- United States

- /

- Transportation

- /

- NasdaqGS:ULH

Here's Why We Think Universal Logistics Holdings (NASDAQ:ULH) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Universal Logistics Holdings (NASDAQ:ULH). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Universal Logistics Holdings

How Quickly Is Universal Logistics Holdings Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Universal Logistics Holdings has grown EPS by 27% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

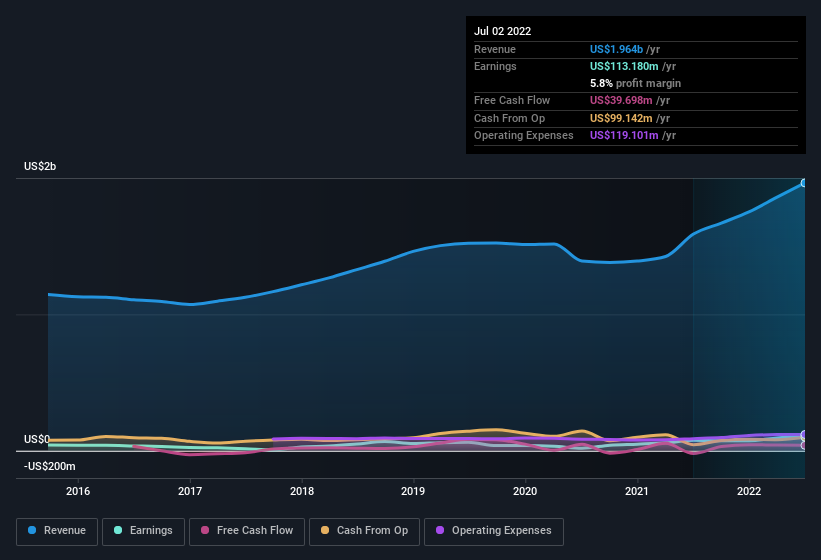

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Universal Logistics Holdings maintained stable EBIT margins over the last year, all while growing revenue 24% to US$2.0b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Universal Logistics Holdings?

Are Universal Logistics Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

In the last year insider at Universal Logistics Holdings were both selling and buying shares; but happily, as a group they spent US$102k more on stock, than they netted from selling it. On balance, that's a good sign. We also note that it was the Chairman, Matthew Moroun, who made the biggest single acquisition, paying US$46m for shares at about US$14.94 each.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Universal Logistics Holdings will reveal that insiders own a significant piece of the pie. In fact, they own 74% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. This insider holding amounts to That means they have plenty of their own capital riding on the performance of the business!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Universal Logistics Holdings' CEO, Tim Phillips, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations between US$400m and US$1.6b, like Universal Logistics Holdings, the median CEO pay is around US$4.0m.

The CEO of Universal Logistics Holdings only received US$1.0m in total compensation for the year ending December 2021. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Universal Logistics Holdings Worth Keeping An Eye On?

You can't deny that Universal Logistics Holdings has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Universal Logistics Holdings that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Universal Logistics Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ULH

Universal Logistics Holdings

Provides transportation and logistics solutions in the United States, Mexico, Canada, and Colombia.

Solid track record and good value.

Market Insights

Community Narratives