- United States

- /

- Transportation

- /

- NYSE:XPO

Does XPO’s Share Price Reflect Its Growth Prospects After Recent Sector Optimism?

Reviewed by Bailey Pemberton

- Wondering if XPO is trading at an attractive price right now? You are not alone, as many investors are looking for signals suggesting when this stock might be undervalued or ready for a rebound.

- The stock is currently at $143.43, with short-term returns showing a 2.5% gain over the last week and a modest -0.3% for the month. Year-to-date, it’s up 8.2%, despite being down 6.5% over the past year.

- Momentum around XPO has been fueled by broader transportation sector optimism and ongoing discussions surrounding logistics infrastructure investments. These headlines are adding context to recent price moves and may be influencing market sentiment as investors weigh potential upsides and risks.

- Right now, XPO scores just 1 out of 6 on our undervaluation checks. This suggests there may be more to the story than meets the eye. Let's look at the main ways valuation is approached, and stay tuned for a deeper insight into how to judge XPO's value by the end of this article.

XPO scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: XPO Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's dollars. This approach aims to capture the total expected free cash generation, reflecting what the business could be worth now if all future cash flows were realized as forecasted.

For XPO, analysts estimate its free cash flow over the next few years, starting from a current figure of -$81.8 million. Looking ahead, forecasts predict strong growth, with projected annual free cash flow reaching $946 million by 2029. After five years, these projections transition to Simply Wall St's own extrapolations, which see annual free cash flows continuing to climb through 2035.

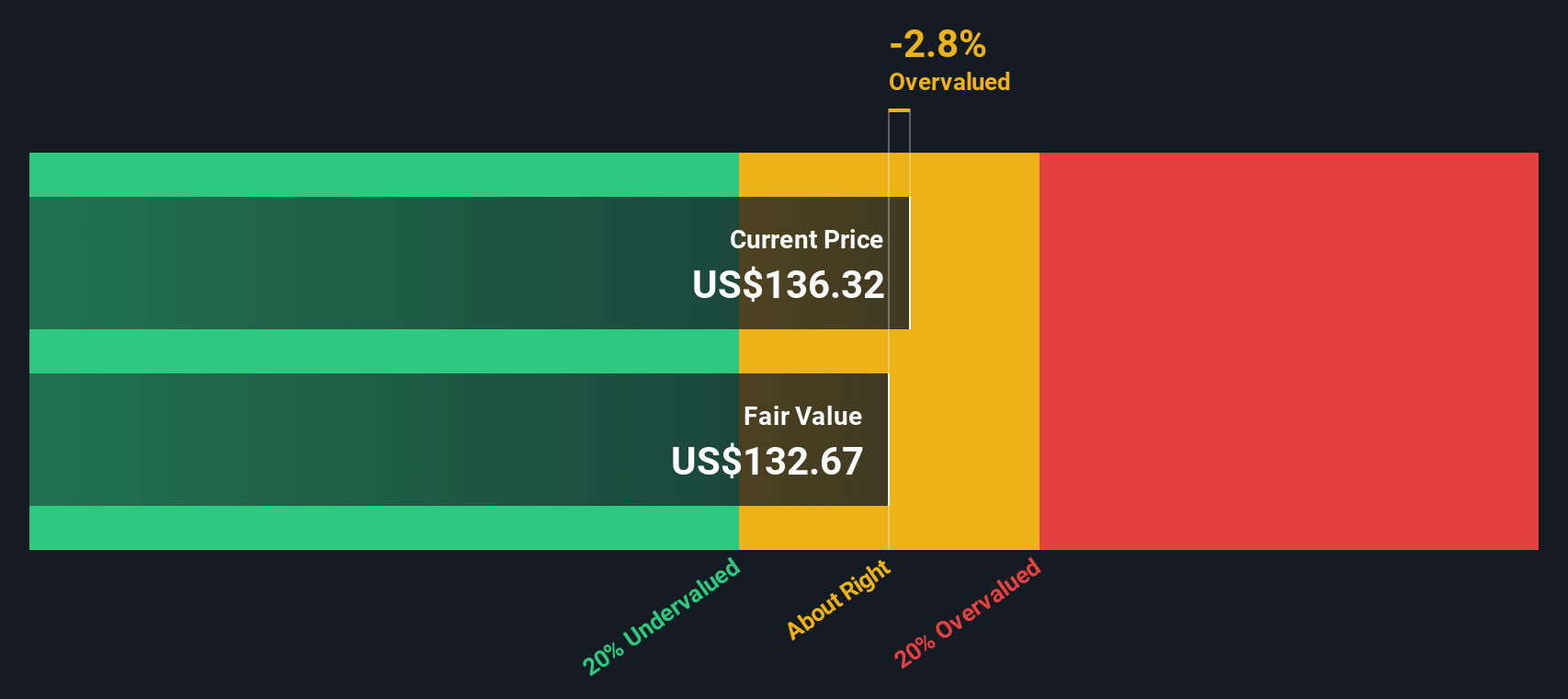

Applying the DCF model, XPO's intrinsic value per share is calculated at $159.08. This is roughly 9.8% higher than its present share price of $143.43. While this suggests XPO is trading slightly below its estimated fair value, the margin is modest.

Result: ABOUT RIGHT

XPO is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: XPO Price vs Earnings

For companies that are profitable, the Price-to-Earnings (PE) ratio is a go-to metric for valuation. It measures how much investors are willing to pay for each dollar of current earnings, making it a useful shorthand for judging whether a stock is cheap or expensive compared to its profits.

The "normal" or "fair" PE ratio for any stock depends on how quickly it's expected to grow and how risky its future is. Companies with higher growth prospects can justify a higher PE, while higher risk should generally lead to a lower one.

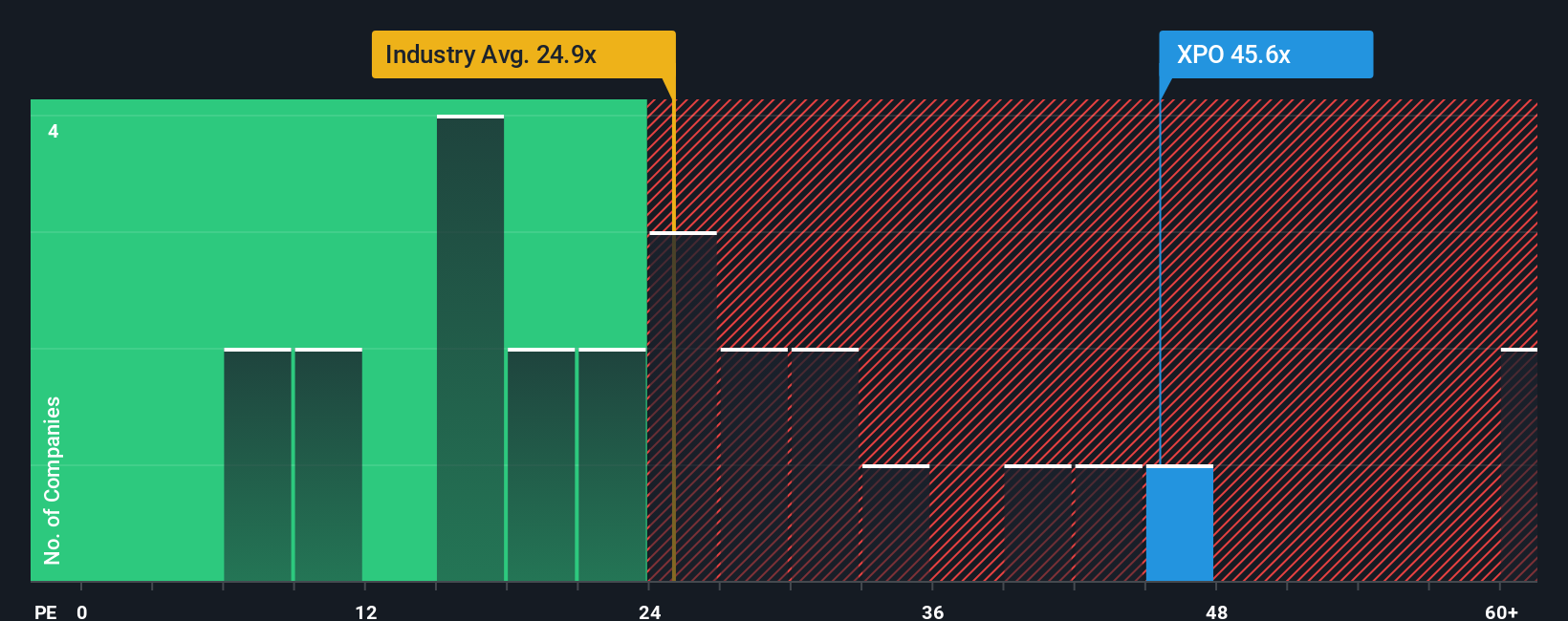

XPO currently trades at a PE ratio of 50.7x. For context, this is well above the transportation industry average of 27.6x and also higher than the average of its direct peers at 30.8x. From a surface-level perspective, this may suggest XPO is priced at a premium.

However, Simply Wall St’s proprietary “Fair Ratio” comes into play here. This measure factors in not just industry positioning or rough peer comparisons, but calibrates for XPO’s unique growth outlook, profit margins, market cap, and risk profile. For XPO, the Fair Ratio stands at 20.2x, reflecting what a reasonable multiple should be for XPO given its characteristics rather than just what the rest of the market is willing to pay.

Since XPO’s actual PE of 50.7x is well above the Fair Ratio of 20.2x, the stock appears overvalued by this metric, even accounting for its specific strengths and risks.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your XPO Narrative

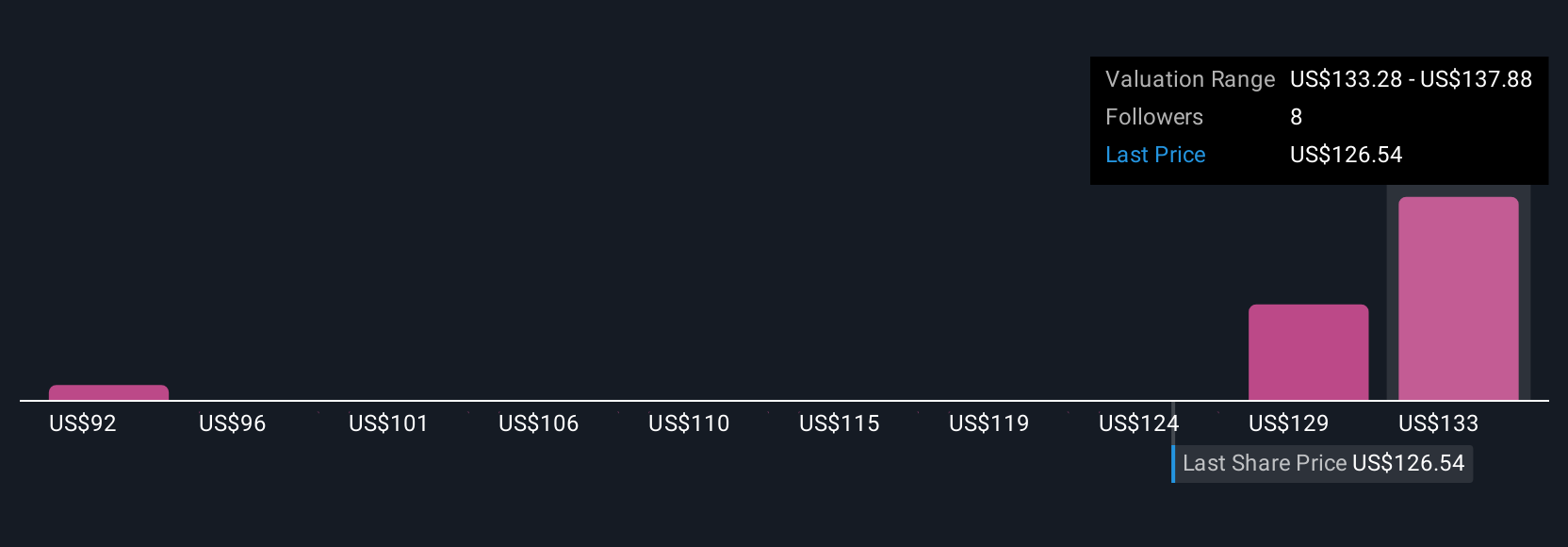

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you tell yourself about a company’s future, combining your perspective on its opportunities and challenges with your estimates for future revenues, earnings, and profit margins. Narratives connect what you believe about a company's potential to a specific, data-driven financial forecast, which then produces your own fair value estimate for the stock.

Available to millions of investors on Simply Wall St’s Community page, Narratives make it easy for anyone to test and share their investment thinking. They turn complex valuation models into accessible, interactive scenarios and help you decide when to buy or sell by comparing your personal Fair Value to the current market Price. Narratives also adapt in real time when fresh news, earnings updates, or company developments arrive.

For example, some investors may see XPO’s ambitious technology adoption and margin expansion as catalysts for a higher fair value, perhaps aligning with the most optimistic analyst target of $156.00. Others, more cautious about freight demand and rising costs, may lean toward the bearish outlook of $84.00. Whatever your view, Narratives empower you to anchor your decisions in well-reasoned expectations and respond quickly as the story changes.

Do you think there's more to the story for XPO? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPO

XPO

Provides freight transportation services in the United States, North America, France, the United Kingdom, and rest of Europe.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026