- United States

- /

- Other Utilities

- /

- NYSE:CNP

CenterPoint Energy (NYSE:CNP) Completes Grid Resiliency Enhancements Ahead Of Hurricane Season

Reviewed by Simply Wall St

CenterPoint Energy (NYSE:CNP) recently finalized its grid resiliency improvements ahead of the 2025 hurricane season, a development that emphasizes its dedication to customer service and reliability. The company's stock price increased by 8% over the past quarter, a period marked by positive market movements that did not significantly diverge in direction. The completion of key infrastructural upgrades added positive weight against a backdrop of market disturbances, such as trade uncertainties led by presidential announcements impacting broad market indices. Overall, CenterPoint's enhancements and strategic collaborations supported its stock performance amidst fluctuating market conditions.

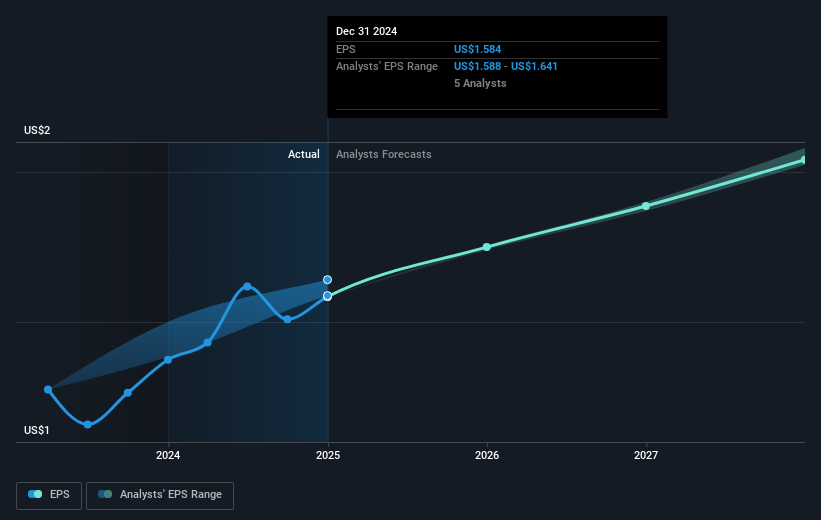

The recent news regarding CenterPoint Energy's completion of grid resiliency improvements is an integral part of the company's planned capital investments aimed at enhancing future revenue and earnings growth. These developments align with the narrative of CenterPoint's focus on infrastructure upgrades to support load growth and regulatory stability. Increased capital expenditures, like the $1 billion boost through 2030, can reinforce long-term earnings potential, especially given the projected 5.3% annual revenue growth and increased profit margins confirming analyst forecasts.

Over the past five years, CenterPoint Energy's total shareholder return, including stock appreciation and dividends, was 135.03%, showcasing a robust performance relative to individual market fluctuations. Over the past year alone, the company's shares outperformed the US Market's 9.1% return and the US Integrated Utilities industry, which returned 12.5%, reflecting its resilience in various market conditions.

Considering the current share price stands at US$38.92, slightly above the consensus analyst price target of US$37.97, implies that investors perceive the stock to be appropriately valued. However, the close proximity suggests potential moderation in upward price movement unless further earnings forecasts are realized. Analysts anticipate earnings will reach $1.4 billion by 2028, requiring a future PE ratio of 22.0x, down from today's 26.3x, which may reflect elevated expectations within the industry. This calculation serves as an important context when weighing the company's current valuation against its growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNP

CenterPoint Energy

Operates as a public utility holding company in the United States.

Proven track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives