- United States

- /

- Trade Distributors

- /

- NasdaqGS:XMTR

3 Growth Companies With High Insider Ownership And 25% Return On Equity

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with major indices like the Dow Jones and S&P 500 pulling back amid anticipation of the Federal Reserve's interest rate decision, investors are increasingly focused on companies that demonstrate strong financial metrics and insider confidence. In this environment, growth companies with high insider ownership and a robust return on equity can offer compelling opportunities for those looking to navigate market volatility effectively.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 29.2% | 114.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.4% | 28.0% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Frontier Group Holdings (ULCC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Frontier Group Holdings, Inc. operates as a low-fare passenger airline serving leisure travelers in the United States and Latin America, with a market cap of approximately $1.18 billion.

Operations: The company generates its revenue primarily from providing air transportation services for passengers, amounting to $3.73 billion.

Insider Ownership: 31.4%

Return On Equity Forecast: 23% (2028 estimate)

Frontier Group Holdings is forecast to achieve profitability within three years, with expected annual earnings growth of 118.06% and revenue growth of 11.8%, surpassing the US market average. Despite a recent net loss of US$77 million for Q3 2025, insiders have shown confidence by purchasing more shares than they sold in the past three months, albeit not in substantial volumes. The company trades at good value compared to peers and industry standards.

- Navigate through the intricacies of Frontier Group Holdings with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Frontier Group Holdings' share price might be on the cheaper side.

Xometry (XMTR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xometry, Inc. operates an AI-powered online manufacturing marketplace serving both the United States and international markets, with a market cap of $3.06 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, which generated $642.78 million.

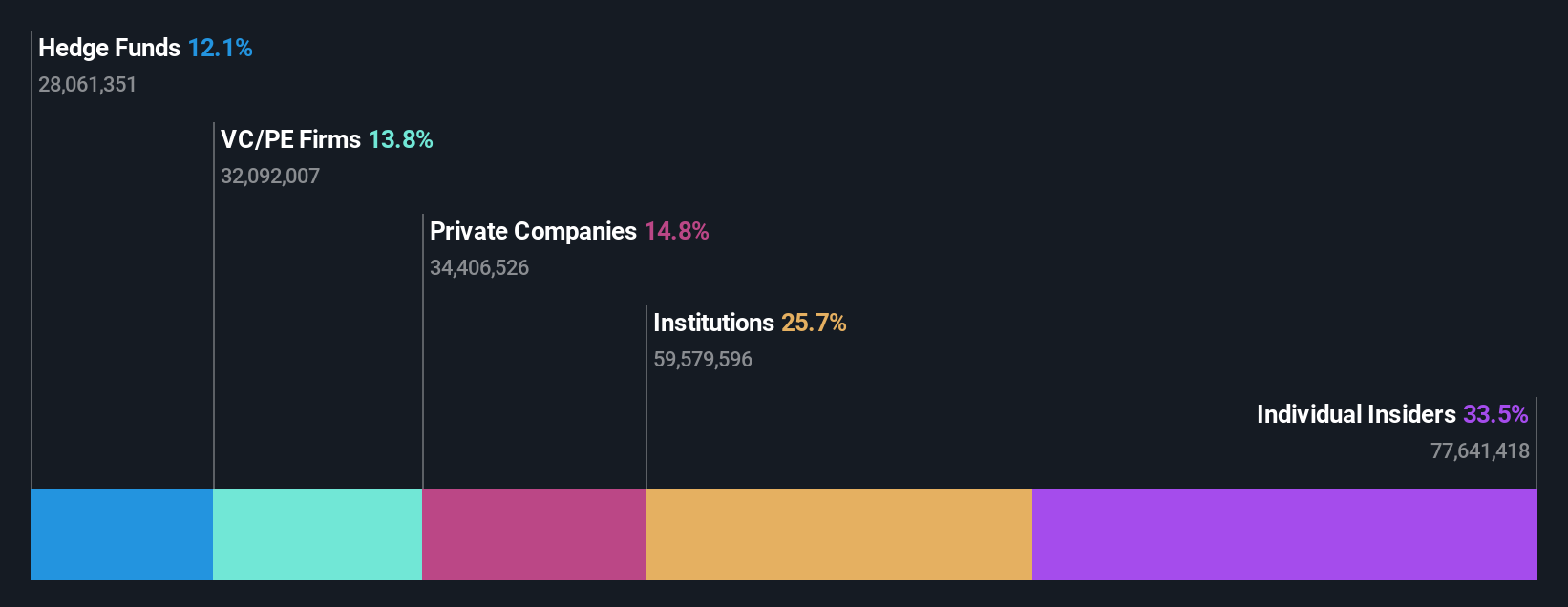

Insider Ownership: 12.7%

Return On Equity Forecast: 21% (2028 estimate)

Xometry is set to achieve profitability in the next three years, with earnings projected to grow at 92.6% annually. Despite a current net loss of US$11.6 million for Q3 2025, revenue increased to US$180.72 million from the previous year’s US$141.7 million, and future guidance has been raised significantly for 2025. The company recently launched an auto-quoting service for injection molding and a Workcenter Mobile App, enhancing its technological capabilities and customer experience.

- Unlock comprehensive insights into our analysis of Xometry stock in this growth report.

- Our valuation report unveils the possibility Xometry's shares may be trading at a premium.

Frontline (FRO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Frontline plc is a shipping company that owns and operates oil and product tankers globally, with a market cap of $5.20 billion.

Operations: Frontline generates revenue primarily from its tanker operations, amounting to $1.77 billion.

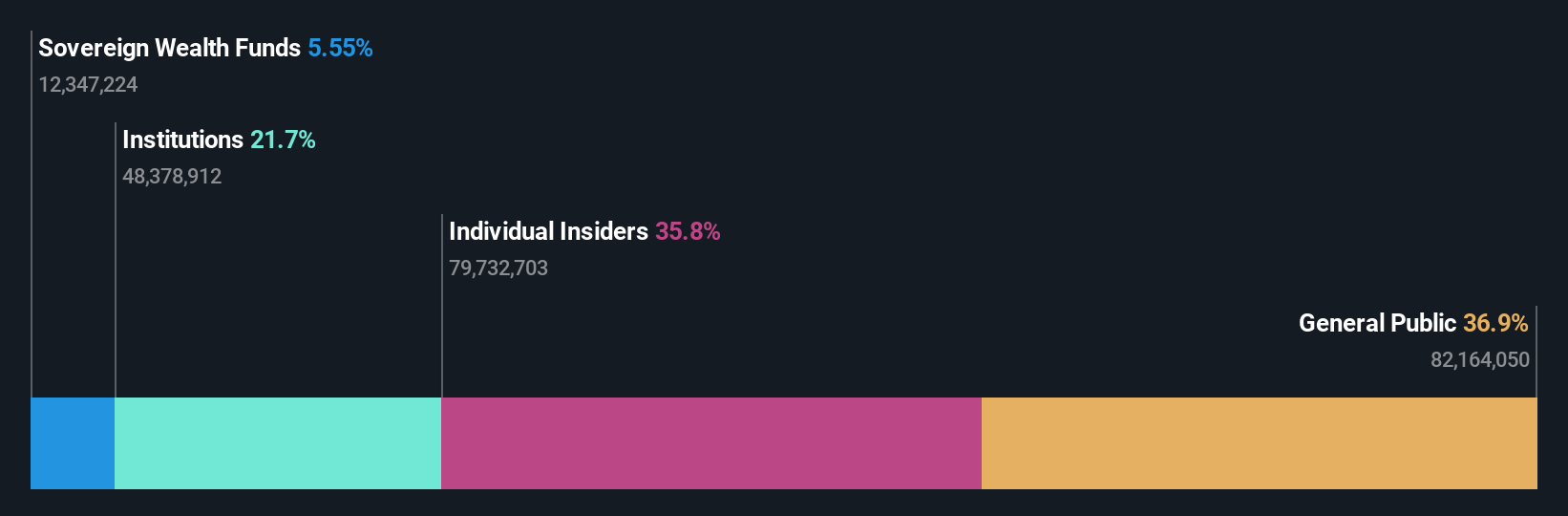

Insider Ownership: 35.9%

Return On Equity Forecast: 25% (2028 estimate)

Frontline faces challenges with declining revenue and net income, as recent earnings show a drop to US$40.32 million from US$60.46 million year-over-year for Q3 2025. Despite these setbacks, the company is forecasted for significant annual earnings growth of 38.9%, outpacing the broader US market's expectations. However, its dividend yield of 7.61% isn't well covered by earnings, and interest payments are not adequately supported by current profits, raising concerns about financial sustainability.

- Click to explore a detailed breakdown of our findings in Frontline's earnings growth report.

- Our expertly prepared valuation report Frontline implies its share price may be lower than expected.

Seize The Opportunity

- Investigate our full lineup of 202 Fast Growing US Companies With High Insider Ownership right here.

- Searching for a Fresh Perspective? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XMTR

Xometry

Operates an artificial intelligence (AI) powered online manufacturing marketplace in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026