- United States

- /

- Other Utilities

- /

- NYSE:BIP

The Big Trends - Part 2: Demographic and Geopolitical Trends

Reviewed by Michael Paige

The Demographic Trends

Demographic changes are one of the dynamics that lead to secular trends. At any time there are numerous demographic shifts occurring around the world and most of them affect local and regional economies. There are also a few major demographic changes occurring across the globe.

Aging Populations and Longevity

In most countries, birth rates are falling while people are also living longer. The implications: the number of people entering the workforce is falling while the number leaving the workforce is rising, and people are living far longer after they retire. This creates several challenges, but also a number of opportunities.

The populations of Japan and many European countries have been aging for a long time. In the US, there will soon be more people aged over 65 than those aged under 15. Typically the age profile of a country changes gradually, but China is beginning to experience unprecedented changes.

In 2022 China’s population shrank for the first time in 60 years - something that would usually take years to affect the size of the working-age population. However, the consequences of China’s ‘One Child’ policy will be felt much sooner.

The percentage of the population reaching working age (around 20) has already been falling for a decade. But in the next decade, an even larger percentage of the population will begin to reach retirement age. This means the workforce will shrink while the number of retirees will increase at an unprecedented rate. China is already planning to raise retirement ages , but that can’t be done indefinitely.

There are several consequences to a shrinking workforce and a growing number of retirees, including:

-

Wage inflation as companies compete for a shrinking pool of workers. This further reduces the cost advantage that China has leveraged in the past.

-

A peak in the number of new consumers and taxpayers.

-

More healthcare resources are required to care for a growing aged population.

-

All of this puts pressure on the country’s finances which are already under pressure due to an over-leveraged property sector.

Of course, technology and automation will offset some of these challenges - which underscores the need for automation - and the opportunity.

The aging of China’s population is happening a lot quicker than elsewhere, but most countries will deal with similar challenges. The difference in Western countries is the level of government debt and the fact that there will eventually be a shrinking pool of taxpayers.

The Opportunities?

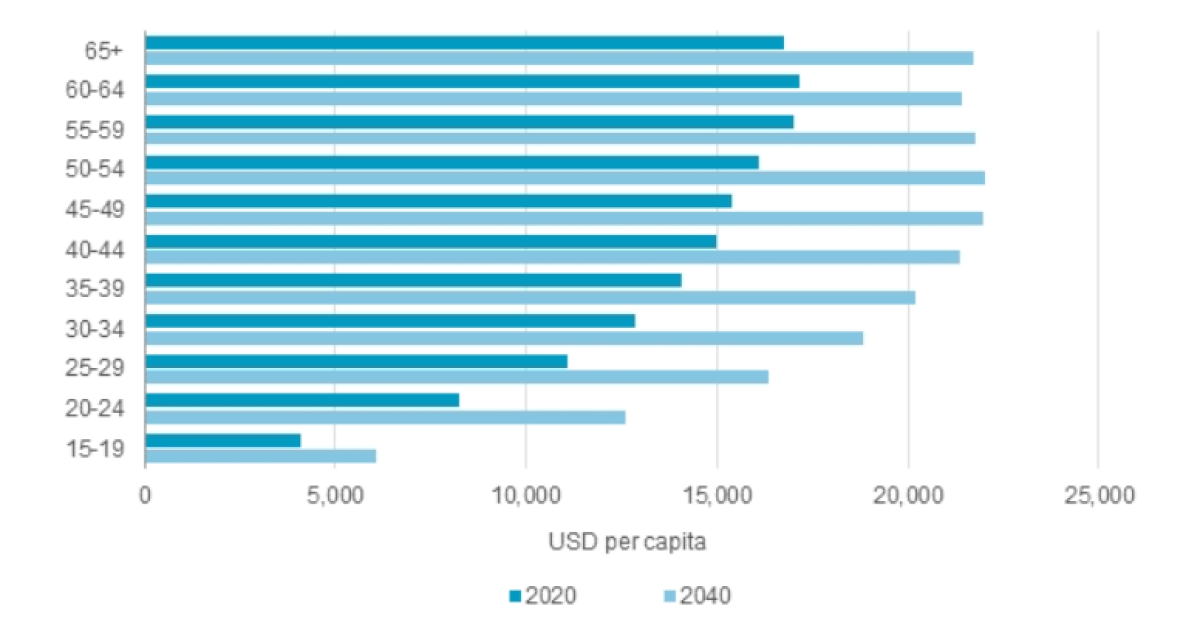

One of the things investors like to see in a company is a growing market for its products. Well, the number of people aged sixty and over is a growing market. And it will continue to grow for years to come. Furthermore, many over-60s have more disposable income than other age groups.

Our Top 5 US Stocks for an Aging Population collection includes some of the companies that stand to benefit from these trends, including Ventas (senior housing) and Carnival Corporation (cruise lines).

It will be interesting to see how the needs and wants of the over 60’s market change. Each year, people turning 60 will be more comfortable with technology - and even with video games! It’s also possible that fewer people will choose to retire in the conventional sense. Working arrangements are more flexible and there’s a growing number of knowledge worker-type jobs - which may keep people working out of choice.

Growing Middle-Class Consumer Markets

When economies become industrialized a ‘middle class’ emerges. In this case, by the middle class, we mean households earning enough to make discretionary purchases after their basic needs have been met.

A growing middle class means more spending on discretionary goods and services like furniture, electronics, vehicles, restaurants, and travel. It also means more people paying more tax, which allows the government to increase investment in infrastructure and services. In this way, a virtuous cycle is created leading to higher-paying jobs, a growing economy, and more opportunities for companies and their investors.

China and parts of Southeast Asia have experienced the fastest-growing middle-class cohorts over the last few decades, as hundreds of millions of people joined the formal economy. These trends are maturing now and the ‘easy gains’ have been made.

Looking forward, India is the obvious candidate to see a rapidly growing middle class with discretionary income. One definition of China’s middle class includes three-person households earning between $14,800 and $74,200 per year . That definition includes 57% of China’s population. In India, more than 90% of the population earns less than $4,000 a year, roughly a third of the lower end of China’s middle-class group.

The map below shows the GDP per capita (as a proxy for average incomes) for each country as of 2021. Per capita GDP in the countries colored red and orange are still below $4000. Besides India, the rest of South Asia, and Africa stand out as regions of opportunity.

While the world’s population is getting older, it’s also still growing. Most of the population growth will now occur in many of the same countries that have low per capita GDP. That means that the working-age population and discretionary spending could increase for decades to come.

Just because there’s potential for a country’s middle class to expand, doesn’t mean it will. For low-income economies to realize their potential, they need to create a business and investor-friendly environment, modernize their financial systems, promote trade, and invest in education and infrastructure (see below).

India has made some important steps in the last decade. Foreign investment is being encouraged, the tax system has been changed to increase the tax base, the monetary system is becoming cashless and an instant payment system was recently introduced. These changes are already paying dividends.

In Africa, many countries still have a lot to do to realize their potential. However the impact of mobile networks and digital wallets has in many cases made up for the lack of government action, and some economies are gathering momentum.

Investing in Middle-Class Growth

In developing economies, growth creates tailwinds for all sectors. But some with broad exposure to increased discretionary spending include:

-

Banks finance projects and provide credit to a growing workforce. Banks offer indirect exposure to all the other sectors.

-

Grocery and furniture retailers can expand quickly as discretionary consumption increases.

-

Power utilities are required to provide electricity to growing industries - and they are often underwritten by the government.

Our Top African Stocks collection includes companies that can benefit from growth across Africa.

Infrastructure Investment is an Imperative

Economies cannot grow without investing in new infrastructure and upgrading old infrastructure. Urbanization is another characteristic of industrialization. If you believe an economy will grow meaningfully, you have to believe that there will be significant investment in infrastructure. This includes roads, ports, telecom infrastructure, power grids, water supply, and more.

But infrastructure investment isn’t only essential to developing economies. Besides the fact that many developed economies desperately need an infrastructure overhaul, many of the other secular trends expected to occur over the next decade or two can’t occur without major investments in infrastructure.

In particular, the electrification of an economy requires a much bigger and more efficient power grid. Other innovations like artificial intelligence can’t deliver the promised improvements in global wealth without infrastructure investment.

The good news for investors is that governments can’t possibly fund these infrastructure projects on their own. Public-private partnerships have become standard to bring in private funding while providing the assurance of government commitment.

Investing in Infrastructure

For investors, infrastructure investment companies like Brookfield Infrastructure Partners and Enbridge are one way to invest directly. Companies like Caterpillar that provide the equipment to build infrastructure are another option, and so are companies like BHP Group that produce the raw materials required to build infrastructure. Don’t forget the cement producers like UltraTech in India and Dangote in Africa either - cement is (literally) the building block of infrastructure.

Geopolitics

Geopolitical trends are more difficult to invest ‘in’. Opportunities are less obvious and trends can quickly change. Nevertheless, they do create some opportunities (which can easily be overlooked by the crowd) and they shape the global economy.

Deglobalization and a ‘Multi-Polar’ World

Globalization was responsible for unprecedented economic growth, but not for everyone. Dissatisfaction reached a peak in the middle of the last decade. Since then, Western governments have enacted policies that favor local manufacturing jobs. This contributed to deteriorating relationships between the US and China and growing mistrust.

Deglobalization is generally a negative for the global economy, but there are some winners. Companies that manufacture and sell locally are one group, and the companies that build factories and supply manufacturing equipment are another.

Security Everywhere

Deteriorating international relations, climate change, rapidly changing technology, and organized crime, have led to a focus on security across almost every facet of life.

Here are some examples:

-

Defense spending is once again increasing rapidly. This was happening prior to Russia’s invasion of Ukraine and has accelerated since. Beneficiaries of this trend include Lockheed Martin and RTX Corporation (formerly Raytheon).

-

Intellectual property security has resulted in the US banning exports of certain semiconductor chips to China. This has widespread implications for the industry - while companies like Intel stand to benefit.

-

Cybersecurity: Governments, companies, and individuals all face a growing threat from various forms of cybercrime. This has resulted in spending on cybersecurity increasing doubling in the last five years. Check out our collection for a few ideas in the space.

-

Data security: Most governments have implemented regulations like the EU’s GDPR policy to protect citizens’ personal data. Breaching these regulations can result in very steep fines.

-

Food security: Climate change and the war in Ukraine have both contributed to concerns about food security and several countries have banned exports of rice, wheat, and corn.

-

Water security: Industrial growth results in increased water use, while climate change is reducing the availability of fresh water.

-

Rare metals: The electric vehicle revolution resulted in a gold rush for minerals like lithium. This has prompted countries with Lithium deposits to ban exports or take control of the industry, as was the case in Chile.

Some of these developments, like cybersecurity ( our collection includes some of the best counters ) and water do offer opportunities. But the increasing focus on security is also something to consider when you are assessing companies in relevant sectors.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Infrastructure Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NYSE:BIP

Brookfield Infrastructure Partners

Owns and operates utilities, transport, midstream, and data businesses in North and South America, Europe, and the Asia Pacific.

Very undervalued average dividend payer.