- United States

- /

- Transportation

- /

- NasdaqGS:LYFT

Lyft (LYFT) Valuation Check as Freenow Deal Closes and New Healthcare App Expands Growth Story

Reviewed by Simply Wall St

Lyft (LYFT) just gave investors two concrete reasons to revisit the stock, closing its Freenow acquisition to push beyond North America while rolling out a healthcare focused Smart on FHIR app with VectorCare.

See our latest analysis for Lyft.

Despite those strategic wins, Lyft’s recent share price performance has cooled. The 1 month share price return is minus 17.37 percent and the 3 month share price return is minus 16.29 percent. At the same time, its 1 year total shareholder return of 36.47 percent and 3 year total shareholder return of 84.56 percent still point to meaningful long term recovery, suggesting near term momentum has faded but the broader rerating story is intact.

If Lyft’s evolving story has your attention, this could be an ideal moment to compare it with other mobility and platform players using auto manufacturers.

With shares still trading at a sizable discount to Wall Street targets despite improving profitability and new growth vectors in Europe and healthcare, is Lyft a quietly mispriced recovery story, or are markets already factoring in the next leg of growth?

Most Popular Narrative: 20.5% Undervalued

With the most followed narrative putting Lyft’s fair value meaningfully above the last close of $19.12, the story leans toward a sizable upside case.

The ongoing rollout and consumer adoption of autonomous vehicles backed by new partnerships with tech leaders like Baidu and operational capabilities in both the U.S. and Europe are expected to significantly expand Lyft's total addressable market (TAM), lower labor costs, and increase long term gross margins and earnings.

Want to see how this bold autonomy and partnership push translates into future profits? The narrative quietly reflects rising margins and compounding earnings power. Curious which assumptions really drive that 20.5 percent discount? Unlock the full narrative to see the numbers behind the claim.

Result: Fair Value of $24.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competitive pressure from Uber, along with regulatory or execution setbacks in autonomous rollouts, could quickly challenge the optimistic growth and margin assumptions embedded in this narrative.

Find out about the key risks to this Lyft narrative.

Another Lens on Value

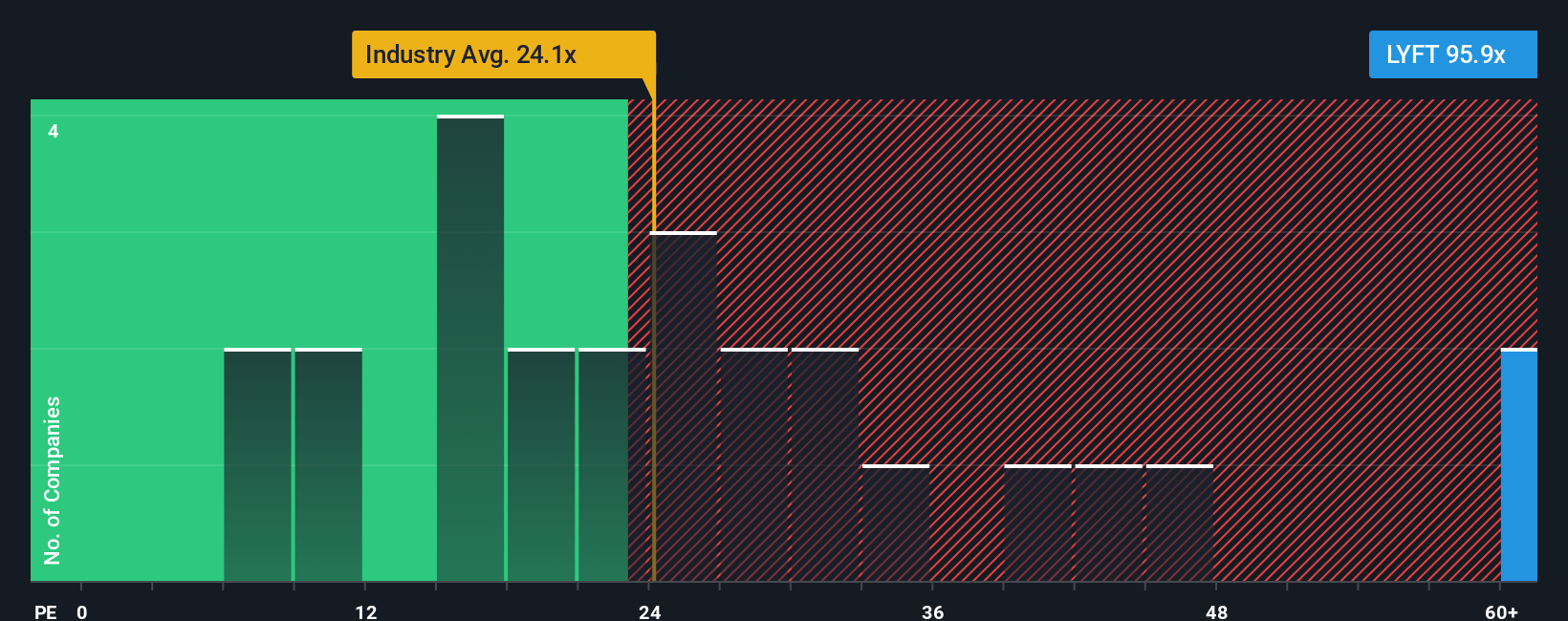

While the narrative suggests Lyft is 20.5 percent undervalued, its current price to earnings ratio of 50.7 times versus a fair ratio of 20.9 times and a transportation industry average of 31.8 times paints a very different picture. This implies meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lyft Narrative

If you see Lyft differently or want to challenge these assumptions with your own research, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Lyft.

Ready for more investment ideas?

Lyft might fit your strategy today, but you will miss out on other opportunities unless you actively search for fresh, data backed ideas right now.

- Capture potential rebound plays by scanning these 905 undervalued stocks based on cash flows that the market has not fully priced in yet.

- Explore your growth hunt by zeroing in on these 26 AI penny stocks shaping developments in intelligent technology.

- Target steady income streams by focusing on these 13 dividend stocks with yields > 3% that may support long term returns through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LYFT

Lyft

Operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)