Last Update26 Aug 25Fair value Increased 5.06%

The consensus price target for Black Hills has increased to $68.50, primarily reflecting a sharp upward revision in forecast revenue growth despite a notable decline in net profit margin.

What's in the News

- Black Hills and NorthWestern Energy Group announced an all-stock, tax-free merger to create a leading regional regulated utility with a pro forma market capitalization of approximately $7.8 billion; CEO Linn Evans will retire following transaction close.

- Black Hills reaffirmed 2025 earnings guidance at $4.00 to $4.20 per share.

- Black Hills’ Kansas natural gas utility received approval for new rates, yielding $15.2 million in annual base rate revenue increase and continued use of the GSRS for pipeline upgrades.

- Black Hills' South Dakota electric utility subsidiary secured approval to begin constructing the $280 million Lange II Project, a 99 MW dispatchable generation resource expected to serve customers in the second half of 2026.

Valuation Changes

Summary of Valuation Changes for Black Hills

- The Consensus Analyst Price Target has risen from $65.20 to $68.50.

- The Consensus Revenue Growth forecasts for Black Hills has significantly risen from 0.1% per annum to 10.3% per annum.

- The Net Profit Margin for Black Hills has significantly fallen from 16.70% to 12.49%.

Key Takeaways

- Growing demand from tech-driven customers and regional development is accelerating volumetric growth and supporting long-term revenue expansion.

- Major capital investments and innovative regulatory strategies are strengthening earnings, cash flow stability, and future margins above industry averages.

- Heavy infrastructure investment and reliance on concentrated, volatile customer segments make Black Hills vulnerable to regulatory delays, evolving energy trends, and regional or environmental risks.

Catalysts

About Black Hills- Through its subsidiaries, operates as an electric and natural gas utility company in the United States.

- Accelerated demand growth from hyperscale data center and blockchain customers-along with broader population and economic development across the Mountain West-is driving substantial increases in electricity peak loads and utility customer counts, pointing toward robust, sustained volumetric growth and upward pressure on long-term revenue.

- Large-scale capital investments-such as the Ready Wyoming transmission expansion, Lange II natural gas generation, and Colorado Clean Energy Plan renewables projects-are expected to materially expand Black Hills' regulated rate base, enabling predictable, above-sector-average long-term earnings and net margins through constructive rate recovery mechanisms and innovative tariffs.

- Successful execution of regulatory strategies-including frequent, constructive rate reviews and timely rider mechanisms-has ensured rapid recovery of over $1.3B in recent system investments and will continue supporting cash flow stability and net margin expansion as capital projects ramp over the next several years.

- Tech-driven industrial load, specifically from major customers like Microsoft and Meta, is forecast to contribute over 10% of total EPS by 2028, and new load agreements (including those not yet in current five-year forecasts) offer upside, underpinning long-term EPS and revenue growth potential above current conservative financial guidance.

- The combination of grid modernization, enhanced resiliency initiatives, and the ability to attract tech customers in regulated territories positions Black Hills to benefit from sustainable financing advantages, potentially lowering capital costs and further improving capital efficiency and future earnings generation.

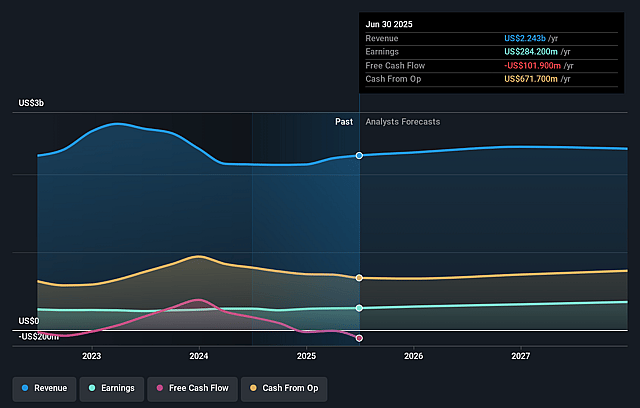

Black Hills Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Black Hills's revenue will grow by 10.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.7% today to 12.5% in 3 years time.

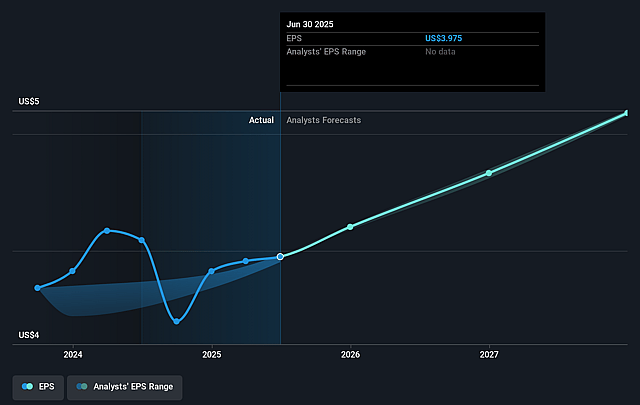

- Analysts expect earnings to reach $375.9 million (and earnings per share of $4.74) by about September 2028, up from $284.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.9x on those 2028 earnings, up from 15.0x today. This future PE is lower than the current PE for the US Integrated Utilities industry at 19.7x.

- Analysts expect the number of shares outstanding to grow by 1.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Black Hills Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy capital expenditure requirements for infrastructure projects (e.g., Ready Wyoming transmission expansion, Lange II generation, Colorado Clean Energy Plan) create ongoing pressure on cash flows, and if regulatory recovery lags or costs overrun, this could compress net margins and limit earnings growth.

- Significant projected revenue growth relies on continued ramp-up of large, concentrated, and potentially volatile data center and blockchain load, exposing Black Hills to demand risk if these customers delay, cancel, or reduce commitments, directly impacting revenues and future earnings.

- The company's core dependence on regulated natural gas operations and geographic concentration in the Mountain West and Midwest makes Black Hills vulnerable to asset stranding, tightening emissions regulation, or region-specific economic/demographic stagnation, potentially affecting long-term revenue and net earnings.

- If distributed energy resources (DERs), renewables, and battery storage adoption accelerate more rapidly than Black Hills anticipates, traditional load growth could be undermined, eroding revenue streams and increasing the risk of under-recovery of fixed costs over the long-term.

- Rising frequency and severity of extreme weather events (e.g., wildfires), even with mitigation programs, may drive up insurance premiums, O&M expenses, and reliability investments, pressuring operating costs and potentially reducing net margins over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $68.5 for Black Hills based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $76.0, and the most bearish reporting a price target of just $64.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.0 billion, earnings will come to $375.9 million, and it would be trading on a PE ratio of 16.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of $58.65, the analyst price target of $68.5 is 14.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.