- United States

- /

- Life Sciences

- /

- NasdaqGS:RGEN

Repligen And 2 Other Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market navigates the complexities of trade tensions and political developments, major indices like the S&P 500 and Nasdaq Composite have recently hit record highs, reflecting a mix of investor optimism and caution. In this environment, identifying undervalued stocks can be particularly appealing to investors seeking opportunities that may not yet be fully recognized by the broader market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SharkNinja (SN) | $107.24 | $210.75 | 49.1% |

| Roku (ROKU) | $88.27 | $173.23 | 49% |

| Robert Half (RHI) | $42.85 | $83.19 | 48.5% |

| Privia Health Group (PRVA) | $22.11 | $43.37 | 49% |

| Insteel Industries (IIIN) | $39.23 | $77.39 | 49.3% |

| Definitive Healthcare (DH) | $4.03 | $7.85 | 48.7% |

| Community West Bancshares (CWBC) | $21.22 | $42.33 | 49.9% |

| Carter Bankshares (CARE) | $18.25 | $35.50 | 48.6% |

| Atlantic Union Bankshares (AUB) | $33.54 | $65.94 | 49.1% |

| Acadia Realty Trust (AKR) | $18.64 | $36.60 | 49.1% |

Underneath we present a selection of stocks filtered out by our screen.

Repligen (RGEN)

Overview: Repligen Corporation is a life sciences company that develops and commercializes bioprocessing technologies and systems globally, with a market cap of approximately $7.16 billion.

Operations: Repligen generates revenue from its Medical Products segment, amounting to $650.43 million.

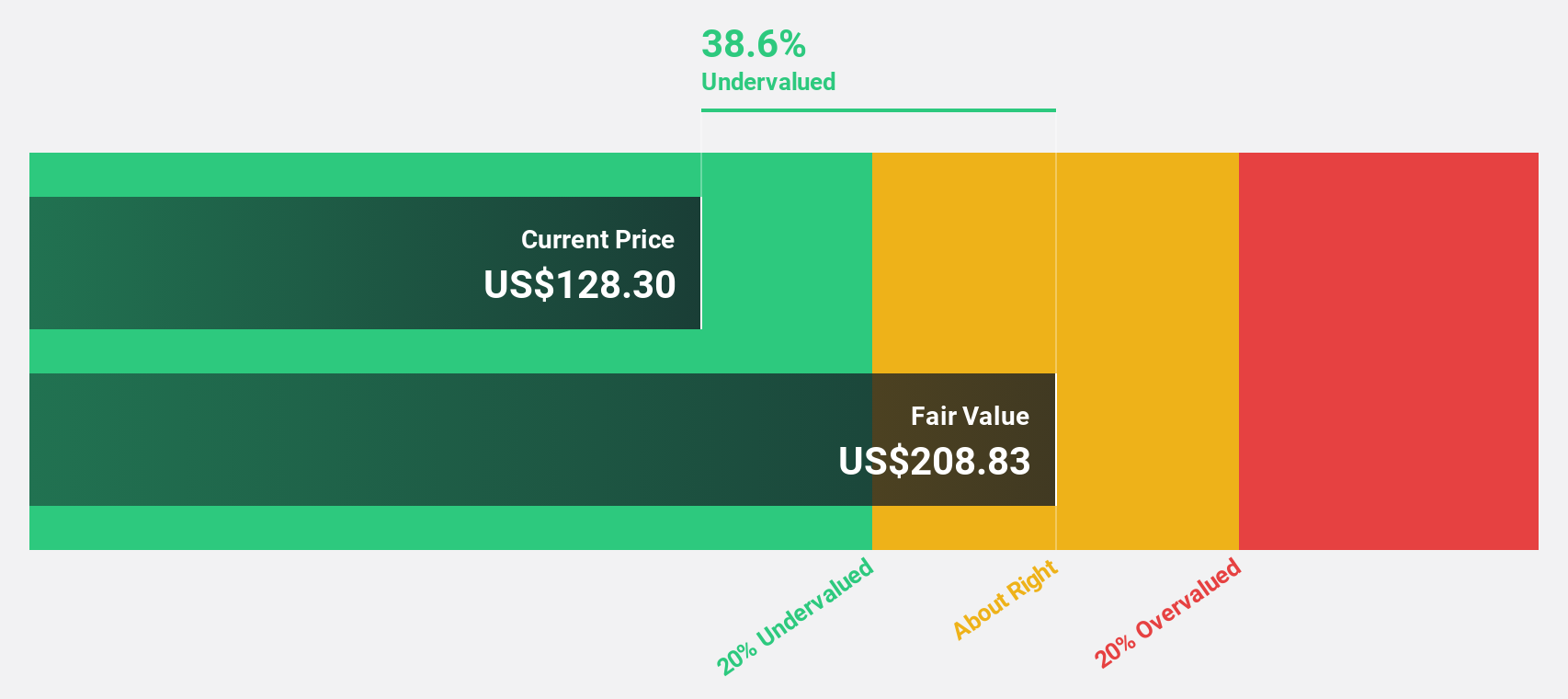

Estimated Discount To Fair Value: 43.2%

Repligen is trading at US$127.47, significantly below its estimated fair value of US$224.55, suggesting it may be undervalued based on cash flows. Despite recent insider selling, the company's earnings are forecast to grow 44.62% annually, with revenue growth expected at 13.8%, outpacing the US market average of 8.7%. However, Return on Equity is projected to remain low at 6% in three years and profitability is anticipated within this period.

- Our earnings growth report unveils the potential for significant increases in Repligen's future results.

- Delve into the full analysis health report here for a deeper understanding of Repligen.

Coeur Mining (CDE)

Overview: Coeur Mining, Inc. is a gold and silver producer operating in the United States, Canada, and Mexico with a market cap of $5.83 billion.

Operations: The company's revenue segments include Wharf with $249.04 million, Palmarejo at $378.49 million, Rochester generating $268.61 million, and Kensington contributing $246.85 million.

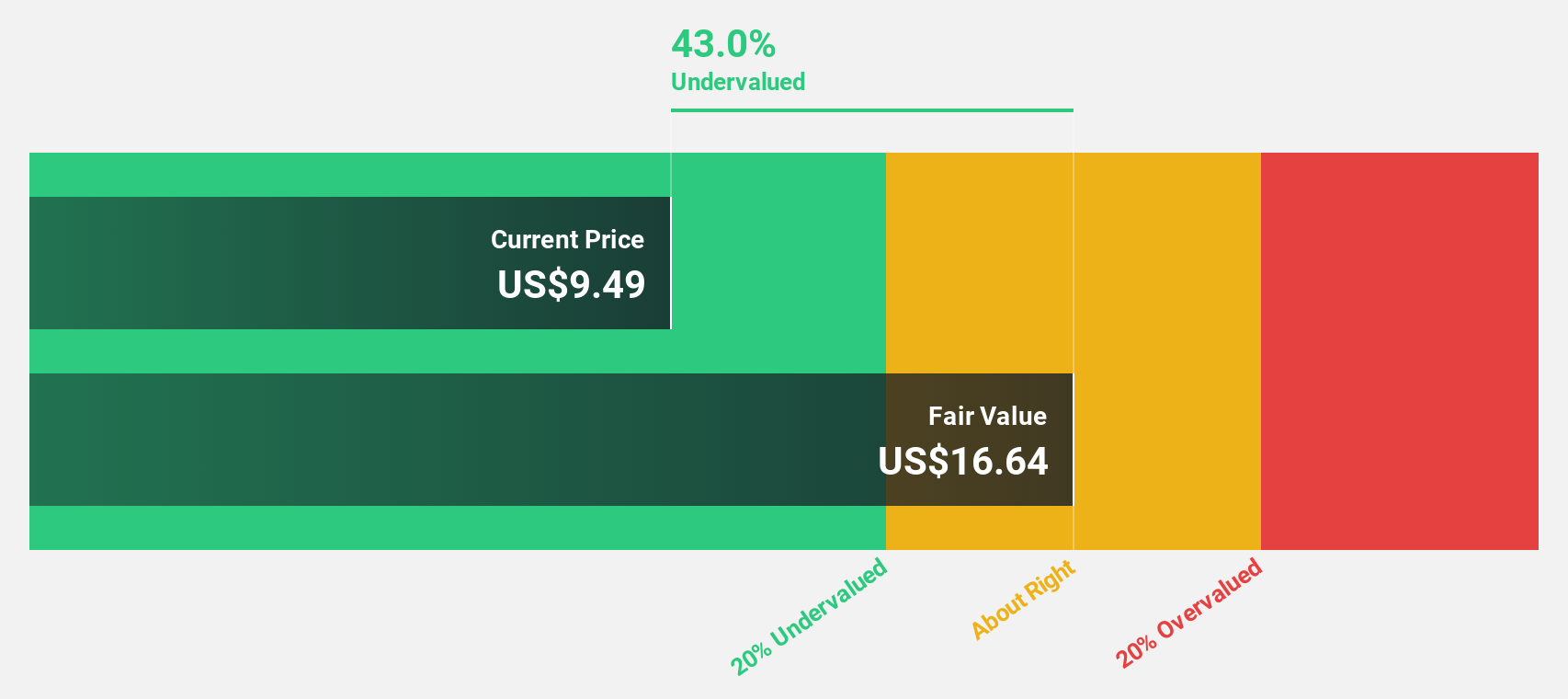

Estimated Discount To Fair Value: 45.2%

Coeur Mining, trading at US$9.12, is undervalued based on cash flows with an estimated fair value of US$16.64. The company has turned profitable this year and earnings are expected to grow significantly at 24.9% annually, outpacing the US market average of 14.7%. While revenue growth is forecasted at 9.5%, faster than the market's 8.7%, shareholders have faced substantial dilution recently despite a recent share repurchase program announcement worth US$75 million.

- Upon reviewing our latest growth report, Coeur Mining's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Coeur Mining's balance sheet health report.

RXO (RXO)

Overview: RXO, Inc. operates in the truck brokerage business across the United States, Canada, Mexico, Asia, and Europe with a market cap of approximately $2.76 billion.

Operations: The company's revenue is primarily derived from its transportation segment, specifically trucking, which generated $5.07 billion.

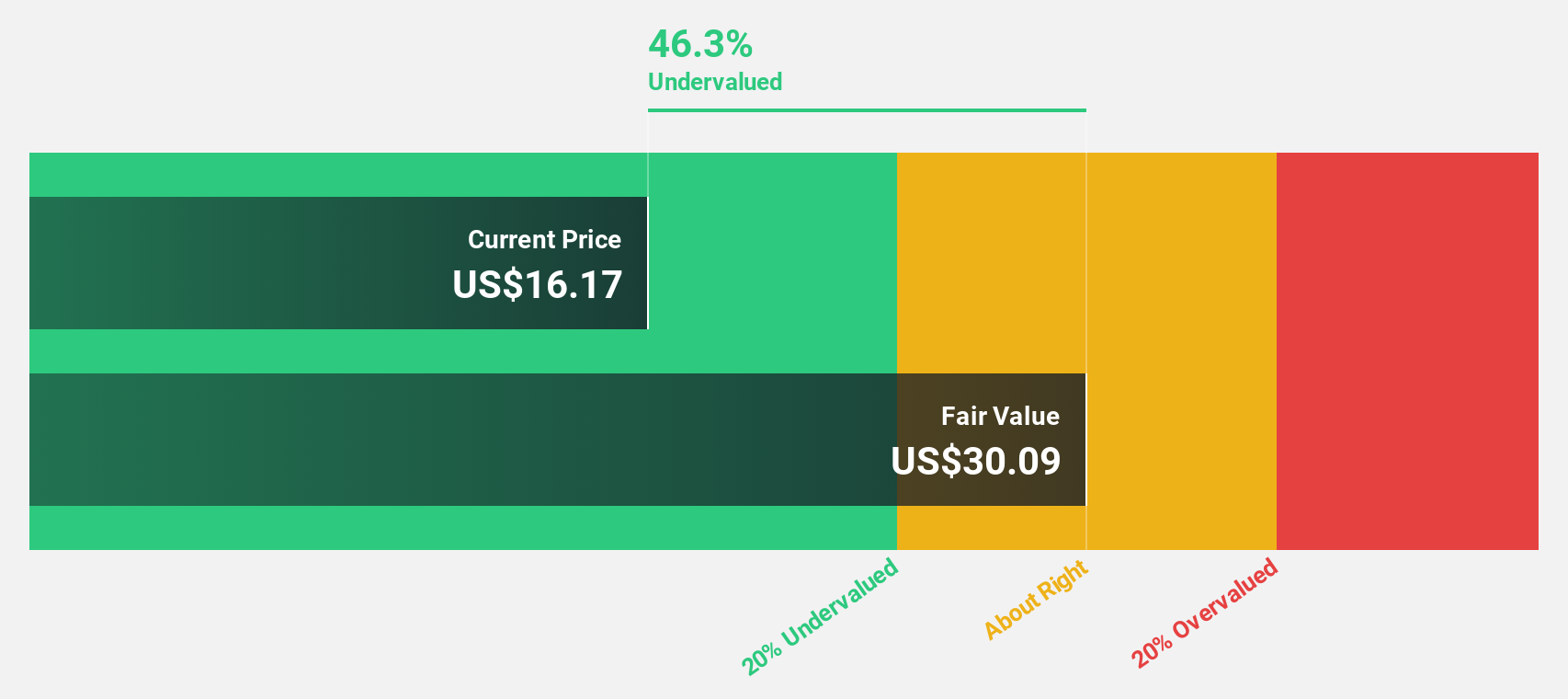

Estimated Discount To Fair Value: 44.1%

RXO is trading at US$16.82, significantly below its estimated fair value of US$30.09, suggesting it is undervalued based on cash flows. Despite a net loss of US$31 million in Q1 2025, revenue increased to US$1.43 billion from the previous year’s US$913 million. While earnings are expected to grow substantially by 130% annually, shareholders have experienced dilution recently. RXO's inclusion in multiple Russell Value indices highlights its market recognition despite financial challenges.

- The growth report we've compiled suggests that RXO's future prospects could be on the up.

- Dive into the specifics of RXO here with our thorough financial health report.

Make It Happen

- Gain an insight into the universe of 179 Undervalued US Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGEN

Repligen

A life sciences company, develops and commercializes bioprocessing technologies and systems in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives