- United States

- /

- Transportation

- /

- NYSE:UHAL

U-Haul (UHAL): Valuation Insights Following Recent Share Price Volatility

Reviewed by Kshitija Bhandaru

See our latest analysis for U-Haul Holding.

U-Haul Holding's share price has shown some volatility over the past year, with a recent 1-day gain of 0.67% but a year-to-date share price return of -18.97%. While short-term momentum appears muted, the longer-term total shareholder return tells a different story. Over the past five years, investors have seen a solid 51.5% gain, suggesting underlying resilience even amid current weakness.

If today’s price swings have you considering new opportunities, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership.

Given U-Haul's recent dip but solid long-term returns, investors have to ask if the current share price reflects a real bargain or if the market is already factoring in all of U-Haul's growth potential.

Most Popular Narrative: 37.8% Undervalued

At $55.92 per share, U-Haul Holding’s stock trades well below the most popular narrative’s calculated fair value. This suggests a sizable upside if expectations are met. This section dives into one key argument supporting that view.

U-Haul is working through fleet imbalances by acquiring new trucks and removing outdated ones. As these imbalances are corrected, the company expects to better serve customer needs, potentially improving revenue and efficiency. This could support future revenue growth.

Want to know why this narrative calls for a much higher price? One significant assumption about market expansion and operational improvements underpins these projections. Curious which transformation and financial metric could shift the story? Take a closer look to uncover the driver behind the bullish fair value.

Result: Fair Value of $89.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising costs and fierce competition in truck rentals could hold back profit margin growth. This may challenge the current optimistic outlook for U-Haul.

Find out about the key risks to this U-Haul Holding narrative.

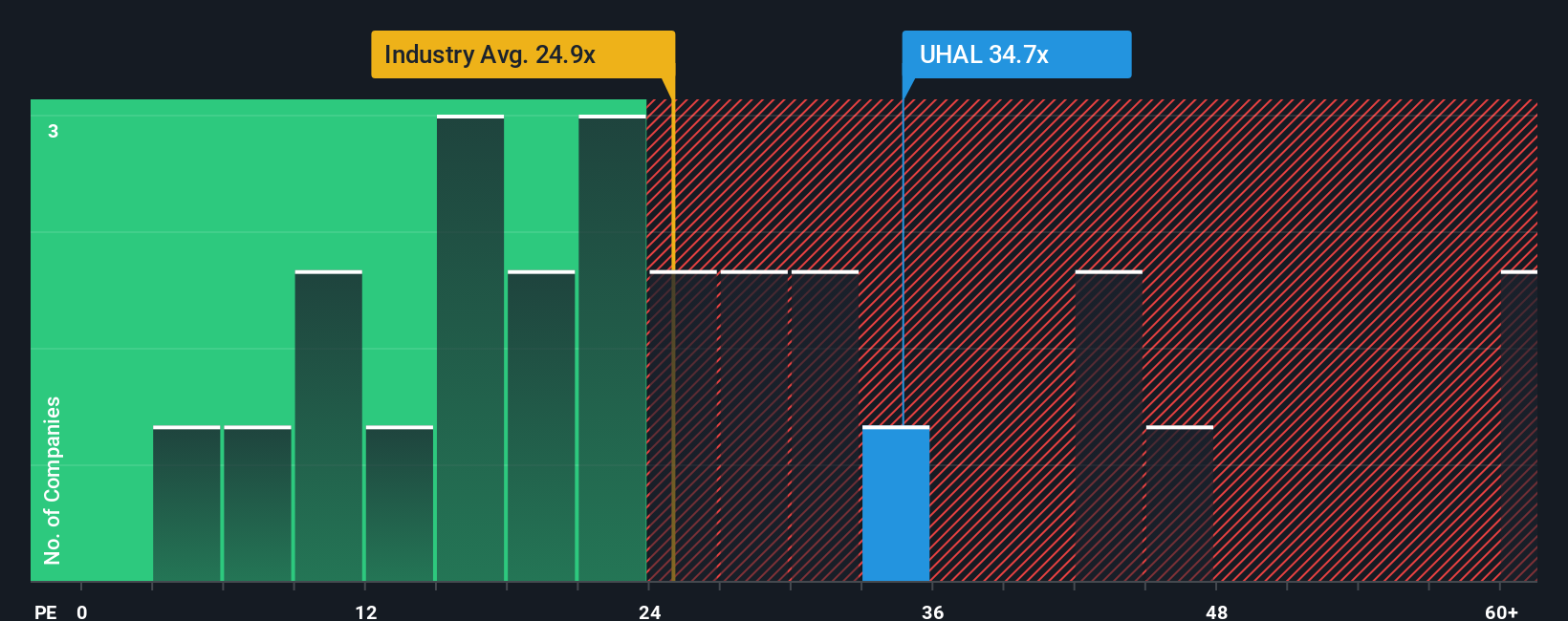

Another View: Market Multiples Paint a Cautious Picture

Looking at U-Haul Holding through the lens of the price-to-earnings ratio, there is less enthusiasm than the narrative-based fair value suggests. The company currently trades at a ratio of 34.9 times earnings, which is higher than both peer averages (29.3x) and the broader US Transportation industry (25.1x). This elevated multiple means investors are paying more for every dollar of U-Haul’s earnings. By this method, the stock could be considered expensive. The question is, does the market see something others do not, or is there valuation risk if expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own U-Haul Holding Narrative

If you see the numbers differently or want to dig a little deeper, you can quickly build your own perspective based on the latest data in just minutes. Do it your way.

A great starting point for your U-Haul Holding research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Ready for Your Next Investment Move?

Why settle for just one opportunity? Supercharge your watchlist and put your money to work in smarter places using these powerful ideas from Simply Wall Street.

- Uncover overlooked potential by tracking these 873 undervalued stocks based on cash flows. This can help you spot companies trading below what their cash flows suggest they are truly worth.

- Tap into innovation and ride the artificial intelligence wave with these 24 AI penny stocks, as companies race to transform entire industries with smarter technology.

- Lock in reliable returns by focusing on these 20 dividend stocks with yields > 3% which offer attractive yields for those seeking income alongside growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UHAL

U-Haul Holding

Operates as a do-it-yourself moving and storage operator for household and commercial goods in the United States and Canada.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives