fair values for the stock between US$36.33 and US$60.39. With regulatory outcomes still uncertain, expectations for future revenue growth vary widely, highlighting the importance of considering multiple viewpoints.

Explore 4 other fair value estimates on California Water Service Group - why the stock might be worth 23% less than the current price!

Build Your Own California Water Service Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your California Water Service Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free California Water Service Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate California Water Service Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWT

California Water Service Group

Through its subsidiaries, provides water utility and other related services in California, Washington, New Mexico, Hawaii, and Texas.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives