- United States

- /

- Transportation

- /

- NYSE:UBER

What Uber Technologies (UBER)'s Drone Deliveries and Retail Expansion Mean for Shareholders

Reviewed by Simply Wall St

- Uber Technologies recently unveiled multiple partnerships and expansions, including launching drone-powered delivery with Flytrex, luxury helicopter rides with Joby Aviation, and adding DSW, Sephora, and Best Buy to its Uber Eats platform, broadening access to on-demand retail and mobility services across the U.S. and Europe.

- These moves highlight Uber's commitment to diversifying its platform beyond ride-hailing and food delivery, leveraging technology to integrate new retail and high-end transportation experiences.

- We'll examine how Uber's push into drone delivery and expanded retail integration could influence the company's long-term investment thesis.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Uber Technologies Investment Narrative Recap

To remain confident as an Uber shareholder, you need to believe in the company’s ability to extend its platform advantage as a global leader in on-demand mobility and delivery, all while realizing synergies and operating efficiencies that could drive sustainable revenue and margin growth. The recent class action lawsuit regarding accessibility in Quebec spotlights ongoing regulatory and reputational risks but does not materially alter the short-term momentum, which is most influenced by Uber’s drive for profitable expansion and further integration of new services.

One of Uber’s most relevant recent announcements is the partnership with Joby Aviation to bring helicopter and air mobility services into the Uber app. This move underscores how new verticals, especially in premium transportation, could serve as compelling growth catalysts by expanding the user base and boosting transaction values, adding both differentiation and higher-margin opportunities to the core platform.

However, in contrast to these growth initiatives, investors should pay attention to mounting compliance challenges that might ...

Read the full narrative on Uber Technologies (it's free!)

Uber Technologies' outlook anticipates $71.2 billion in revenue and $9.7 billion in earnings by 2028. This assumes a 14.6% annual revenue growth rate, but a decrease in earnings of $2.9 billion from current earnings of $12.6 billion.

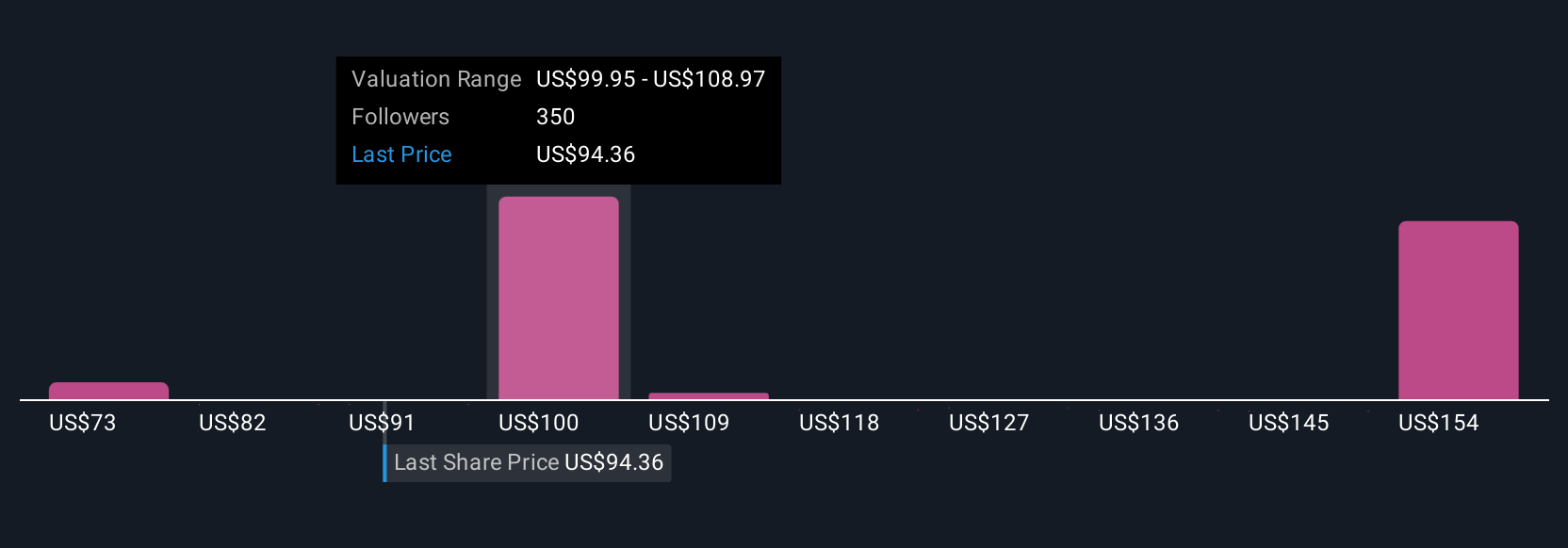

Uncover how Uber Technologies' forecasts yield a $106.43 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Fifty-eight members of the Simply Wall St Community have shared fair value estimates for Uber ranging from US$72.92 to US$162.34. While expansion into premium and autonomous services is seen as a key earnings driver, many recognize how regulatory issues could impact the company’s financial progress; explore these different viewpoints for a broader understanding.

Explore 58 other fair value estimates on Uber Technologies - why the stock might be worth as much as 63% more than the current price!

Build Your Own Uber Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Uber Technologies research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Uber Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Uber Technologies' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)