- United States

- /

- Other Utilities

- /

- NYSE:AVA

Assessing Avista’s (AVA) Valuation After a Recent Pullback and Cooling Share Price Momentum

Reviewed by Simply Wall St

Recent Performance Sets the Stage

Avista (AVA) has slipped about 7% over the past month but is still up around 6% year to date. This combination naturally raises the question of whether the pullback is offering a reasonable entry point.

See our latest analysis for Avista.

At a share price of $38.56, Avista’s recent 30 day share price return of negative 7.4 percent sits against a more constructive year to date gain and double digit one year total shareholder return. This suggests momentum has cooled but not broken.

If Avista’s mix of stability and modest growth has your attention, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover bolder ideas with significant insider ownership.

With steady earnings growth, a modest pullback, and shares trading only slightly below analyst targets, the key question is whether Avista is quietly undervalued or if the market is already pricing in its future growth.

Most Popular Narrative Narrative: 5% Undervalued

Avista’s narrative fair value of $40.60 sits modestly above the last close at $38.56, framing a cautiously optimistic gap that hinges on steady earnings expansion.

The sharp rise in large industrial and commercial load inquiries over 3,000 megawatts in the pipeline compared to a roughly 2,000 megawatt current peak load signals accelerating electrification and potential for outsized rate base and revenue growth if even a fraction of these loads materialize over the next 3 to 5 years.

For investors curious how a mature utility can justify a richer future earnings multiple without relying on hyper growth projections or forecasts of very high margins, the narrative math may be surprising.

Result: Fair Value of $40.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, localized wildfire and regulatory risks, along with rising grid modernization costs, could still derail the earnings trajectory behind this modest undervaluation story.

Find out about the key risks to this Avista narrative.

Another Lens on Value

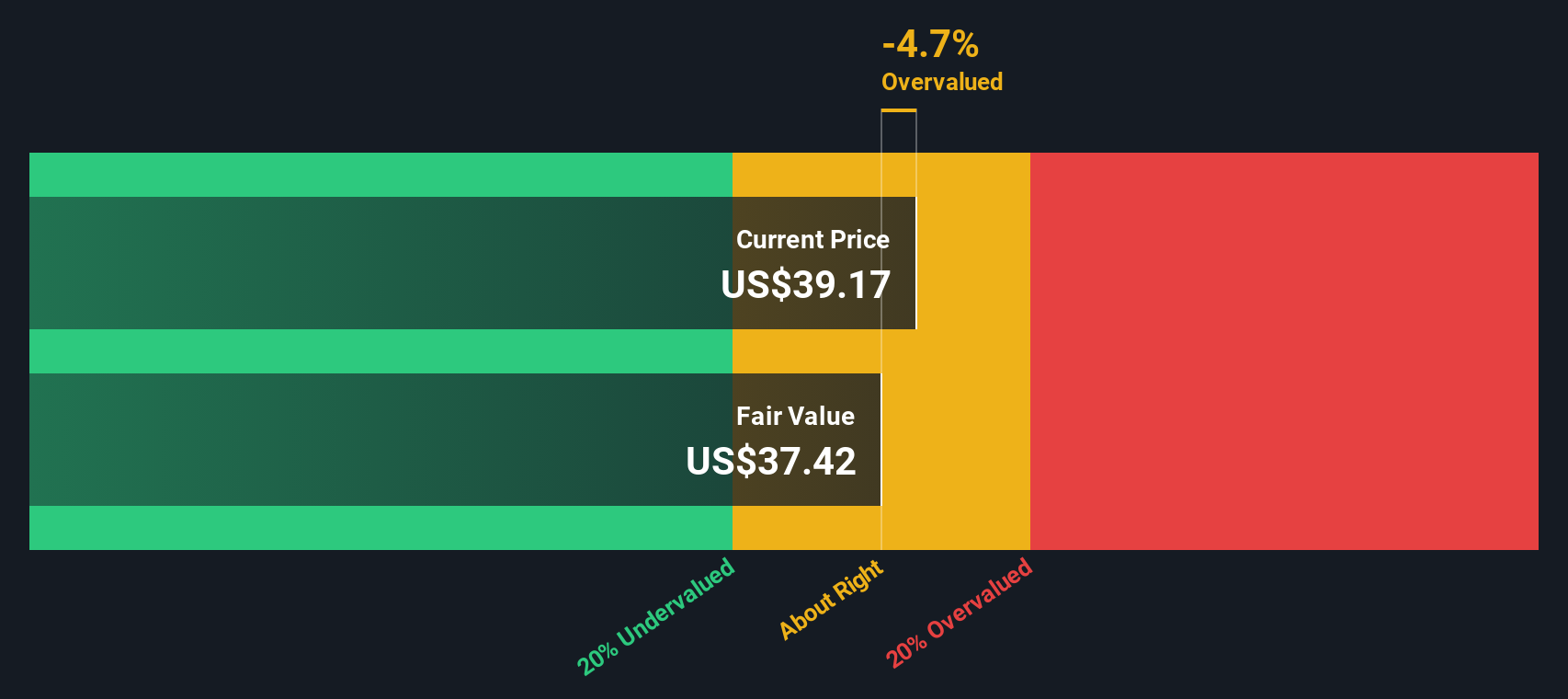

Our DCF model points to a fair value of $37.39, slightly below the current $38.56 share price, suggesting Avista may be a touch overvalued despite the narrative fair value upside. Is the market overpaying for stability, or underestimating future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Avista for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Avista Narrative

If you see the story differently or want to dig into the numbers yourself, you can quickly build a personalized view in just a few minutes, Do it your way.

A great starting point for your Avista research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more timely opportunities?

Right now is a great moment to broaden your watchlist, and you will not want to miss the focused stock ideas Simply Wall Street’s Screener can surface for you.

- Capture potential bargains by scanning these 907 undervalued stocks based on cash flows that the market may be overlooking despite solid fundamentals and cash flow support.

- Ride powerful innovation trends by zeroing in on these 26 AI penny stocks positioned to benefit from accelerating adoption of intelligent software and automation.

- Strengthen your income stream by targeting these 13 dividend stocks with yields > 3% that can help you build more reliable long term returns from regular cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVA

Avista

Operates as an electric and natural gas utility company in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)