- United States

- /

- Other Utilities

- /

- NYSE:BKH

Will Black Hills' (BKH) $4.7 Billion Expansion Pipeline Power Its Long-Term Growth Strategy?

Reviewed by Sasha Jovanovic

- Black Hills Corporation, a provider of electricity and natural gas to 1.34 million customers across eight states, recently announced it will report its Q3 2025 earnings on November 5, with Wall Street analysts expecting year-over-year improvement in earnings per share to US$0.45.

- The company has also highlighted a US$4.7 billion investment pipeline through 2029 focused on transmission and pipeline expansions, and continues to be recognized for maintaining strong credit metrics and paying a dividend yield above 4%.

- We will explore how Black Hills’ robust capital spending plans could influence its long-term growth and reshape its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Black Hills Investment Narrative Recap

To be a shareholder in Black Hills Corporation, you need to believe in the ongoing demand for regulated electric and gas utilities in its eight-state footprint, underpinned by a robust US$4.7 billion capital program aimed at transmission and pipeline expansions through 2029. The recent confirmation of its Q3 2025 earnings release and analyst expectations for improved earnings per share do not materially shift the current investment catalysts or the primary risk: the significant cash demands of these long-term infrastructure projects if regulatory recovery is delayed or cost overruns occur.

Among the recent company announcements, the regulatory approval in Kansas for US$118 million in system investments, with rate hikes to generate US$15.2 million in annual base revenue, is especially relevant. This kind of timely regulatory win remains crucial for financing Black Hills' infrastructure pipeline and helps support the key short-term catalyst of predictable earnings growth through effective rate recovery.

But as regulatory frameworks evolve and cost pressures persist, investors should also be mindful of the ongoing risk if infrastructure spending gets too far ahead of recovery timelines and...

Read the full narrative on Black Hills (it's free!)

Black Hills' narrative projects $3.0 billion revenue and $375.9 million earnings by 2028. This requires 10.3% yearly revenue growth and a $91.7 million earnings increase from $284.2 million.

Uncover how Black Hills' forecasts yield a $68.50 fair value, a 10% upside to its current price.

Exploring Other Perspectives

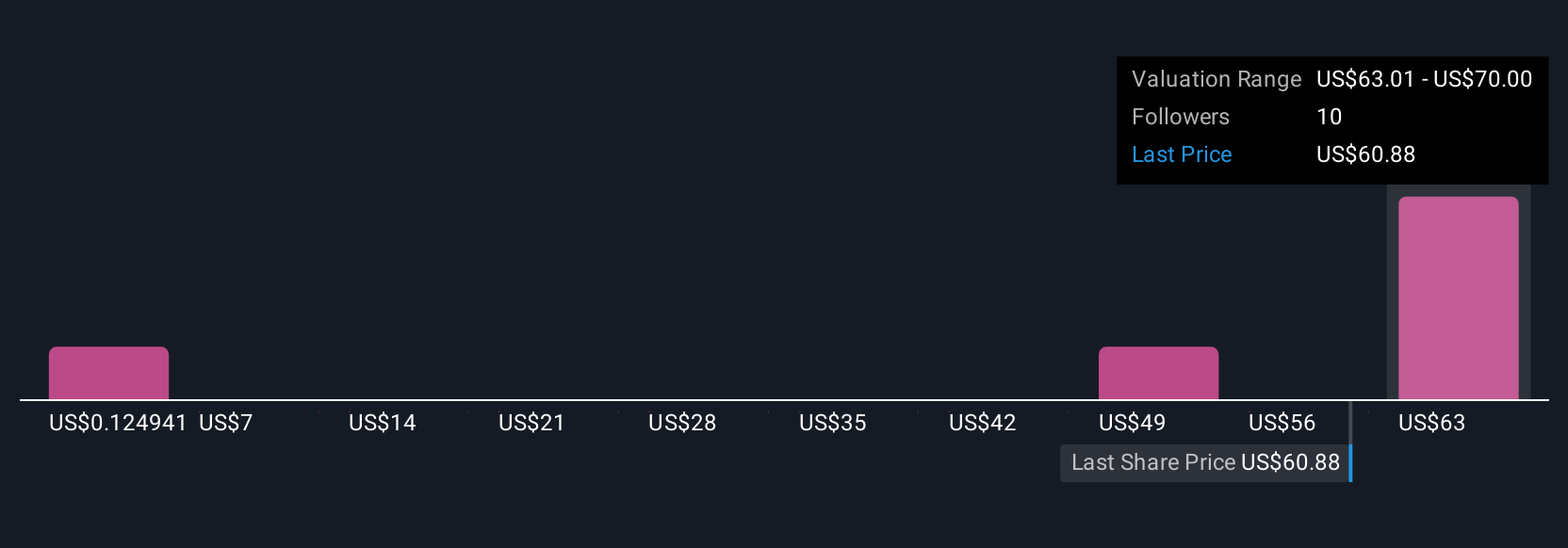

Six private investor estimates from the Simply Wall St Community place Black Hills’ fair value between US$0.12 and US$70, showing strikingly different views on its potential. While several foresee opportunity in regulated asset growth, others point to the balance sheet risks tied to heavy infrastructure outlays and their impact on future earnings.

Explore 6 other fair value estimates on Black Hills - why the stock might be worth as much as 13% more than the current price!

Build Your Own Black Hills Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Black Hills research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Black Hills research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Black Hills' overall financial health at a glance.

No Opportunity In Black Hills?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Hills might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKH

Black Hills

Through its subsidiaries, operates as an electric and natural gas utility company in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives