- United States

- /

- Other Utilities

- /

- NYSE:BIP

Brookfield Infrastructure Partners (NYSE:BIP): Evaluating Valuation After Renewed Buyback Approvals and Capital Return Plans

Reviewed by Simply Wall St

Brookfield Infrastructure Partners (NYSE:BIP) just renewed its normal course issuer bids, giving management fresh approval to buy back and cancel a meaningful slice of LP units, preferred units, and exchangeable shares over the next year.

See our latest analysis for Brookfield Infrastructure Partners.

The timing of these renewed buybacks lines up with a clear turn in sentiment. The latest share price of $35.10 and a solid 90 day share price return of 14.48% support a 10.76% one year total shareholder return and signal that momentum is starting to build again after a softer stretch.

If this kind of capital allocation story interests you, it could be worth scanning for other infrastructure like names via fast growing stocks with high insider ownership and seeing which management teams are also backing their own stock.

With buybacks ramping up, a double digit total return over the past year, and the stock still trading at a sizeable discount to analyst targets, is Brookfield Infrastructure undervalued or already pricing in its next leg of growth?

Most Popular Narrative: 16.2% Undervalued

With Brookfield Infrastructure Partners closing at $35.10 against a narrative fair value near $41.91, the widely followed view sees meaningful upside still on the table.

The analysts have a consensus price target of $39.909 for Brookfield Infrastructure Partners based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $53.0, and the most bearish reporting a price target of just $31.0.

Curious how a business with shrinking top line can still command a premium future earnings multiple? The explanation lies in the margin story and a long-term profit reset. Want to see exactly how those assumptions stack up over time and why the discount rate matters so much here?

Result: Fair Value of $41.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated leverage and execution risk on large capital projects could undermine earnings visibility and challenge the upgraded, growth-focused valuation narrative.

Find out about the key risks to this Brookfield Infrastructure Partners narrative.

Another Angle on Valuation

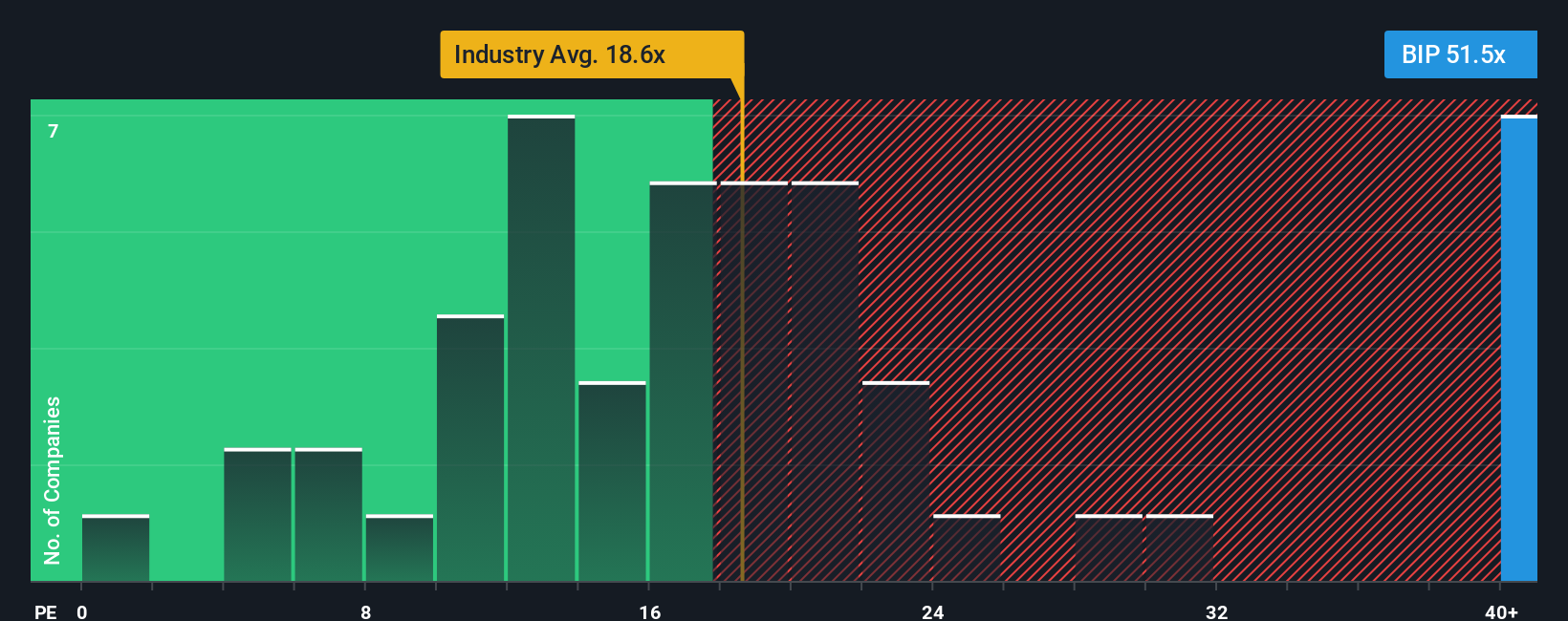

On earnings, the picture flips. BIP trades at about 50.1 times earnings, far richer than both the global integrated utilities average of 17.8 times and its own fair ratio of 1.3 times, suggesting the market may be pricing in a lot of good news up front.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Brookfield Infrastructure Partners Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized view in just a few minutes, Do it your way.

A great starting point for your Brookfield Infrastructure Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh, data driven opportunities on Simply Wall Street so you are not the one catching up later.

- Capitalise on mispriced quality by screening for companies trading below their cash flow potential through these 904 undervalued stocks based on cash flows and line up your next watchlist candidates.

- Position for the next wave of innovation by targeting high potential names across these 25 AI penny stocks and stay ahead of where growth capital is moving.

- Build a reliable income engine by focusing on cash generators in these 12 dividend stocks with yields > 3% and avoid scrambling for yield after the best ideas have already rerated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Brookfield Infrastructure Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BIP

Brookfield Infrastructure Partners

Engages in the utilities, transport, midstream, and data businesses.

Average dividend payer with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion