- United States

- /

- Other Utilities

- /

- NYSE:CNP

Leadership Overhaul and $65 Billion Plan Might Change The Case For Investing In CenterPoint Energy (CNP)

Reviewed by Sasha Jovanovic

- Earlier this month, CenterPoint Energy announced key leadership changes, naming Jason P. Wells as Chair of the Board and Christopher H. Franklin as Lead Director, alongside the launch of a new 10-year, $65 billion capital plan aimed at long-term growth.

- This move leverages deep industry expertise at the board level to steer a major capital investment initiative that focuses on infrastructure resiliency and operational effectiveness.

- To understand how this leadership shift and capital plan could shape future prospects, we’ll explore its implications for CenterPoint Energy’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

CenterPoint Energy Investment Narrative Recap

To be a shareholder in CenterPoint Energy, you need to believe in the company’s ability to execute its long-term, capital-heavy growth plans while managing regulatory and cost risks. The recent $500 million debt tender reflects efforts to optimize the balance sheet, but does not materially change execution risk as the key short-term catalyst, nor does it alter the most pressing risk of regulatory delays affecting capital recovery. For now, these fundamentals remain the primary drivers to watch.

Among recent announcements, the execution of a $65 billion, 10-year capital plan stands out as most relevant, reinforcing the importance of timely regulatory approvals and disciplined project delivery. This initiative aims to support the company's growth trajectory while highlighting the potential for both operational and financial upside, contingent on effective risk management and regulatory processes.

However, investors should be especially mindful of the potential downside if regulatory lags or approval delays ...

Read the full narrative on CenterPoint Energy (it's free!)

CenterPoint Energy’s outlook anticipates $10.5 billion in revenue and $1.5 billion in earnings by 2028. This implies a 5.4% annual revenue growth rate and a $564 million increase in earnings from the current $936 million.

Uncover how CenterPoint Energy's forecasts yield a $40.85 fair value, a 3% upside to its current price.

Exploring Other Perspectives

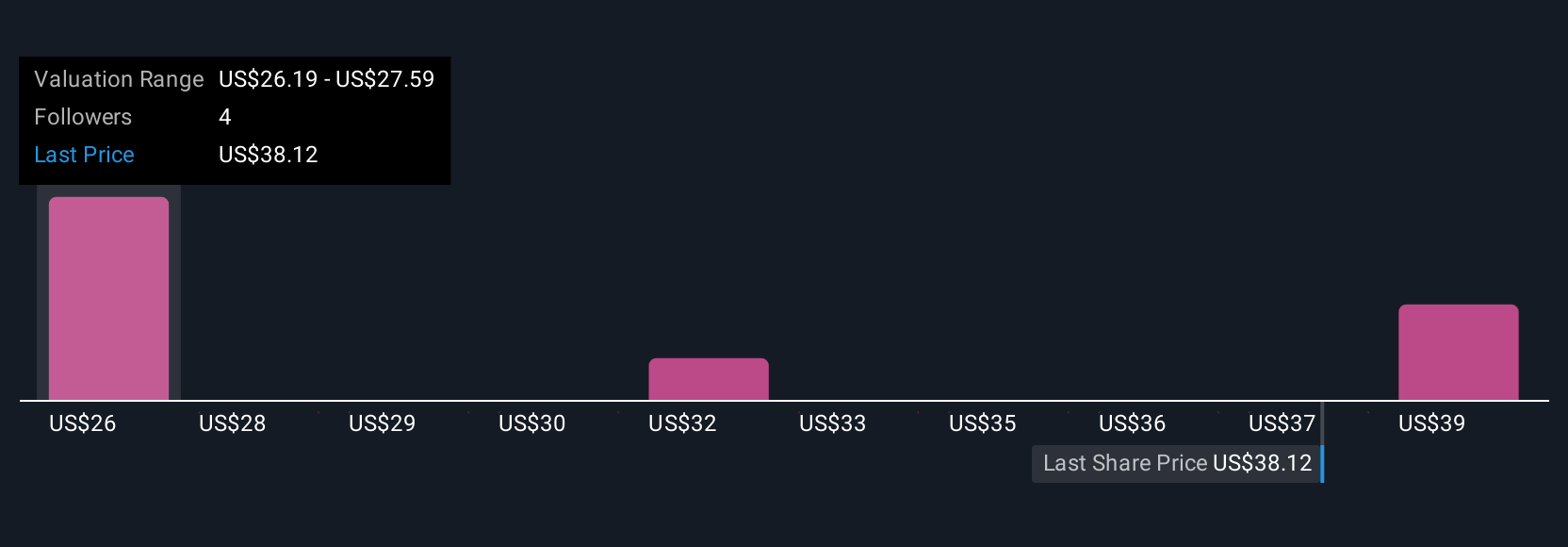

Community fair value estimates for CenterPoint Energy span from US$26.15 to US$43 based on four different analyses from the Simply Wall St Community. With execution risk tied closely to regulatory approvals and capital planning, your perspective may align with one of many possible views on the company’s long-term prospects.

Explore 4 other fair value estimates on CenterPoint Energy - why the stock might be worth 34% less than the current price!

Build Your Own CenterPoint Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CenterPoint Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free CenterPoint Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CenterPoint Energy's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNP

CenterPoint Energy

Operates as a public utility holding company in the United States.

Questionable track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives