- United States

- /

- Other Utilities

- /

- NYSE:CNP

A Fresh Look at CenterPoint Energy (CNP) Valuation as Shares Reach New Highs in 2024

Reviewed by Kshitija Bhandaru

See our latest analysis for CenterPoint Energy.

CenterPoint Energy’s share price has picked up meaningful steam in 2024, rising over 24% so far this year and building on strong investor sentiment that is also reflected in an impressive 36% total shareholder return over the past twelve months. While a steady drumbeat of operational progress has quietly supported the rally, it is clear that momentum is still building for the stock as market enthusiasm for utilities with stable growth profiles continues.

If you’re searching for the next wave of opportunities beyond utilities, now is a great time to broaden your scope and uncover fast growing stocks with high insider ownership

With shares reaching new highs and strong fundamentals in place, the crucial question remains: is CenterPoint Energy undervalued at current levels, or has the market already priced in its future growth prospects, leaving little room for upside?

Most Popular Narrative: 3.9% Undervalued

CenterPoint Energy’s latest fair value calculation stands above the last close, suggesting there is still some upside potential from current levels. This narrative frames the investment case around the company’s aggressive capital investment outlook and the long-term financial runway it provides.

The company announced a $1 billion increase to its capital investment plan through 2030, driven by significant load growth in the Houston Electric service territory. This is expected to bolster capital expenditures and, consequently, long-term revenue and earnings.

Curious what’s powering this edge in valuation? Behind these numbers are bold forecasts of expanding growth channels, profit margin expansion, and a future earnings multiple that is turning heads among utility investors. Can these ambitious targets really hold up? Find out exactly what is driving analyst optimism in the full narrative.

Result: Fair Value of $40.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory delays or higher financing costs could quickly weigh on earnings and challenge the optimistic outlook that currently supports CenterPoint Energy's valuation.

Find out about the key risks to this CenterPoint Energy narrative.

Another View: Looking at Market Multiples

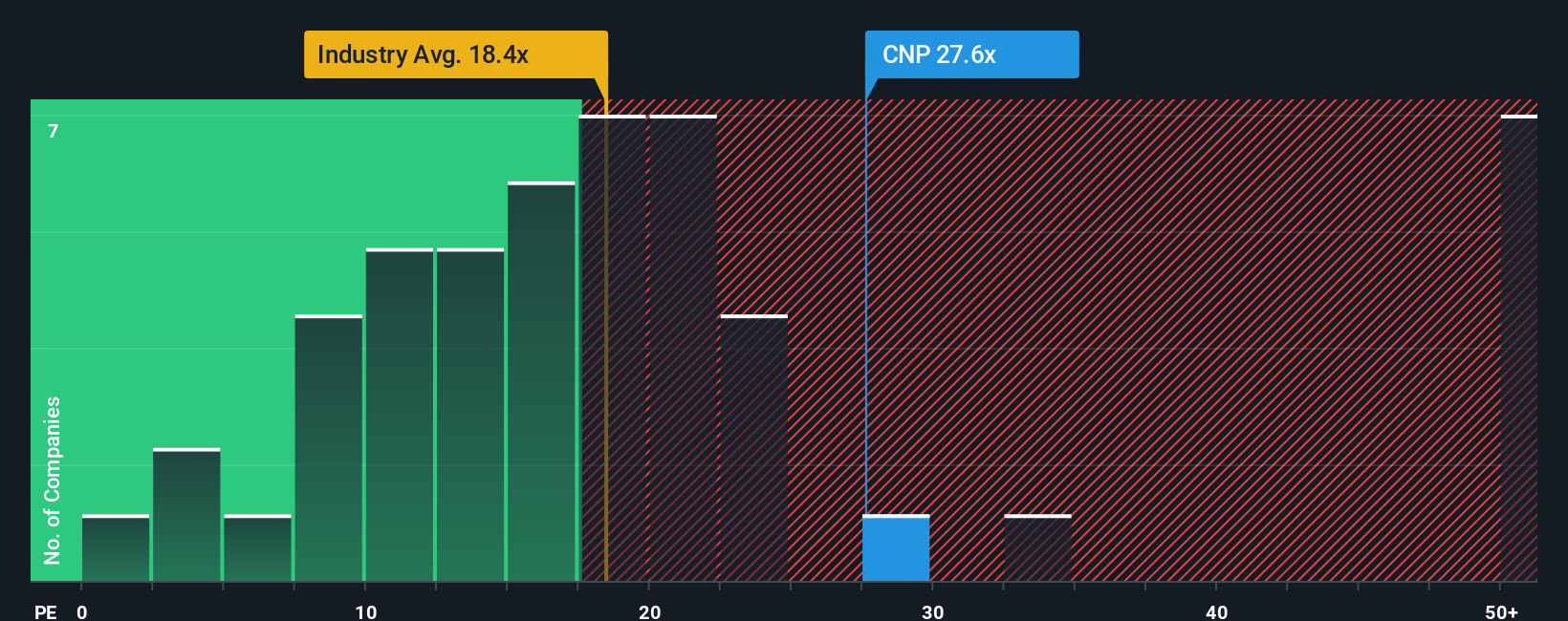

While the fair value narrative points to a slight undervaluation, market multiples tell a different story. CenterPoint Energy is currently trading at a price-to-earnings ratio of 27.4x, which is well above its peer average of 22.5x and the global industry average of 18.4x. Even against its own fair ratio of 23.4x, the stock appears expensive. This could mean limited upside unless earnings growth accelerates.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CenterPoint Energy Narrative

If the evidence points you in a different direction, or if you want to run your own numbers, you can craft your own view in just a few minutes with Do it your way.

A great starting point for your CenterPoint Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for just one angle. Supercharge your investing by tapping into handpicked stock ideas you won’t want to overlook on your next market move.

- Catch high yields and steady growth with these 19 dividend stocks with yields > 3% for a lineup of strong dividend payers with proven stability.

- Chase early-stage gains from companies harnessing advanced tech trends by checking out these 24 AI penny stocks.

- Zero in on value plays that could boost your returns with these 892 undervalued stocks based on cash flows for picks with strong cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNP

CenterPoint Energy

Operates as a public utility holding company in the United States.

Questionable track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives