- United States

- /

- Transportation

- /

- NYSE:UHAL

How Investors May Respond To U-Haul Holding (UHAL) Higher Revenue But Falling Net Income This Quarter

Reviewed by Simply Wall St

- On August 6, 2025, U-Haul Holding Company reported its first quarter financial results, with sales of US$1,292.51 million and revenue of US$1,630.47 million, both higher than the year before, while net income declined to US$142.33 million from US$195.42 million.

- This mixed performance, rising top-line results alongside lower profitability, offers insight into the company's evolving cost structure and operational challenges.

- We'll explore how U-Haul Holding’s higher revenue but lower net income this quarter may influence the company’s growth and margin outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

U-Haul Holding Investment Narrative Recap

Owning U-Haul Holding stock means believing in the company’s ability to grow its core moving and self-storage businesses despite significant competitive and cost headwinds. The recent quarterly results, showing increased revenue but falling net income, do not materially change the main short-term catalyst, U-Haul’s ongoing efforts to correct fleet imbalances and improve operational efficiency. However, persistent pressure on margins from higher operating expenses remains the biggest near-term risk to watch.

Among recent company announcements, the May opening of new self-storage facilities, such as the expanded Mount Branson site, stands out for its relevance to U-Haul’s stated growth strategy. This initiative relates closely to the company’s short-term catalyst, as expanding the self-storage footprint could help balance competitive threats and drive top-line growth, even as margin pressures continue.

By contrast, rising operating costs may still erode profit margins faster than revenue can grow, this is a critical detail investors should be aware of as...

Read the full narrative on U-Haul Holding (it's free!)

U-Haul Holding's narrative projects $6.3 billion revenue and $709.9 million earnings by 2028. This requires 2.8% yearly revenue growth and a $342.8 million earnings increase from $367.1 million today.

Uncover how U-Haul Holding's forecasts yield a $89.84 fair value, a 57% upside to its current price.

Exploring Other Perspectives

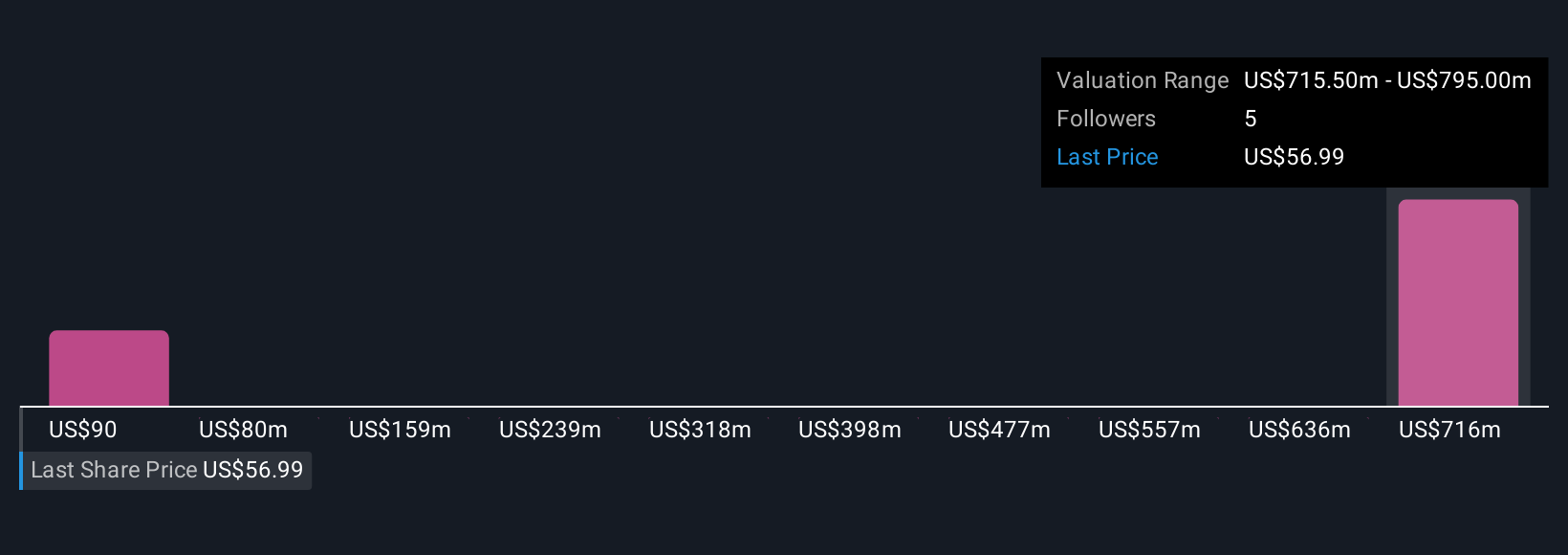

Two Simply Wall St Community members placed fair value estimates for U-Haul Holding between US$89.84 and an outlier above US$795 million. Despite the wide spread in community valuations, margin pressure from higher operating costs remains a focus and could shape future performance, so consider multiple perspectives before deciding where you stand.

Explore 2 other fair value estimates on U-Haul Holding - why the stock might be a potential multi-bagger!

Build Your Own U-Haul Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your U-Haul Holding research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free U-Haul Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate U-Haul Holding's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UHAL

U-Haul Holding

Operates as a do-it-yourself moving and storage operator for household and commercial goods in the United States and Canada.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives