- United States

- /

- Transportation

- /

- NasdaqGS:JBHT

J.B. Hunt (JBHT) valuation check after Fed rate cut optimism and freight recovery hopes

Reviewed by Simply Wall St

J.B. Hunt Transport Services (JBHT) is back in the spotlight after the Federal Reserve’s rate cut, with several high profile commentators pointing to the shipper as a prime beneficiary of easing financial conditions.

See our latest analysis for J.B. Hunt Transport Services.

That optimism is already showing up in the numbers, with the stock delivering a powerful 22.03 percent 1 month share price return and a 45.71 percent 3 month share price return. Longer term total shareholder returns look solid but less explosive, which suggests momentum is building off a more measured base.

If J.B. Hunt’s rebound has you thinking about what else could be re-rating as conditions shift, it might be a good moment to explore auto manufacturers as another way to consider evolving transport demand.

But with J.B. Hunt now trading above the average analyst price target and only a modest intrinsic discount implied by cash flows, is this still an overlooked value story, or has the market already priced in the next leg of growth?

Most Popular Narrative: 15.2% Overvalued

With J.B. Hunt’s shares closing at $198.68 against a narrative fair value of $172.39, expectations now lean ahead of consensus fundamentals and cycle timing.

The analysts have a consensus price target of $159.375 for J.B. Hunt Transport Services based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $180.0, and the most bearish reporting a price target of just $133.0.

Want to see what kind of freight recovery and margin lift would have to materialize for that valuation to stick? The narrative hinges on steadily compounding revenues, expanding profitability and a future earnings multiple that assumes logistics scale advantages keep building. Curious how those moving parts combine into today’s punchy price tag?

Result: Fair Value of $172.39 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn inflation and weak freight demand could quickly squeeze margins, challenging assumptions about steady earnings growth and undermining today’s optimistic valuation narrative.

Find out about the key risks to this J.B. Hunt Transport Services narrative.

Another Lens on Valuation

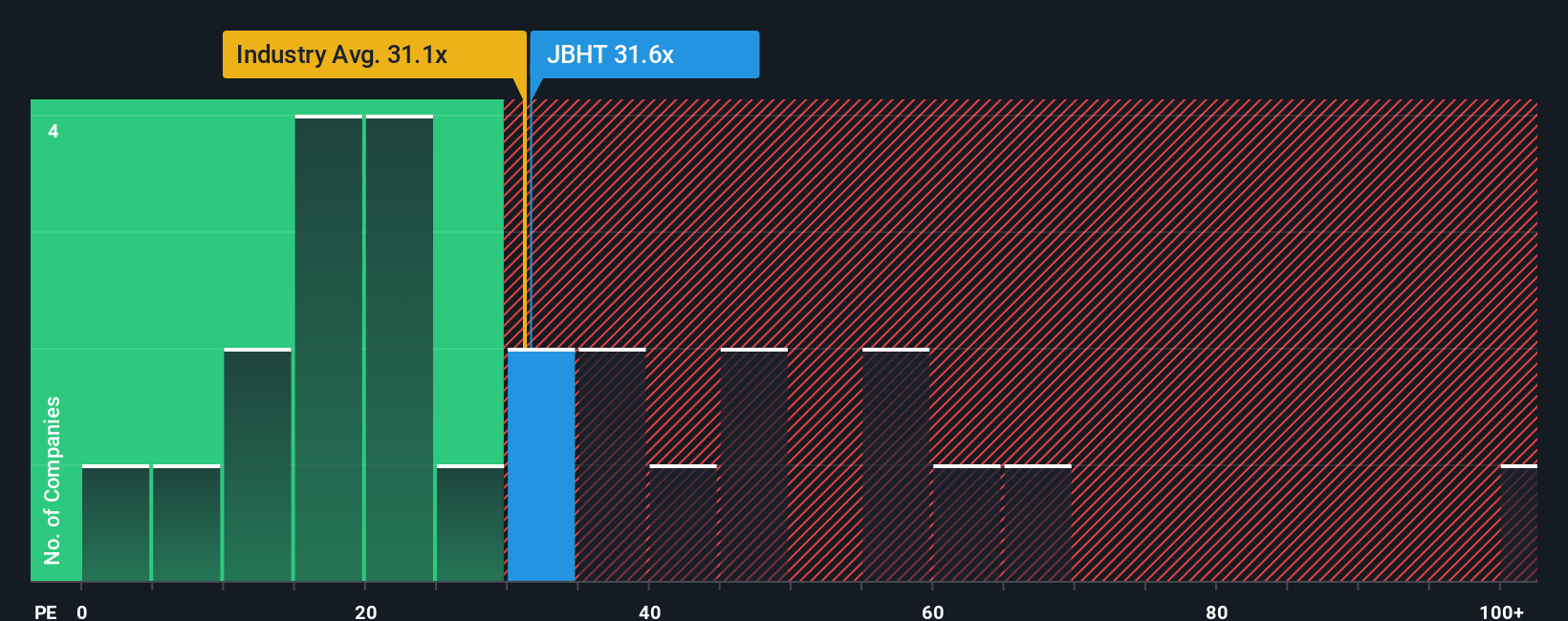

Step away from narratives and analyst targets, and J.B. Hunt looks stretched on plain earnings maths. The shares trade on about 33 times earnings versus a fair ratio of 17.1 times and a US transportation average near 32.3 times, which implies limited valuation cushion if the cycle disappoints. Could this multiple compress faster than the earnings can grow into it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own J.B. Hunt Transport Services Narrative

If you see the story differently or just want to dig into the numbers yourself, you can craft a complete view in minutes: Do it your way.

A great starting point for your J.B. Hunt Transport Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential win by running smart, targeted searches through our powerful stock screeners, built to surface opportunities others overlook.

- Capture underappreciated value by scanning these 908 undervalued stocks based on cash flows that pair solid cash flows with attractive entry prices.

- Ride the next wave of innovation by targeting these 26 AI penny stocks positioned at the forefront of artificial intelligence transformations.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that balance yield with sustainable fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JBHT

J.B. Hunt Transport Services

Provides surface transportation, delivery, and logistic services in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)