- United States

- /

- Other Utilities

- /

- NYSE:CMS

Will Emergency Training Partnerships and Data Center Deals Shift CMS Energy's (CMS) Growth Trajectory?

Reviewed by Sasha Jovanovic

- Consumers Energy, a subsidiary of CMS Energy, recently partnered with ERS International to conduct a weeklong firefighter training at the Marshall Training Center, focusing on hands-on emergency response tactics and strengthening collaboration between utilities and first responders.

- This initiative underlines CMS Energy's ongoing efforts to enhance emergency preparedness and foster greater community safety through direct engagement with essential service partners.

- We'll review how the new data center agreement and expanding emergency partnerships impact CMS Energy's investment outlook and projected growth.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

CMS Energy Investment Narrative Recap

CMS Energy shareholders typically look for steady regulated growth, a supportive Michigan regulatory environment, and disciplined capital investments to underpin long-term earnings and dividend stability. While Consumers Energy’s firefighter training partnership strengthens community ties and risk management, its impact on short-term load growth catalysts and primary balance sheet risks is not material for near-term results.

Of recent announcements, the new data center agreement stands out. Adding up to 1 gigawatt of incremental demand, this project is highly relevant to CMS’s main growth catalyst, accelerating load from large customers, but will heighten the pressure on infrastructure resilience and capital allocation effectiveness.

However, in contrast to these growth prospects, investors should not overlook the risk that ongoing expansion could require substantial financing beyond internal cash flows if rate recovery or demand falls short...

Read the full narrative on CMS Energy (it's free!)

CMS Energy is projected to reach $9.2 billion in revenue and $1.4 billion in earnings by 2028. This outlook assumes annual revenue growth of 4.6% and a $0.4 billion increase in earnings from the current $1.0 billion.

Uncover how CMS Energy's forecasts yield a $76.54 fair value, a 4% upside to its current price.

Exploring Other Perspectives

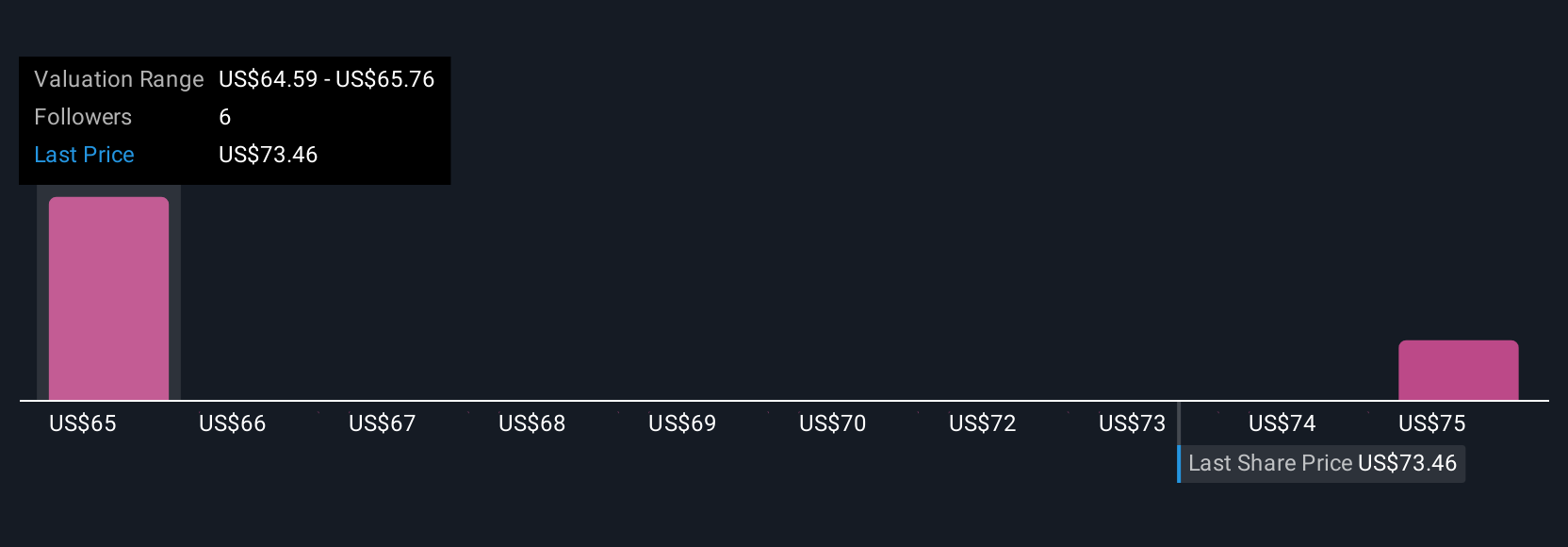

With two fair value estimates from the Simply Wall St Community ranging from US$64.21 to US$76.54, your peers see the stock priced both below and above current levels. As capital needs climb with new large-scale load commitments, shifting opinions highlight just how much future revenue growth and cost recovery can influence return expectations.

Explore 2 other fair value estimates on CMS Energy - why the stock might be worth as much as $76.54!

Build Your Own CMS Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CMS Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CMS Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CMS Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMS

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives