- United States

- /

- Transportation

- /

- NYSE:NSC

Norfolk Southern (NSC): Assessing Valuation Following a 23% Year-to-Date Rally

Reviewed by Kshitija Bhandaru

See our latest analysis for Norfolk Southern.

Norfolk Southern’s share price has gained real traction this year, climbing over 23% year-to-date. Its latest uptick suggests renewed investor confidence amid steady business momentum. The stock’s three-year total shareholder return of 43% highlights its staying power for long-term investors.

If this kind of momentum appeals to you, it could be the perfect opportunity to broaden your investing horizons and discover fast growing stocks with high insider ownership

The strong rally raises a critical question: Are Norfolk Southern shares undervalued relative to their fundamentals, or has the recent surge already priced in much of the company’s future growth potential?

Most Popular Narrative: 5.7% Undervalued

Norfolk Southern’s most followed narrative sets its fair value at $307 per share, placing it ahead of the last closing price of $289.70. This perspective drives considerable focus on the company’s transformation, with attention on growing efficiencies, long-term market share, and the impact of merger developments.

The commitment to $150 million in productivity and cost reduction initiatives over three years is being propelled by better labor productivity and fuel efficiency, which are anticipated to sustain EPS growth even if revenue growth slows.

Want to know which unexpected operational strategies support this value? The narrative hinges on aggressive savings plans and investor optimism for margin expansion. Find out how bold earnings forecasts and improved productivity come together in this widely debated estimate.

Result: Fair Value of $307 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still real risks. Rising storm-related costs and pricing pressure from weaker coal markets could challenge this optimistic outlook.

Find out about the key risks to this Norfolk Southern narrative.

Another View: A Look at Earnings Multiples

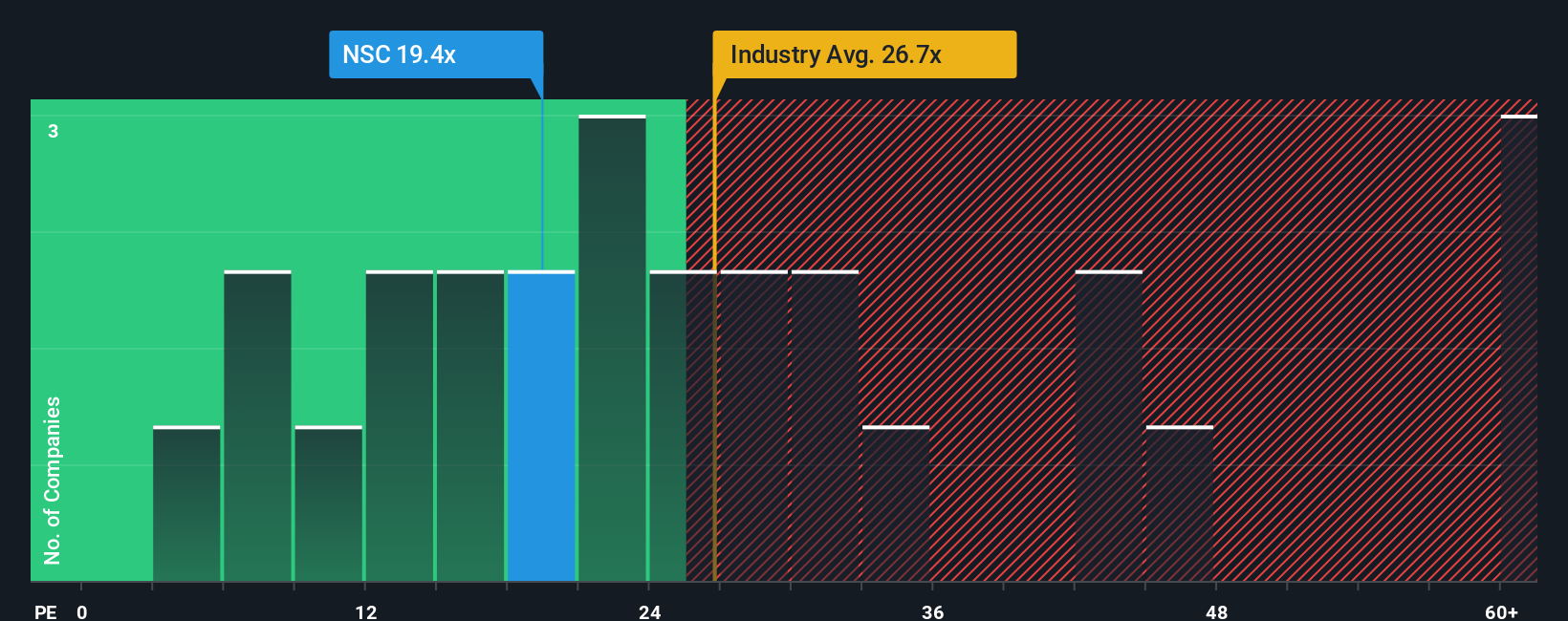

While some investors see value in Norfolk Southern based on fair value estimates, a glance at its earnings multiple tells a more cautious story. The company trades at a Price-to-Earnings ratio of 19.4x, lower than the US Transportation industry average of 24.4x and in line with peers at 19.9x. However, this is still well above the fair ratio of 15.8x, which highlights potential downside if the market reverts to this benchmark. Could this gap signal valuation risk if optimism fades?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Norfolk Southern Narrative

Prefer to form your own opinion? Delve into the available data and craft your personal view. Building your own narrative takes just a few minutes. Do it your way

A great starting point for your Norfolk Southern research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by searching beyond the obvious. Seize your chance to uncover compelling stocks and opportunities you may have missed elsewhere.

- Tap into the potential of companies disrupting medicine and treatment innovation by browsing these 33 healthcare AI stocks.

- Ride the wave of reliable income by reviewing these 18 dividend stocks with yields > 3%, offering yields above 3% for stable, long-term returns.

- Spot tomorrow’s leaders early by checking out these 3571 penny stocks with strong financials with resilient financials and growth prospects that stand out from the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norfolk Southern might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSC

Norfolk Southern

Engages in the rail transportation of raw materials, intermediate products, and finished goods in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives