- United States

- /

- Other Utilities

- /

- NYSE:CMS

Is CMS Energy's (CMS) Spending Surge Delivering on Its Capital Allocation Strategy?

Reviewed by Simply Wall St

- In recent news, CMS Energy's return on capital employed has stayed flat at about 5.1% over the past five years, even as it increased capital investments by 36% during that period.

- This ongoing reinvestment without a corresponding rise in returns points to underlying difficulties in earning higher profits from new growth initiatives.

- We will explore how CMS Energy's flat return on invested capital, despite higher spending, affects its overall investment outlook and prospects.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

CMS Energy Investment Narrative Recap

To be a shareholder in CMS Energy, you need to believe in the utility’s ability to turn robust grid and renewable investments into sustained growth, especially as Michigan’s energy demand rises. However, the recent news that return on capital has remained flat, despite a 36% increase in capital investment, does not meaningfully change the company’s short-term catalysts, like new load growth or grid expansion, but does sharpen focus on the biggest risk: expensive financing may pressure margins and future returns if profits per dollar invested fail to improve.

Among recent announcements, CMS Energy’s July 2025 debt tender offer stands out. The move to repurchase outstanding bonds aligns with efforts to better manage financing costs, especially relevant as ongoing capital spending and muted returns make the cost and mix of funding a central focus for future profit margins amid regulatory and market shifts.

In contrast, investors should be aware that if rising capital costs continue outpacing returns, the sustainability of CMS Energy’s growth plans could be at risk…

Read the full narrative on CMS Energy (it's free!)

CMS Energy's outlook anticipates $9.2 billion in revenue and $1.4 billion in earnings by 2028. This is based on a 4.6% annual revenue growth rate and a $0.4 billion increase in earnings from the current $1.0 billion.

Uncover how CMS Energy's forecasts yield a $76.54 fair value, a 7% upside to its current price.

Exploring Other Perspectives

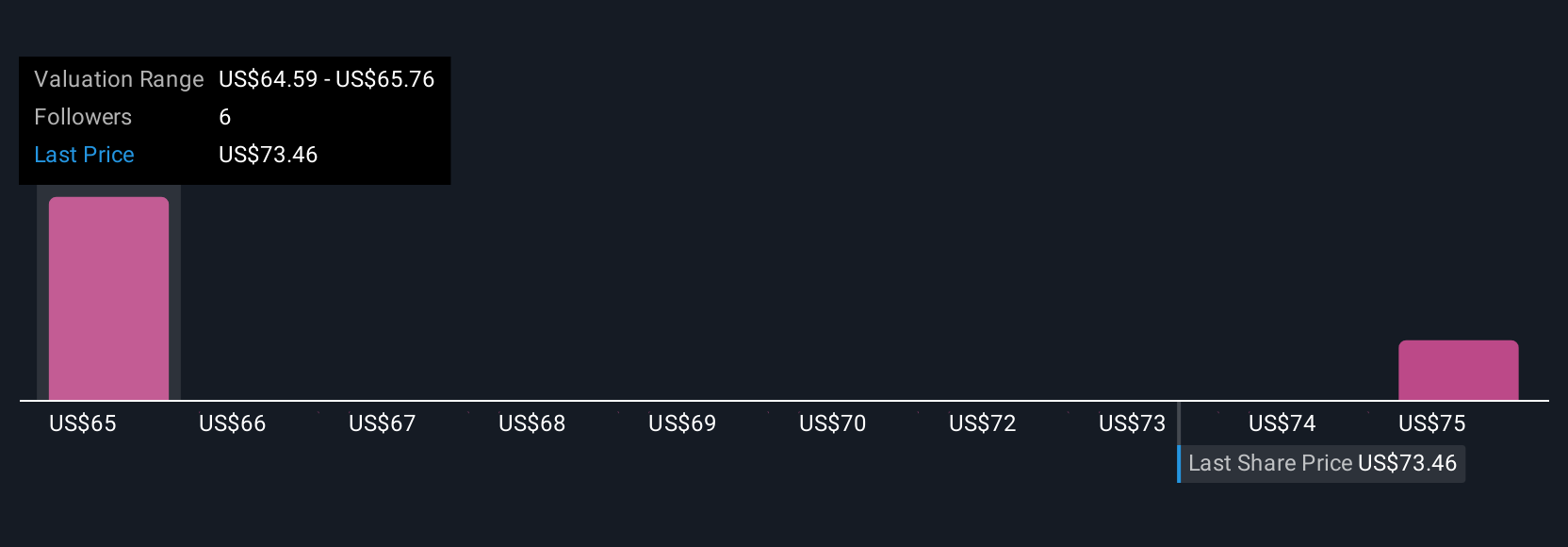

Simply Wall St Community members provided two fair value estimates for CMS Energy shares, ranging sharply from US$64.21 to US$76.54. Different opinions on the company’s capital returns and financing risks show that views can vary widely, explore these alternative viewpoints to sharpen your own assessment.

Explore 2 other fair value estimates on CMS Energy - why the stock might be worth 10% less than the current price!

Build Your Own CMS Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CMS Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CMS Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CMS Energy's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMS

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives