- United States

- /

- Transportation

- /

- NYSE:SNDR

Schneider National (SNDR): A Fresh Look at Valuation Following Recent Share Price Uptick

Reviewed by Kshitija Bhandaru

See our latest analysis for Schneider National.

Today’s modest share price uptick follows a stretch of losses for Schneider National, as the stock has struggled to gain momentum in 2024. While the 1-day share price return is mildly positive, the year-to-date share price return sits at -22.14%. Still, the company maintains a positive three-year and five-year total shareholder return, suggesting that long-term holders have fared better despite recent weakness. At $22.68, it is clear that investor sentiment has been cautious, possibly reflecting evolving views on growth prospects and risk.

If you’re wondering what other areas of the market are picking up steam, now is a smart moment to broaden your perspective with fast growing stocks with high insider ownership

After recent declines, investors face a key question: is Schneider National now trading below its true value, or have markets already accounted for its future growth prospects, leaving little room for further upside?

Most Popular Narrative: 15.6% Undervalued

The narrative consensus estimates Schneider National’s fair value at $26.86, reflecting a notable premium to its last close at $22.68. This suggests analysts see potential for upside if key business catalysts unfold as expected.

Schneider's continued investments and focus on technology-driven efficiency (AI, automation, digital freight platform) and cost reduction initiatives are set to drive sustainable operational improvements. These efforts aim to contain expenses even in inflationary environments, which should support higher net margins and earnings growth as volumes recover.

Curious what future-looking assumptions justify this premium? The most widely followed narrative banks on ambitious profit expansion and a radical transformation of operating margins. Ready to peek behind the curtain to see the full story?

Result: Fair Value of $26.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak freight demand and sustained cost pressures could challenge margin recovery and limit the upside potential for Schneider National's shares.

Find out about the key risks to this Schneider National narrative.

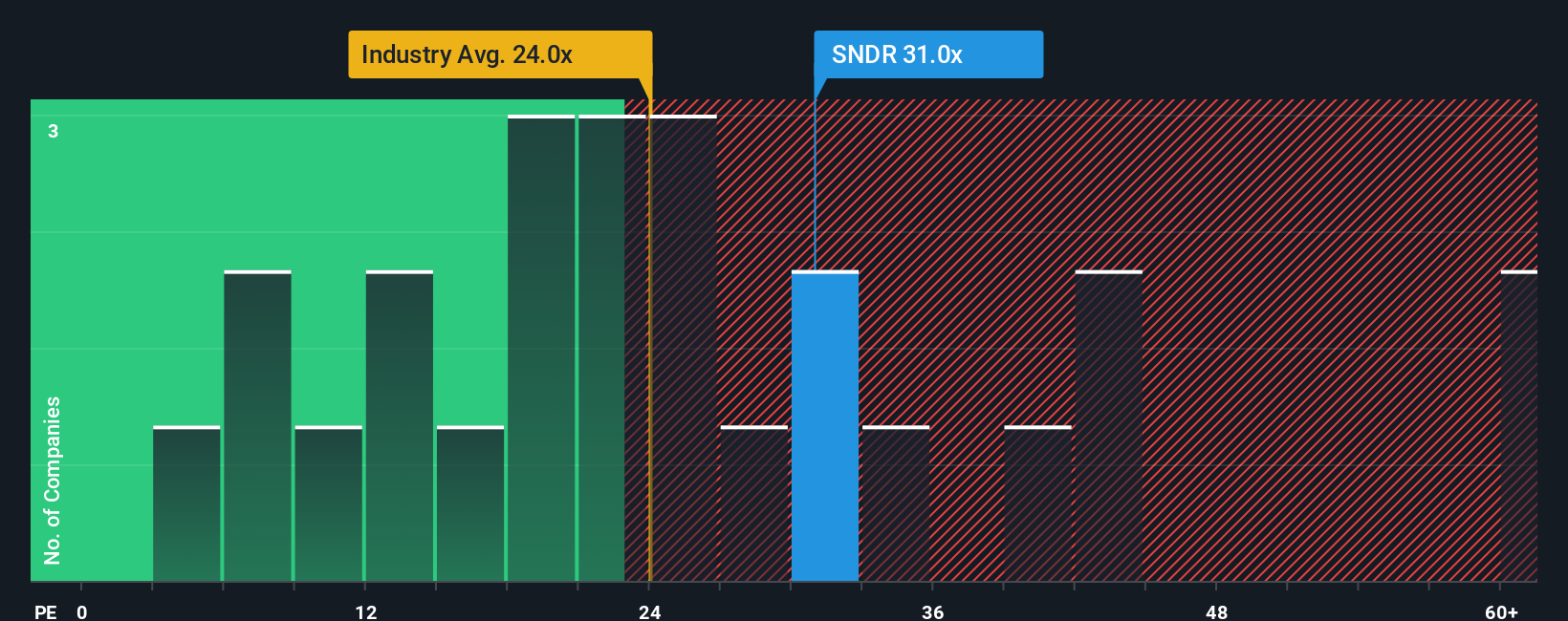

Another View: Market Multiples Send a Different Signal

While fair value estimates look optimistic, a close examination of price-to-earnings shows a different perspective. Schneider National trades at 31.7x earnings, which is much higher than both the Transportation industry average of 24.4x and the peer average of 23.7x. The market’s fair ratio, at just 19.3x, suggests shares could face valuation pressure if investor sentiment changes, challenging the idea of a clear-cut opportunity. Could this premium hinder future gains, or do the company’s strengths justify the higher valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Schneider National Narrative

If you think there’s another angle to explore or would rather dive into the numbers yourself, it only takes a few minutes to craft a personal perspective. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Schneider National.

Looking for More Investment Ideas?

Step up your investing game by jumping into fresh stock themes that countless investors overlook. Don’t let others get the edge before you do!

- Capitalize on potential big returns by seizing these 3557 penny stocks with strong financials, which are already attracting savvy, value-focused investors.

- Ride the AI revolution by starting with these 24 AI penny stocks, positioned to benefit most from advances in artificial intelligence and automation.

- Boost your income portfolio with these 18 dividend stocks with yields > 3%, offering attractive yields and steady cash flow for long-term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNDR

Schneider National

Provides multimodal surface transportation and logistics solutions in the United States, Canada, and Mexico.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives