- United States

- /

- Transportation

- /

- NasdaqGS:ODFL

Is Old Dominion’s Stock Drop a Signal After Recent Freight Slowdown in 2025?

Reviewed by Bailey Pemberton

If you have Old Dominion Freight Line on your watchlist, you’re probably wondering what the story is behind its stock movements this year and what it all means for the value you’re actually getting. Let’s face it, deciding what to do next with a stock is rarely straightforward, and Old Dominion is a prime example. After all, in just the past week, shares have nudged up 1.3%, but that comes after the stock dropped 5.2% in the last month and is still down a sobering 18.7% year-to-date. Even more striking, the stock has lost 23.8% over the past year. If you zoom out to five years, you’re looking at a 45.5% gain—this shows the stock's significant volatility.

Some of these swings are tied to broader shifts in the freight and shipping sector, as investors weigh changing risk and growth prospects. Market participants have been watching for signs of industry stabilization and adjusting their outlooks accordingly, which might explain those recent bumps and dips. With all that volatility, a lot of readers are naturally asking whether the stock’s current price offers genuine value or if there’s more downside ahead.

On that front, let’s look at valuation. Using a standard six-point checklist to gauge if the company is undervalued, Old Dominion scores just 1 out of 6. This means it only passes one of the common undervaluation tests. Not exactly a slam dunk for bargain hunters, but sometimes, these scores miss the full story.

So, how do these value checks stack up, and is there a better way to understand if Old Dominion truly deserves a spot in your portfolio? Let’s break down each valuation approach first. Then I’ll share a smarter perspective that might help you see this company in a whole new light.

Old Dominion Freight Line scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Old Dominion Freight Line Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s true worth by forecasting its future cash flows and then discounting those amounts back to their value in today’s dollars. For Old Dominion Freight Line, this approach uses the company’s own Free Cash Flow as the foundation and considers how those cash flows might grow in the coming years.

Right now, Old Dominion generates about $745 million in Free Cash Flow each year. Analysts expect this figure to keep rising, with projections showing Free Cash Flow reaching about $1.2 billion in 2029. These first 5 years are grounded in analyst estimates, while longer-term forecasts are mathematically extended based on trends in the freight transport sector.

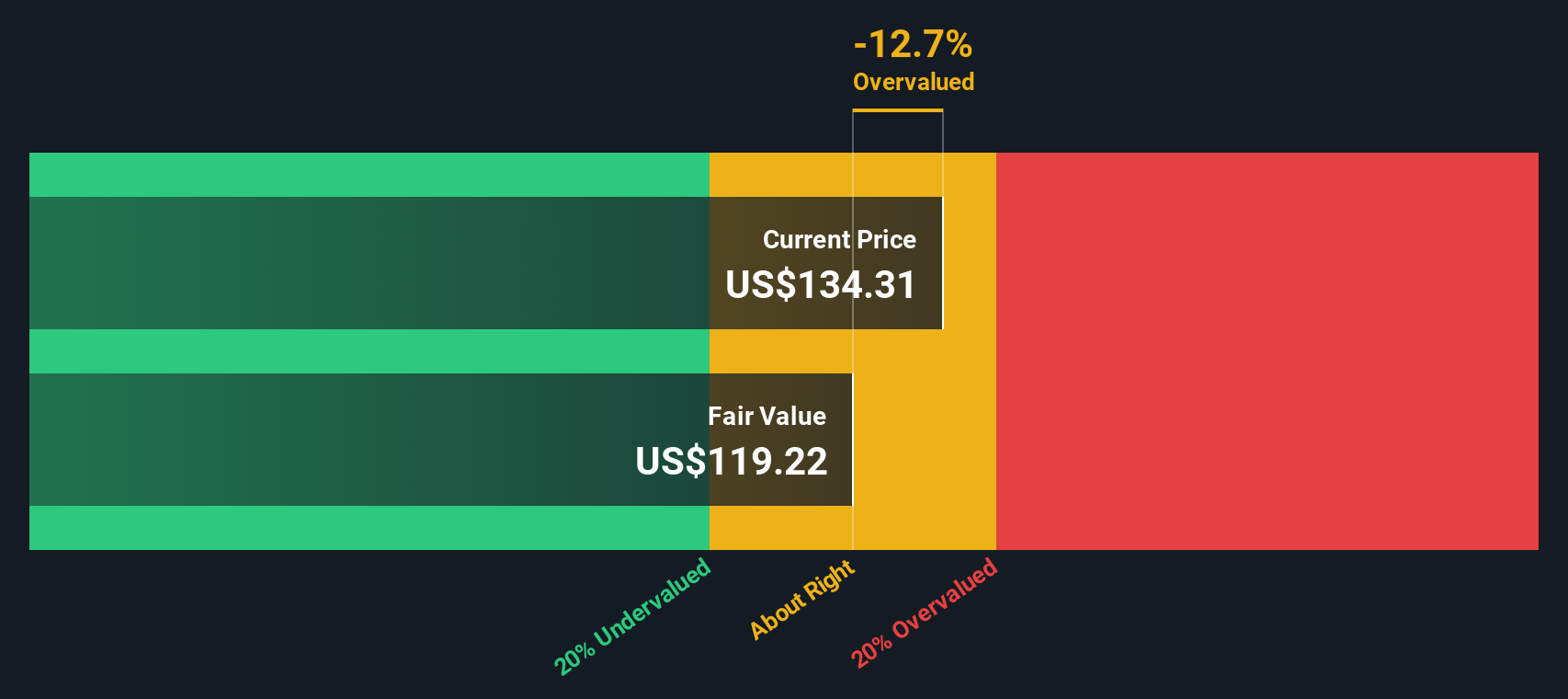

Using the DCF method, the estimated intrinsic value for Old Dominion’s stock comes out to $119.05 per share. When compared to the current share price, this means the stock is about 20% overvalued according to this model. The bottom line, at least from a DCF perspective, is that investors today would be paying well above what the company’s future cash flows appear to justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Old Dominion Freight Line may be overvalued by 20.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Old Dominion Freight Line Price vs Earnings (P/E)

The price-to-earnings (P/E) ratio is a popular valuation tool for profitable companies like Old Dominion Freight Line because it directly compares a company’s share price to its earnings power. For businesses with solid earnings, P/E helps investors gauge whether they are getting good value for each dollar of profit the company generates.

Growth expectations and risk play significant roles in determining what makes a “fair” P/E ratio. Fast-growing, low-risk companies tend to justify higher P/E multiples, while slower-growing or riskier businesses usually command lower ones.

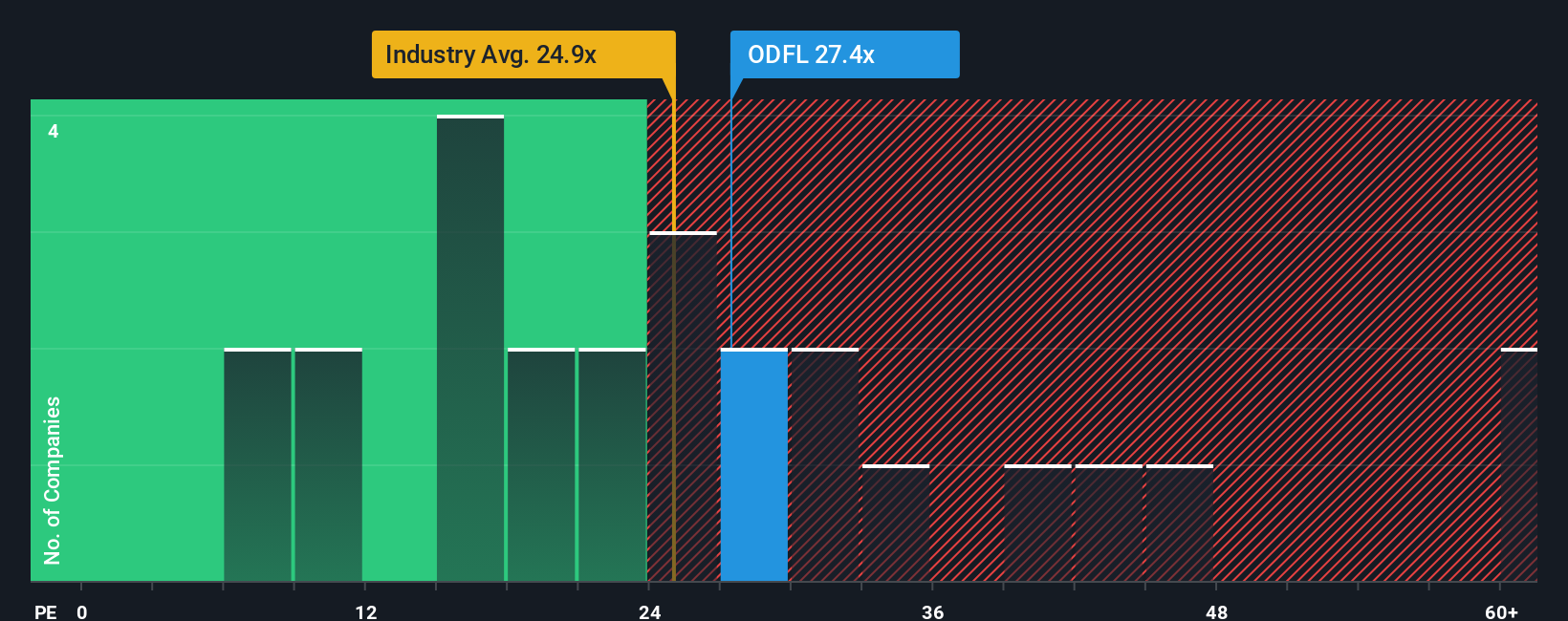

Old Dominion Freight Line currently trades on a P/E multiple of 27.4x. This is above the industry average of 24.9x and slightly below its major peers, which average 32.6x. However, benchmarks like the industry average and peer group do not always tell the whole story, as they may not reflect each company’s unique growth profile or risk factors.

This is where Simply Wall St’s proprietary “Fair Ratio” can be useful. The Fair Ratio, calculated at 15.9x for Old Dominion, incorporates not only sector trends but also the company’s growth outlook, profit margins, size, and specific risks. This provides a more tailored benchmark than broad averages or peer groups alone.

Comparing the Fair Ratio to the current P/E, Old Dominion’s 27.4x multiple is considerably higher than what the Fair Ratio suggests. This signals the stock is overvalued using this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Old Dominion Freight Line Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply your story or perspective about a company, what you believe about its business, future prospects, and risks, connected to your own forecast of key numbers like fair value, revenue, and earnings.

Rather than only looking at ratios or model outputs, Narratives give you the power to tie together the story behind Old Dominion Freight Line, link it to a financial outlook, and see how that translates into a price you believe is fair for the stock. This approach lets you move beyond static numbers and provides context to your investment decisions.

On Simply Wall St’s Community page, Narratives are an easy and accessible tool used by millions of investors. They help you make buy or sell choices with more confidence by showing, in real time, how your fair value compares to today’s share price. As market-moving news or earnings updates come in, Narratives update dynamically, ensuring your perspective stays relevant.

For example, some investors project robust margin improvement and market share gains, giving Old Dominion Freight Line a fair value near $195, while others are more cautious given economic uncertainty, setting their fair value closer to $129.

Do you think there's more to the story for Old Dominion Freight Line? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ODFL

Old Dominion Freight Line

Operates as a less-than-truckload motor carrier in the United States and North America.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives