- United States

- /

- Transportation

- /

- NYSE:SNDR

Schneider National (SNDR): Exploring Valuation Gaps and Investor Sentiment This Quarter

Reviewed by Kshitija Bhandaru

Schneider National (SNDR) has drawn some attention after recent stock movements that have left investors weighing its performance trends over the past month and quarter. Let’s take a closer look at how things are shaping up for this US transportation company.

See our latest analysis for Schneider National.

While Schneider National’s latest share price of $21.73 reflects a market still weighing its prospects, the stock’s 1-year total shareholder return of -0.19% hints at a year shaped more by caution than momentum. This is despite some robust operational gains and stability across the sector. At this stage, recent moves appear to signal that investors are waiting for clearer cues before pushing the stock’s trajectory in either direction.

If you’re interested in the bigger picture across transportation and logistics, now’s a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With recent gains in profit and a share price hovering below analyst targets, the question now is whether Schneider National offers hidden value for patient buyers, or if the market has already factored in its growth prospects.

Most Popular Narrative: 21.5% Undervalued

The most widely followed narrative puts Schneider National’s fair value at $27.69, well above the last close at $21.73. This discrepancy has investors taking note and searching for the drivers anchoring this bullish stance.

Schneider's continued investments and focus on technology-driven efficiency (AI, automation, digital freight platform) and cost reduction initiatives are set to drive sustainable operational improvements, containing expenses even in inflationary environments, which should support higher net margins and earnings growth as volumes recover.

Curious how projections for margin growth and operational upgrades set this price target? The real intrigue lies in the scale of expected profit expansion and how much higher those future earnings could be. What bold assumptions are behind this market-beating valuation? Only the full narrative reveals the numbers moving the market.

Result: Fair Value of $27.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent freight downturns or rising regulatory costs could still derail Schneider National’s margin recovery and challenge these optimistic projections.

Find out about the key risks to this Schneider National narrative.

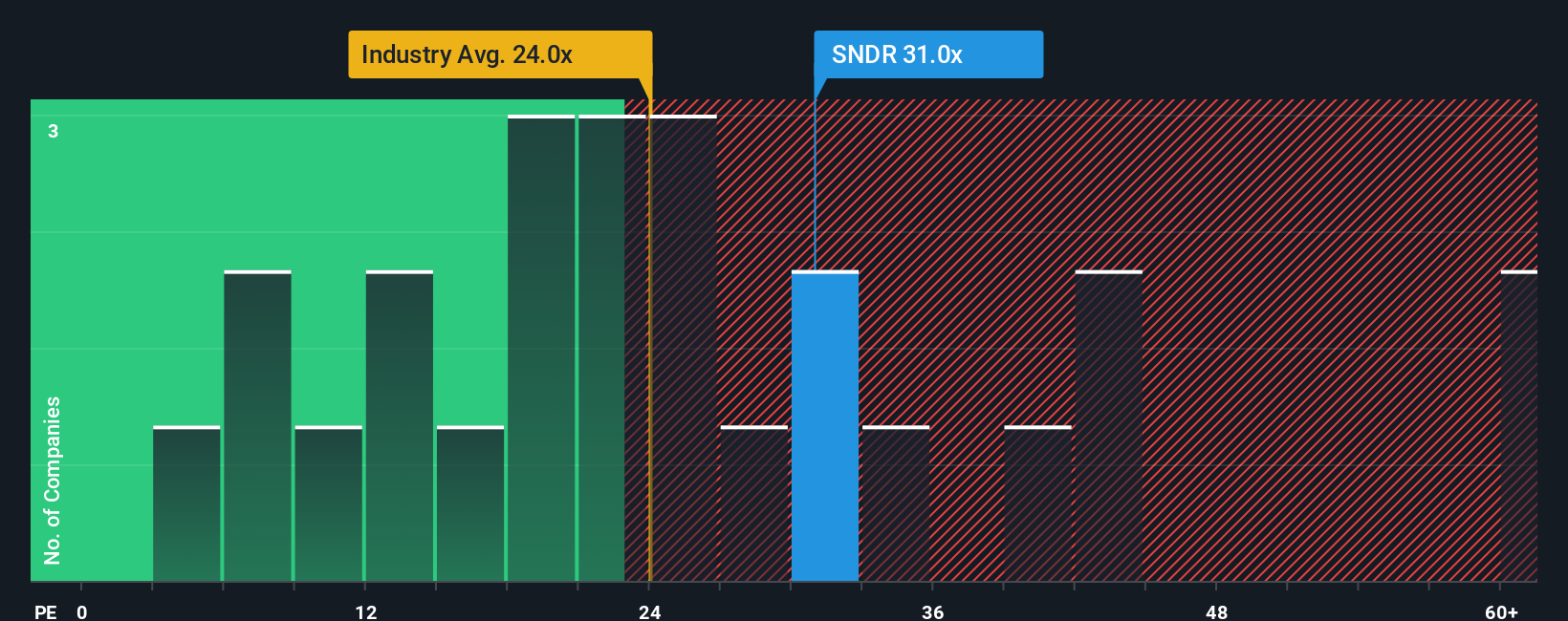

Another View: Market Ratios Raise a Red Flag

While the analyst consensus points to Schneider National being undervalued, a look at its price-to-earnings ratio tells a different story. At 30.4x, the stock is more expensive than both the US industry average of 24.1x and its peers at 26.9x. It also sits well above a fair ratio of 20.9x. This suggests the market is pricing in strong future growth, leaving less margin for safety if those expectations are not met. Could the optimism be overdone, or is there justification for paying a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Schneider National Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Schneider National.

Looking for more investment ideas?

Don't miss out on a wealth of new opportunities. Expand your horizons with carefully curated stock ideas that could make all the difference for your portfolio.

- Tap into the fast-paced tech sector and seize the momentum around artificial intelligence with these 24 AI penny stocks.

- Power up your long-term growth strategy by checking out these 885 undervalued stocks based on cash flows that could be trading below their intrinsic value.

- Secure steady income streams by exploring these 19 dividend stocks with yields > 3% offering reliable yields above 3% for smart investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNDR

Schneider National

Provides multimodal surface transportation and logistics solutions in the United States, Canada, and Mexico.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives