- United States

- /

- Transportation

- /

- NasdaqGM:PAMT

Pamt (PAMT): Profitability Worsens with Annual Net Losses Up 39.5% Heading Into Earnings

Reviewed by Simply Wall St

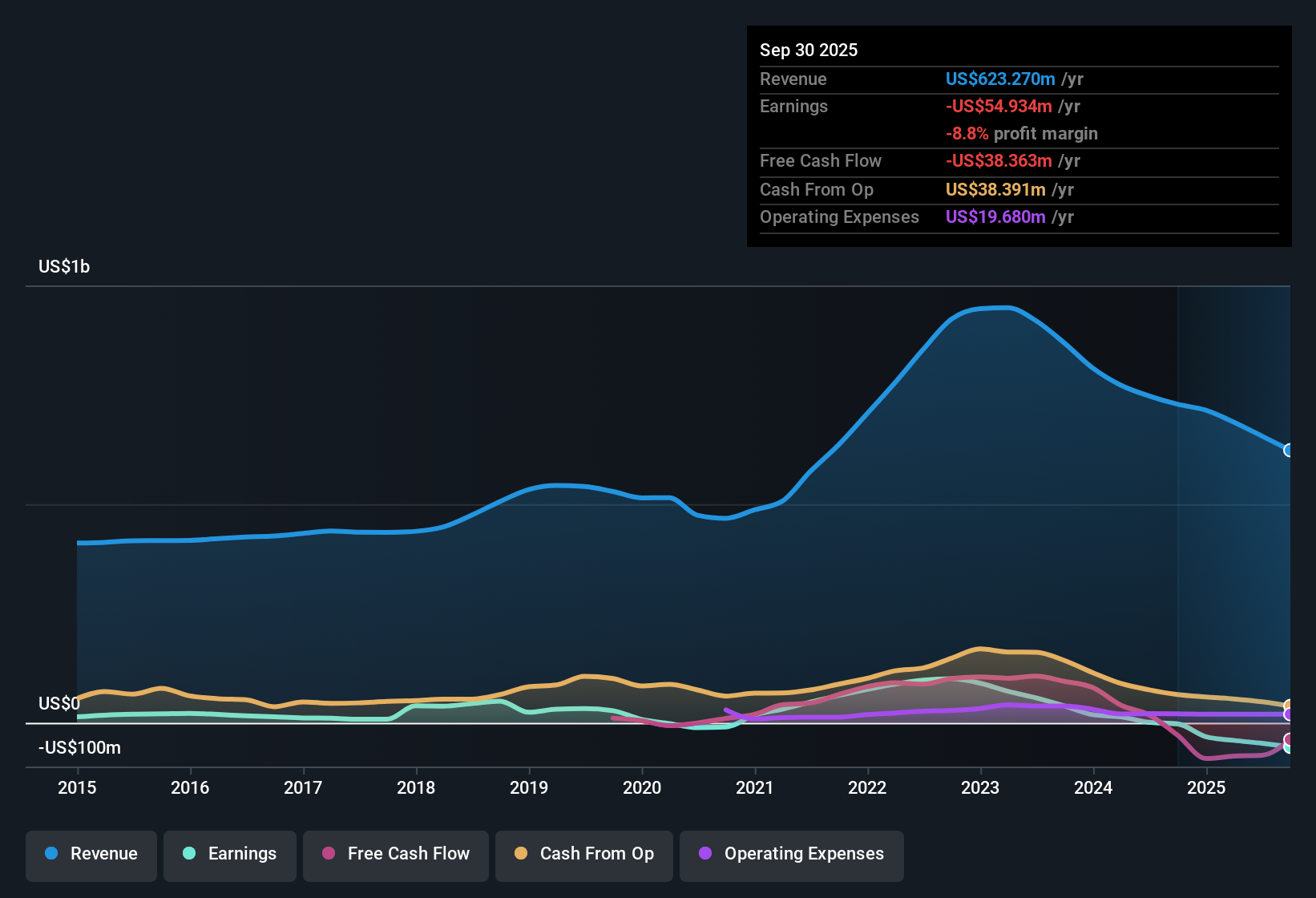

Pamt (PAMT) reported that losses have grown at an annualized rate of 39.5% over the past five years, with net profit margins showing no improvement. The company’s Price-To-Sales Ratio sits at 0.4x, offering a discount to both its peer average of 0.6x and the broader US Transportation industry at 1.3x. However, these valuation discounts are counterbalanced by persistent losses and an uncertain financial outlook.

See our full analysis for Pamt.Next, we will see how these numbers measure up against the current stories and narratives about Pamt, highlighting where expectations match reality and where surprises may lie.

Curious how numbers become stories that shape markets? Explore Community Narratives

Persistent Net Losses Deepen

- PAMT’s net loss has grown at a sharp 39.5% annualized pace over five years, making its path to profitability look significantly more challenging than many sector peers.

- The prevailing market view highlights how these mounting losses, combined with stagnant net profit margins, reinforce concerns about the durability of PAMT’s business model.

- Bears may point to the absence of any improvement in net profit margin as a structural warning sign, especially since there is no track record of "high-quality" earnings in recent filings.

- It is notable that despite the discount valuation, investors have not seen improved financial performance, leading to limited near-term confidence in a turnaround.

Financial Outlook Lacks Positive Catalysts

- Neither PAMT’s revenue nor its earnings are expected to grow based on the latest filings, and the company’s financial position remains weak by industry standards.

- According to the prevailing market view, the lack of projected growth and thin financial strength both stand out as major risks for new investors considering a position.

- Critics highlight that missing out on sector upswings or operational improvements further weakens the case for near-term optimism.

- Supporters looking for a hidden upside may be disappointed, as recent disclosures provide no evidence of rewards or forward momentum on revenue or profit.

Valuation Discount Is Not Enough

- PAMT’s Price-To-Sales Ratio sits at 0.4x, a discount to the peer average of 0.6x and the broader US Transportation industry at 1.3x. However, the company’s current share price of $10.68 only appears attractive if profitability concerns can be addressed.

- The prevailing market view indicates that while valuation multiples suggest relative cheapness, persistent operational headwinds are likely to outweigh the headline discount.

- Bulls drawn in by low multiples must contend with ongoing annual net losses and a financial footing that has yet to show signs of recovery.

- The discount compared to industry peers may be justified by fundamentals, limiting the case for a value-driven rebound without earnings momentum or margin improvement.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Pamt's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

PAMT’s ongoing steep net losses, lack of profit margin progress, and weak financial position undermine hopes for a turnaround or sustainable growth.

If you want exposure to companies demonstrating reliable resilience and stronger fundamentals, check out solid balance sheet and fundamentals stocks screener (1980 results) to find those built to weather tough environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PAMT

Pamt

Through its subsidiaries, operates as a truckload transportation and logistics company in the United States, Mexico, and Canada.

Slightly overvalued with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)