- United States

- /

- Transportation

- /

- NasdaqGS:SAIA

Saia, Inc.'s (NASDAQ:SAIA) P/E Is Still On The Mark Following 27% Share Price Bounce

Saia, Inc. (NASDAQ:SAIA) shares have continued their recent momentum with a 27% gain in the last month alone. The annual gain comes to 102% following the latest surge, making investors sit up and take notice.

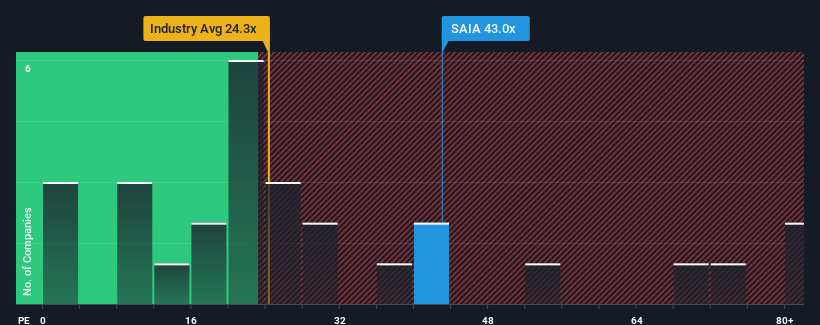

Following the firm bounce in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider Saia as a stock to avoid entirely with its 43x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Saia's negative earnings growth of late has neither been better nor worse than most other companies. One possibility is that the P/E is high because investors think the company can turn things around and break free from the broader downward trend in earnings. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Saia

How Is Saia's Growth Trending?

Saia's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.1%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 153% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 17% per year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 11% each year growth forecast for the broader market.

With this information, we can see why Saia is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Saia's P/E is flying high just like its stock has during the last month. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Saia maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Saia you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SAIA

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives