- United States

- /

- Software

- /

- NYSE:BLND

Advantage Solutions And 2 Other Promising US Penny Stocks

Reviewed by Simply Wall St

As the United States stock market experiences a surge with big-tech rallies and the S&P 500 marking its best week in two months, investors are turning their attention to various opportunities within the market. Penny stocks, though an old-fashioned term, continue to represent potential growth avenues by highlighting smaller or less-established companies that can offer substantial value. By focusing on those with strong financials and clear growth prospects, investors can uncover hidden gems that may provide both stability and potential upside.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $108.36M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.89 | $6.46M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.91 | $11.73M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.73 | $2.08B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.275 | $10.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.57 | $61.94M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.13 | $20.04M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8937 | $80.38M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.42 | $365.18M | ★★★★☆☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Advantage Solutions (NasdaqGS:ADV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Advantage Solutions Inc. offers business solutions to consumer goods manufacturers and retailers across North America and internationally, with a market cap of approximately $808.30 million.

Operations: Advantage Solutions Inc. has not reported specific revenue segments.

Market Cap: $808.3M

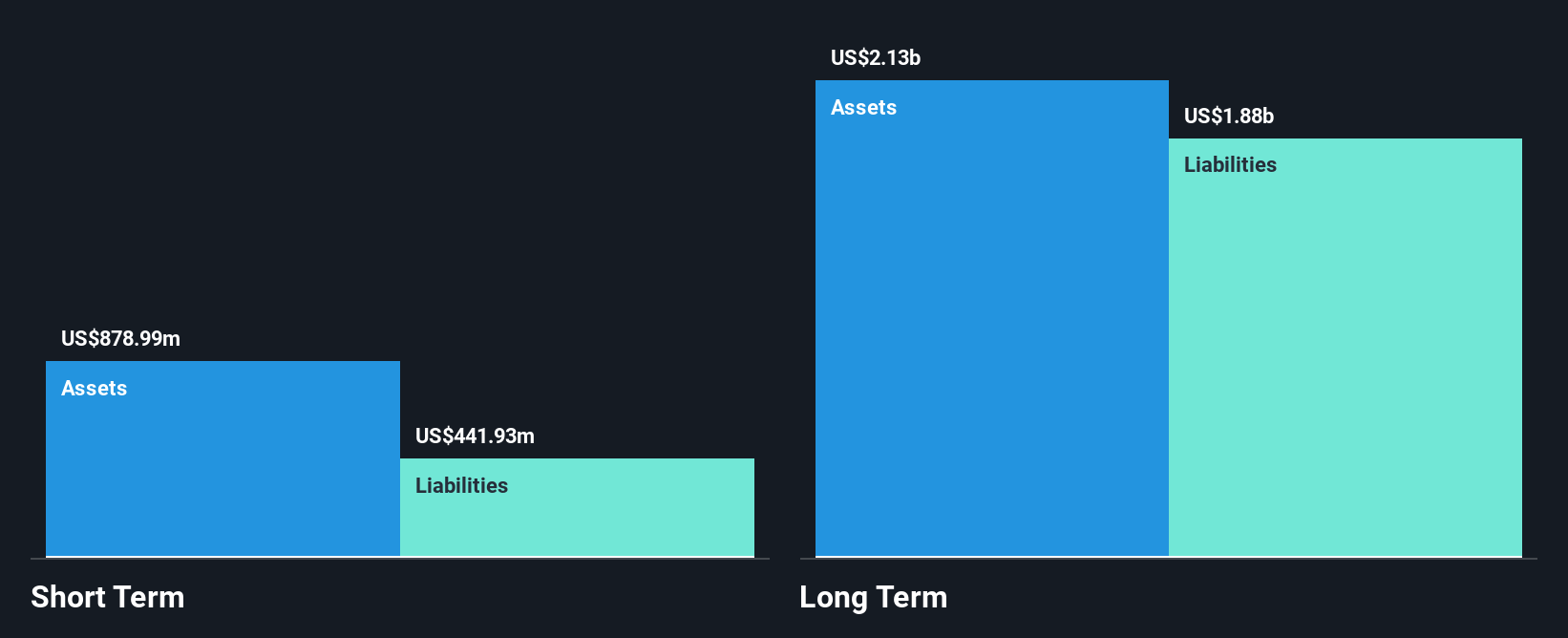

Advantage Solutions Inc., with a market cap of approximately US$808.30 million, has been navigating challenges typical for penny stocks, including profitability issues and high debt levels. The company's short-term assets of US$975.2 million cover its short-term liabilities but fall short against long-term liabilities of US$1.9 billion. Despite being unprofitable, Advantage maintains a positive cash runway exceeding three years and has reduced its debt-to-equity ratio from 197.3% to 182.5% over five years. Recent strategic changes include appointing George Johnson as chief workforce operations officer to enhance talent deployment across retail locations, signaling potential operational improvements ahead.

- Dive into the specifics of Advantage Solutions here with our thorough balance sheet health report.

- Examine Advantage Solutions' earnings growth report to understand how analysts expect it to perform.

Blend Labs (NYSE:BLND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blend Labs, Inc. provides cloud-based software platform solutions for financial services firms in the United States and has a market cap of approximately $921.35 million.

Operations: The company generates revenue from two main segments: Title, contributing $45.20 million, and Blend Platform, accounting for $111.51 million.

Market Cap: $921.35M

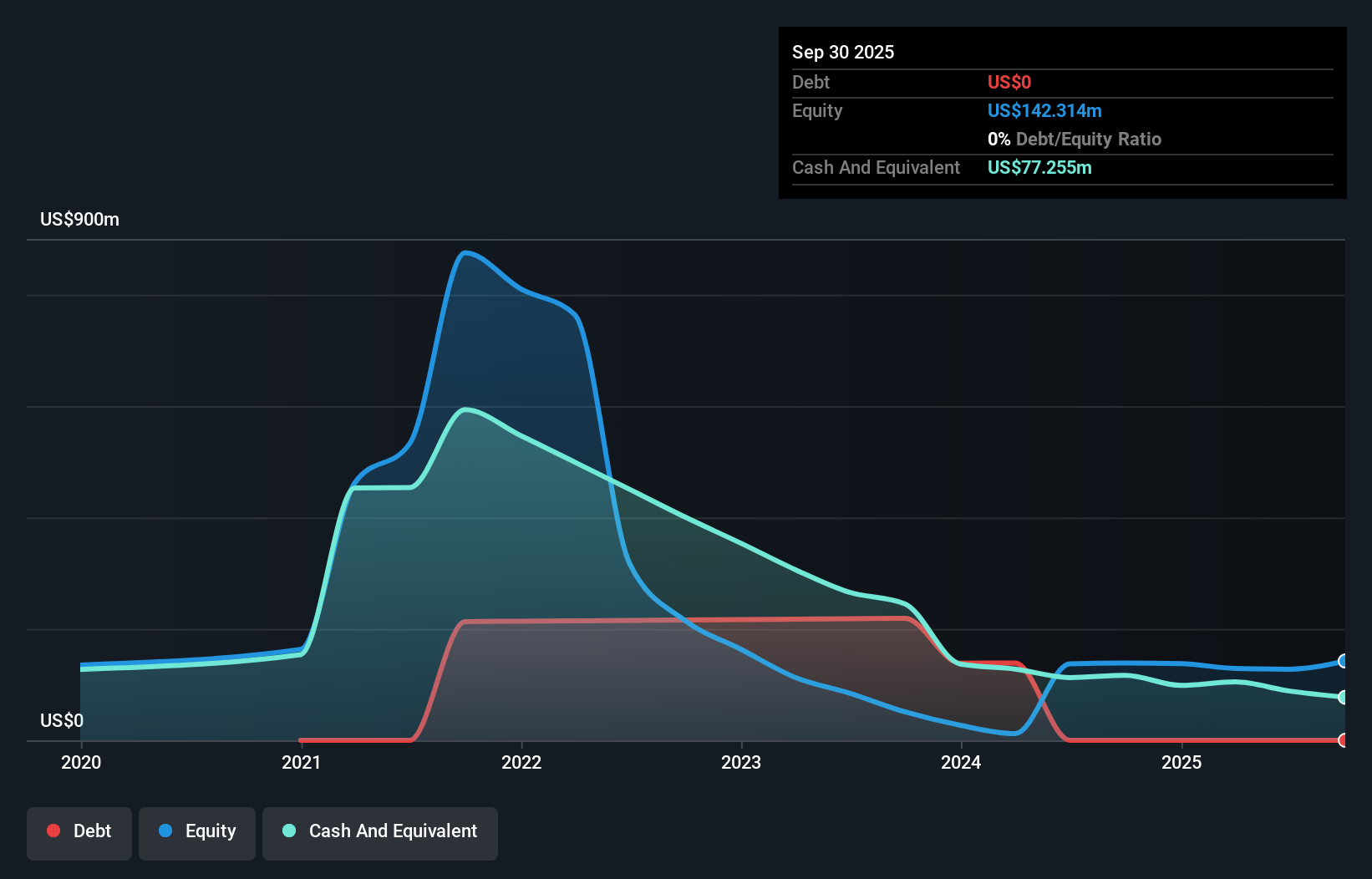

Blend Labs, Inc., with a market cap of approximately US$921.35 million, faces typical challenges for penny stocks, including ongoing unprofitability and negative return on equity. Despite these hurdles, the company remains debt-free and boasts sufficient cash runway for over three years. Recent strategic partnerships with PHH Mortgage and Covered Insurance Solutions aim to enhance Blend's mortgage suite capabilities and insurance offerings, potentially driving operational efficiencies. The appointment of Srini Venkatramani as Head of Product underscores efforts to accelerate growth in digital banking. Revenue forecasts suggest potential growth despite recent net losses narrowing significantly compared to previous periods.

- Jump into the full analysis health report here for a deeper understanding of Blend Labs.

- Understand Blend Labs' earnings outlook by examining our growth report.

DiDi Global (OTCPK:DIDI.Y)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DiDi Global Inc. operates a mobility technology platform offering various services in China, Brazil, Mexico, and internationally, with a market cap of approximately $22.76 billion.

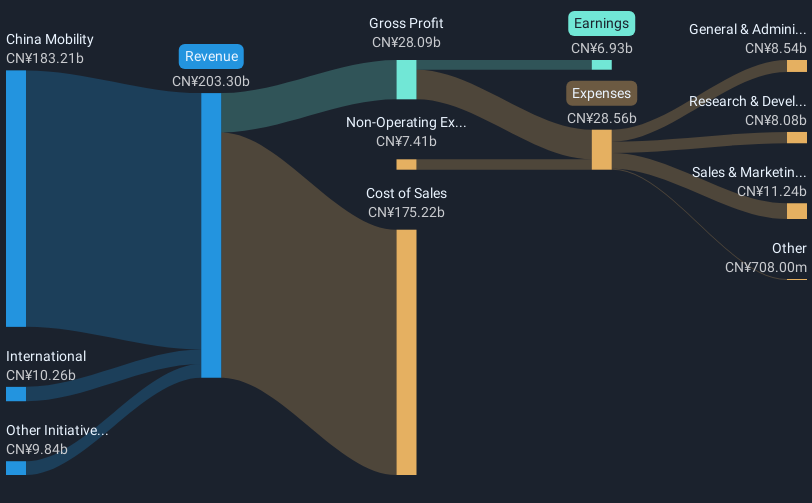

Operations: The company's revenue is primarily derived from its China Mobility segment, generating CN¥183.21 billion, followed by International operations at CN¥10.26 billion and Other Initiatives contributing CN¥9.84 billion.

Market Cap: $22.76B

DiDi Global Inc., with a market cap of approximately CN¥22.76 billion, has shown significant financial improvement by becoming profitable over the past year, reporting third-quarter sales of CN¥53.95 billion and net income of CN¥929 million. The company’s strong balance sheet is highlighted by short-term assets exceeding both short- and long-term liabilities, while its debt is well covered by operating cash flow. Trading at 55.2% below estimated fair value suggests potential undervaluation compared to peers, although return on equity remains low at 8%. Analysts anticipate continued earnings growth, forecasting an increase of 35.54% annually.

- Take a closer look at DiDi Global's potential here in our financial health report.

- Review our growth performance report to gain insights into DiDi Global's future.

Turning Ideas Into Actions

- Explore the 709 names from our US Penny Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blend Labs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLND

Blend Labs

Engages in the provision of cloud-based software platform solutions for financial services firms in the United States.

Excellent balance sheet with reasonable growth potential.