- United States

- /

- Transportation

- /

- NasdaqGM:PAMT

With EPS Growth And More, P.A.M. Transportation Services (NASDAQ:PTSI) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like P.A.M. Transportation Services (NASDAQ:PTSI). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for P.A.M. Transportation Services

How Fast Is P.A.M. Transportation Services Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Who among us would not applaud P.A.M. Transportation Services's stratospheric annual EPS growth of 46%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

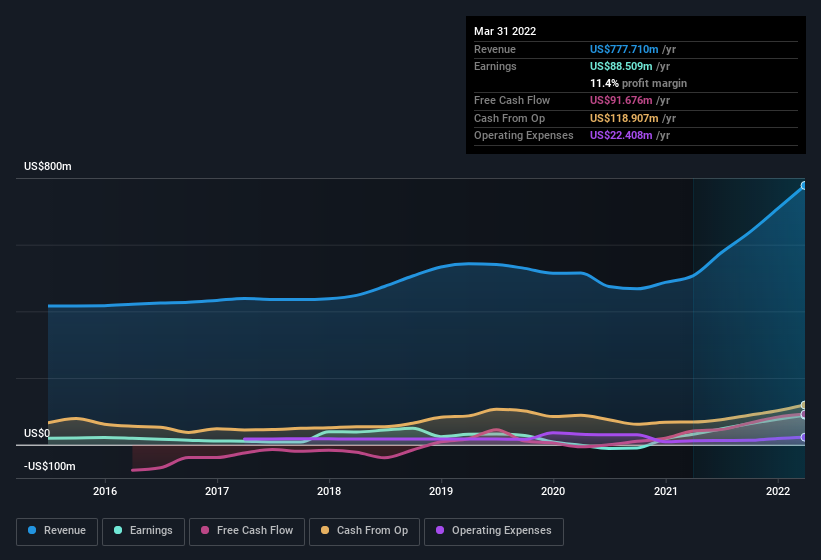

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that P.A.M. Transportation Services's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. P.A.M. Transportation Services shareholders can take confidence from the fact that EBIT margins are up from 7.6% to 15%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check P.A.M. Transportation Services's balance sheet strength, before getting too excited.

Are P.A.M. Transportation Services Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Like a sturdy phalanx P.A.M. Transportation Services insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the Independent Director, W. Davis, paid US$126k to buy shares at an average price of US$15.73.

And the insider buying isn't the only sign of alignment between shareholders and the board, since P.A.M. Transportation Services insiders own more than a third of the company. Indeed, with a collective holding of 70%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. And their holding is extremely valuable at the current share price, totalling US$416m. That means they have plenty of their own capital riding on the performance of the business!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Joseph Vitiritto, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like P.A.M. Transportation Services with market caps between US$200m and US$800m is about US$2.7m.

P.A.M. Transportation Services offered total compensation worth US$1.5m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is P.A.M. Transportation Services Worth Keeping An Eye On?

P.A.M. Transportation Services's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe P.A.M. Transportation Services deserves timely attention. What about risks? Every company has them, and we've spotted 3 warning signs for P.A.M. Transportation Services (of which 1 is potentially serious!) you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of P.A.M. Transportation Services, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PAMT

Pamt

Through its subsidiaries, operates as a truckload transportation and logistics company in the United States, Mexico, and Canada.

Low risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.