- United States

- /

- Transportation

- /

- NYSE:UNP

Assessing Union Pacific (UNP) Valuation After Its Recent Share Price Climb

Reviewed by Simply Wall St

Union Pacific (UNP) has quietly pushed higher in recent weeks, with shares up about 8% over the past month, prompting investors to revisit what is driving the move and whether the current valuation still makes sense.

See our latest analysis for Union Pacific.

The recent 7.59% 1 month share price return comes on top of steady gains over the past quarter. With the stock now around $239.95, that upward momentum broadly aligns with Union Pacific’s 3 year total shareholder return of 22.47%, suggesting investors are slowly warming to its growth and risk profile again.

If this kind of steady rerating has your attention, it might be a good time to broaden your watchlist and explore fast growing stocks with high insider ownership for other potential opportunities.

Given Union Pacific’s solid earnings growth, modest discount to analyst targets, and only slight premium to intrinsic value, investors now face a key question: is this simply fair value catching up, or a potential opportunity before future growth is fully reflected in the price?

Most Popular Narrative: 7.8% Undervalued

With Union Pacific last closing at $239.95 against a narrative fair value near $260, the current price sits below what long term cash flows might justify.

The analysts have a consensus price target of $256.92 for Union Pacific based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $294.0, and the most bearish reporting a price target of just $213.0.

If you want to see what kind of revenue runway and margin profile support that premium multiple, and why it still screens cheaper than many peers, explore the full narrative.

Result: Fair Value of $260.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this optimistic setup still hinges on resilient volumes and stable trade policy, with prolonged intermodal softness or adverse tariff shifts potentially undermining the bullish case.

Find out about the key risks to this Union Pacific narrative.

Another Angle on Valuation

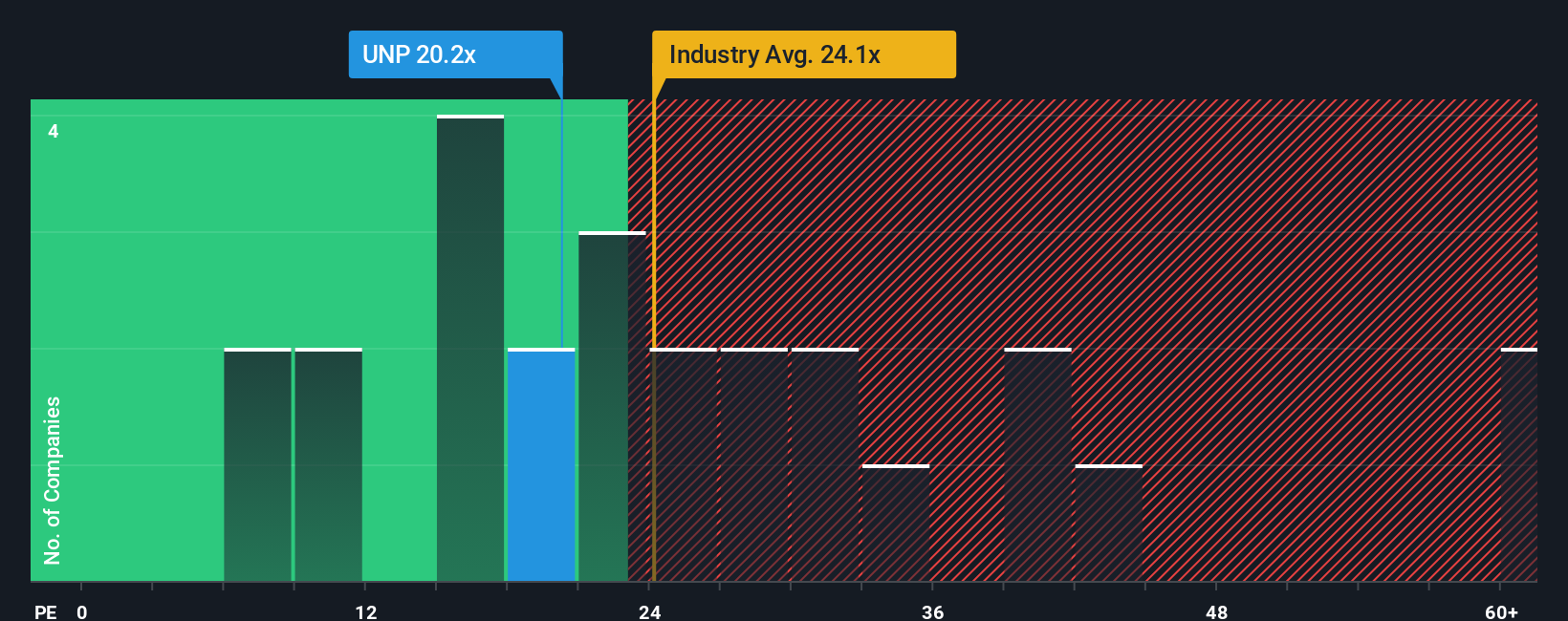

While the narrative fair value implies upside, our numbers based on earnings paint a tighter picture. Union Pacific trades on a 20.2x price to earnings ratio compared with a fair ratio of 22x, above peers at 18.2x but well below the Transportation industry at 32.3x. Does that signal limited downside or capped upside?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Union Pacific for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Union Pacific Narrative

If you prefer your own perspective or want to dig into the numbers yourself, you can build a personalized view in under three minutes, Do it your way.

A great starting point for your Union Pacific research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with Union Pacific. Take the next step on Simply Wall St and uncover fresh opportunities that match your strategy using powerful, data driven screeners.

- Capitalize on overlooked value by targeting companies trading below their cash flow potential through these 908 undervalued stocks based on cash flows.

- Explore innovation in automation and machine learning by scanning these 26 AI penny stocks for companies in this area.

- Support your income strategy by focusing on companies with a history of paying dividends using these 13 dividend stocks with yields > 3% as your starting universe.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNP

Union Pacific

Through its subsidiary, Union Pacific Railroad Company, operates in the railroad business in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)