- United States

- /

- Water Utilities

- /

- NYSE:AWK

Does American Water Works Still Offer Value After Recent Expansion and Rate Approvals?

Reviewed by Bailey Pemberton

- If you have wondered whether American Water Works Company is fairly priced or quietly offering value, you are not alone, and now is a good moment to take a closer look.

- The stock has drifted, up just 3.5% year to date and roughly flat over the last year at 0.2%, which masks a tougher 3 year stretch with shares down about 14.0%.

- Recent headlines have focused on American Water Works expanding regulated water and wastewater operations through municipal system acquisitions and ongoing infrastructure upgrades, reinforcing its long term growth narrative. At the same time, regulatory approvals for new investments and rate cases have helped clarify the cash flow outlook that underpins the share price.

- Despite this, the company only scores 1 out of 6 on our undervaluation checks, so we will unpack what different valuation approaches say about the stock, and then finish with a more complete way to think about its true worth.

American Water Works Company scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: American Water Works Company Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what a stock is worth by projecting all future dividend payments and discounting them back to today, based on how fast those dividends can grow and how risky they are.

For American Water Works Company, the model uses an annual dividend per share of about $3.76, a return on equity of roughly 10.4%, and a payout ratio near 56%. That payout level suggests the company is returning a little over half of its earnings to shareholders while still retaining enough to reinvest in its regulated asset base.

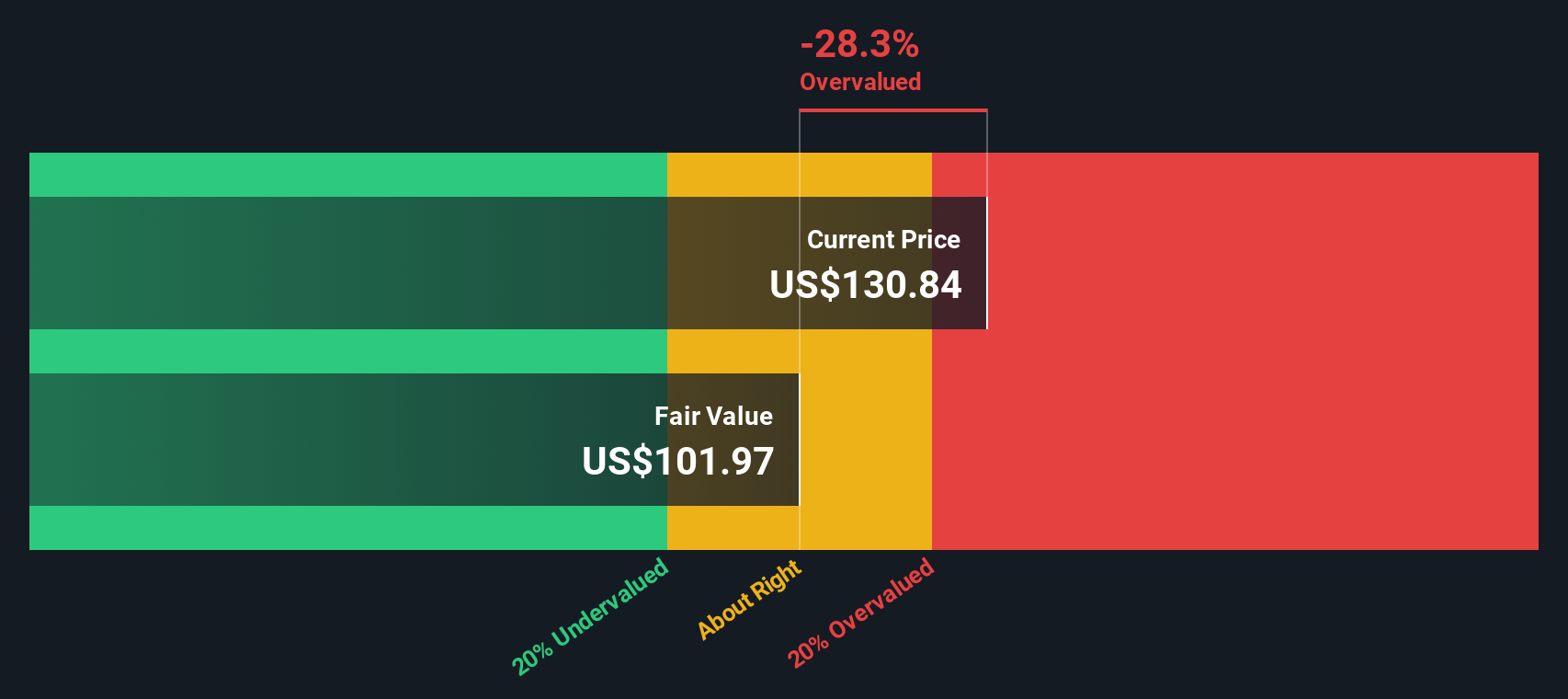

To avoid assuming unrealistically high long term expansion, the long run dividend growth rate is capped at 3.26%, slightly below the shorter term expected growth of about 4.6%. On this basis, the DDM produces an intrinsic value of roughly $101.62 per share.

With the DDM implying that the stock is 26.1% overvalued compared to the current share price, the model indicates that investors are paying a premium for American Water Works Company’s dividend reliability and growth story.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests American Water Works Company may be overvalued by 26.1%. Discover 903 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: American Water Works Company Price vs Earnings

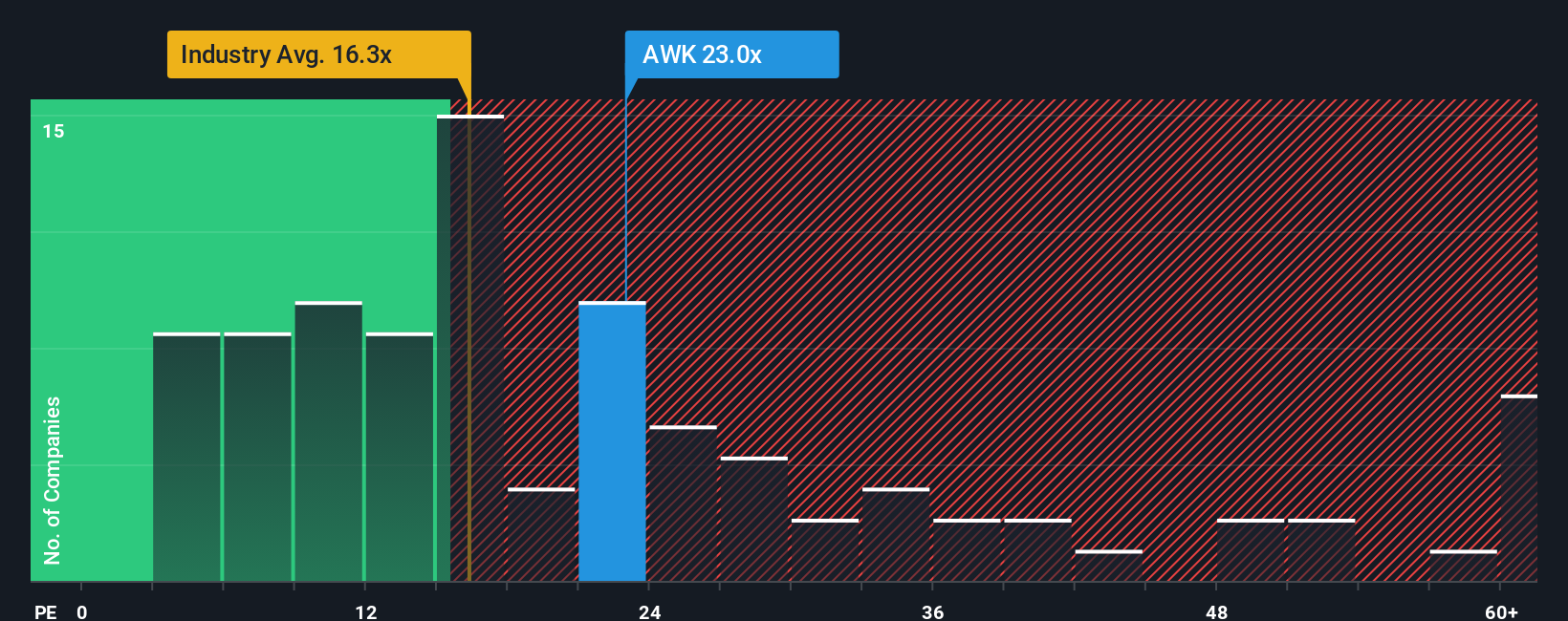

The price to earnings ratio is a useful way to value a consistently profitable utility, because it links what investors pay directly to the earnings that ultimately support dividends and reinvestment. For a stable, regulated business like American Water Works Company, a higher PE can sometimes be seen when earnings are expected to grow steadily and the risk profile is relatively low, while slower growth or higher risk is often associated with a lower, more conservative PE.

American Water Works Company currently trades on a PE of about 22.49x, above both the Water Utilities industry average of roughly 15.86x and the broader peer average of around 17.74x. Simply Wall St’s Fair Ratio for the company is 23.56x, which is a proprietary estimate of what a reasonable PE could be once earnings growth, profit margins, industry characteristics, company size and specific risks are all taken into account.

Because the Fair Ratio is tailored to the company’s fundamentals rather than just comparing it with generic peers, it offers a more nuanced view of value. With the current PE only modestly below the 23.56x Fair Ratio, the shares appear slightly expensive but broadly aligned with what the fundamentals suggest.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your American Water Works Company Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, which are simple stories that capture your view of a company’s future, link that story to a financial forecast for revenue, earnings and margins, and then translate it into a Fair Value you can compare with today’s share price. On Simply Wall St’s Community page, millions of investors use Narratives as an easy, accessible tool to spell out why they think a stock is attractive or not, and the platform turns those assumptions into dynamic valuations that automatically update as new news, earnings, or guidance comes in. Narratives help you clarify your decision on when to buy or sell by making it clear whether your Fair Value sits above or below the current price, and by showing how sensitive that view is to changes in growth or profitability. For American Water Works Company, for example, one investor might build a bullish Narrative around steady rate base growth and assign a Fair Value near the high end of analyst targets at about $159, while a more cautious investor may focus on debt, regulation and weather risk and land closer to $116. Yet both Narratives are transparent and testable.

Do you think there's more to the story for American Water Works Company? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AWK

American Water Works Company

Through its subsidiaries, provides water and wastewater services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)