- United States

- /

- Transportation

- /

- NYSE:UHAL

Should U-Haul’s Analyst Upgrade Highlight a Hidden Strength in Its Integrated Model for UHAL Investors?

Reviewed by Sasha Jovanovic

- An analyst recently upgraded U-Haul Holding Company from 'buy' to 'strong buy,' citing its unique combination of self-moving and self-storage operations, revenue growth, and appealing valuation compared to peers.

- This upgrade suggests that the market may not fully recognize U-Haul's potential value, despite current profitability challenges.

- We'll explore how this favorable analyst view of U-Haul's valuation influences its overall investment narrative.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

U-Haul Holding Investment Narrative Recap

To own U-Haul Holding Company stock, shareholders need to believe in the company’s ability to translate its dual self-moving and self-storage business into sustainable growth, despite recent profitability headwinds and expenses. While the recent analyst upgrade focuses attention on valuation, short-term catalysts remain tied to operational improvements, especially in fleet management, and these news events do not materially change the risk posed by fleet imbalances and margin pressure.

The most relevant company development for investors is U-Haul’s continued expansion of its self-storage network, including new openings in Champaign and Marietta. This aligns closely with ongoing efforts to drive revenue by boosting occupancy and increasing the number of rentable units, supporting future growth despite challenges seen in recent earnings.

However, it is important to note that in contrast to expanding storage capacity, U-Haul continues to face cost pressures from...

Read the full narrative on U-Haul Holding (it's free!)

U-Haul Holding's narrative projects $6.3 billion revenue and $709.9 million earnings by 2028. This requires 2.8% yearly revenue growth and a $342.8 million earnings increase from $367.1 million today.

Uncover how U-Haul Holding's forecasts yield a $89.84 fair value, a 56% upside to its current price.

Exploring Other Perspectives

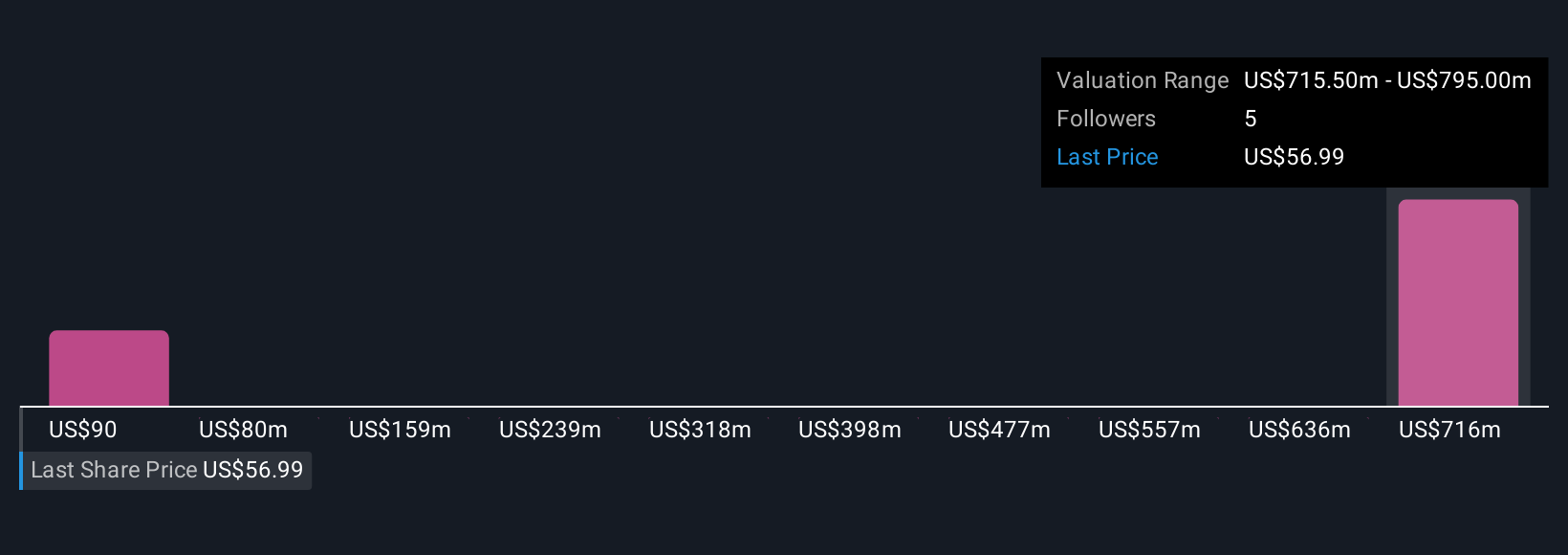

Simply Wall St Community members shared two fair value estimates for U-Haul Holding Company, ranging from US$89.84 all the way to US$795,001,555.39. With such wide-ranging viewpoints, examining ongoing profit margin pressures becomes even more essential as you weigh community optimism against the company’s recent financial trends.

Explore 2 other fair value estimates on U-Haul Holding - why the stock might be a potential multi-bagger!

Build Your Own U-Haul Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your U-Haul Holding research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free U-Haul Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate U-Haul Holding's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UHAL

U-Haul Holding

Operates as a do-it-yourself moving and storage operator for household and commercial goods in the United States and Canada.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives