- United States

- /

- Renewable Energy

- /

- OTCPK:AZRE.F

After losing 80% in the past year, Azure Power Global Limited (NYSE:AZRE) institutional owners must be relieved by the recent gain

Key Insights

- Significantly high institutional ownership implies Azure Power Global's stock price is sensitive to their trading actions

- 53% of the company is held by a single shareholder (Caisse de dépôt et placement du Québec)

- Using data from company's past performance alongside ownership research, one can better assess the future performance of a company

Every investor in Azure Power Global Limited (NYSE:AZRE) should be aware of the most powerful shareholder groups. And the group that holds the biggest piece of the pie are institutions with 88% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

Last week's US$19m market cap gain would probably be appreciated by institutional investors, especially after a year of 80% losses.

Let's take a closer look to see what the different types of shareholders can tell us about Azure Power Global.

View our latest analysis for Azure Power Global

What Does The Institutional Ownership Tell Us About Azure Power Global?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

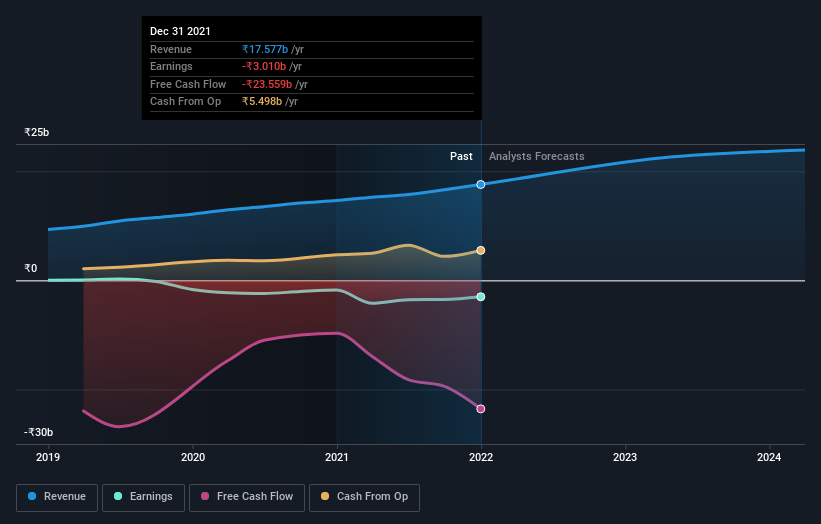

Azure Power Global already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Azure Power Global, (below). Of course, keep in mind that there are other factors to consider, too.

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. We note that hedge funds don't have a meaningful investment in Azure Power Global. Caisse de dépôt et placement du Québec is currently the largest shareholder, with 53% of shares outstanding. This essentially means that they have extensive influence, if not outright control, over the future of the corporation. OMERS Administration Corporation is the second largest shareholder owning 21% of common stock, and Swedbank Robur Fonder AB holds about 3.2% of the company stock.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There is a little analyst coverage of the stock, but not much. So there is room for it to gain more coverage.

Insider Ownership Of Azure Power Global

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that Azure Power Global Limited insiders own under 1% of the company. It appears that the board holds about US$161k worth of stock. This compares to a market capitalization of US$168m. Many tend to prefer to see a board with bigger shareholdings. A good next step might be to take a look at this free summary of insider buying and selling.

General Public Ownership

The general public-- including retail investors -- own 12% stake in the company, and hence can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Azure Power Global better, we need to consider many other factors. Be aware that Azure Power Global is showing 2 warning signs in our investment analysis , you should know about...

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:AZRE.F

Azure Power Global

Operates as a renewable energy developer and independent renewable power producer in India.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion