- United States

- /

- Transportation

- /

- NYSE:UBER

Uber (UBER): Exploring Valuation Perspectives After Recent Pullback and Year-to-Date Gains

See our latest analysis for Uber Technologies.

Uber’s recent pullback comes after a long run of gains. While momentum has slowed slightly in the past month, the company’s impressive year-to-date share price return of 51% and 20% total return over the last 12 months show it is still in a strong position compared to the market.

If you want to see what’s moving beyond rideshare and delivery, check out See the full list for free.

With shares trading below analyst price targets and Uber delivering strong long-term returns, the question now is whether investors are overlooking further upside or if the market has already factored in all of the company’s future growth.

Most Popular Narrative: 27.2% Overvalued

Uber's last closing price of $95.43 is well above the fair value zone estimated by the most widely followed narrative. The narrative's conclusion stands in sharp contrast to recent share strength and robust headline performance, setting up a challenging case for current buyers.

• Fair Value Range: $90-135B market cap

• Current Market Cap: $192B (significantly overvalued)

• Target Entry Price: $65-75 per share (vs current ~$95)

Seeking what is fueling this valuation tension? The secret sauce lies in bold long-term growth assumptions and ambitious future profit margins. Uncover the detailed numbers and see what could truly shake up Uber's market value outlook. There might be surprises ahead.

Result: Fair Value of $75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, still, breakthroughs in autonomous technology or stronger than expected profitability could quickly shift sentiment and challenge the current overvaluation worries.

Find out about the key risks to this Uber Technologies narrative.

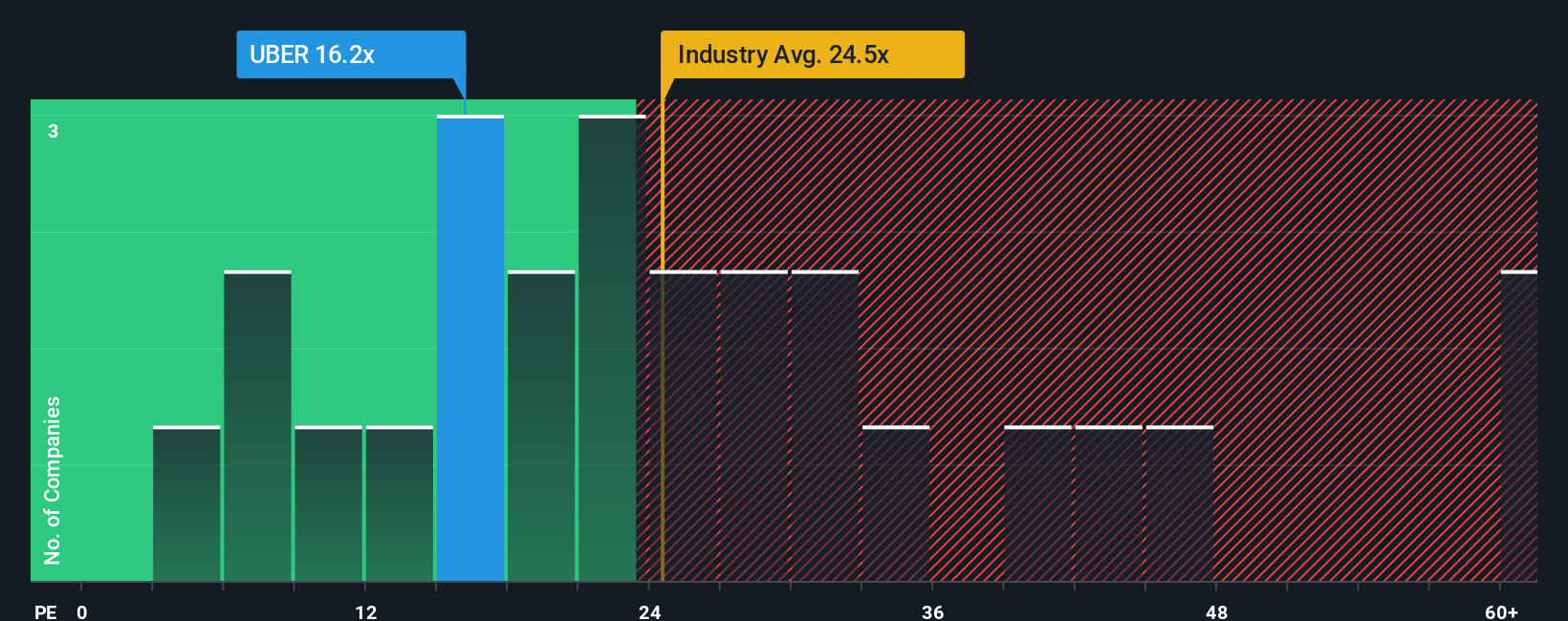

Another View: What Multiples Suggest

Stepping back from narrative fair values, it is useful to look at how Uber's price compares to other transportation stocks. Uber trades at a price-to-earnings ratio of 15.8, which is far below both the industry average of 26.1 and the peer average of 37.7, and just under the estimated fair ratio of 16.9. This relative undervaluation suggests the market might be underrating Uber's business strength, or perhaps there is caution about its future growth. Could the real opportunity be hiding in plain sight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Uber Technologies Narrative

If you see the story unfolding differently, or want to run your own analysis on Uber’s fundamentals, shaping your own take is quick and straightforward. Just give it a try with Do it your way.

A great starting point for your Uber Technologies research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your horizon beyond Uber and seize fresh opportunities now. Limiting yourself could mean missing out on tomorrow’s best performers just one click away.

- Boost your portfolio's yield by targeting companies with consistent payouts through these 21 dividend stocks with yields > 3%.

- Uncover potential in rapidly growing healthcare innovators with these 34 healthcare AI stocks, tapping into breakthroughs driven by artificial intelligence.

- Be among the first to track undervalued opportunities using these 866 undervalued stocks based on cash flows, and catch market mispricings before others do.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

METHODE ELECTRONICS (MEI): A Short Circuit or Just a Blown Fuse?

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!