- United States

- /

- Logistics

- /

- NasdaqGS:HUBG

Will New Analyst Optimism About Intermodal Growth Shift Hub Group's (HUBG) Investment Narrative?

Reviewed by Sasha Jovanovic

- Hub Group recently announced the passing of director Lisa Dykstra, who served on the company's board and key committees since 2022.

- Her leadership on the audit, compensation, and governance committees played a significant role in the company’s oversight and strategic direction over the past years.

- We’ll explore how a recent analyst upgrade, tied to growth prospects in Hub Group’s intermodal business, could influence its investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

Hub Group Investment Narrative Recap

For investors to consider a position in Hub Group, they need confidence in the company's ability to capitalize on intermodal growth, sustainability trends, and ongoing digitalization to drive long-term earnings, while managing the risks tied to revenue volatility and changing logistics industry dynamics. The passing of Director Lisa Dykstra, while a loss for board continuity, is not expected to materially shift the most important short-term catalyst, intermodal business growth, or increase the primary risk of ongoing revenue pressure from cyclical and competitive challenges.

Among recent announcements, Raymond James' upgrade of Hub Group, citing growth potential in intermodal transport and possible benefits from a key railroad merger, aligns directly with the company's position as an end-to-end, tech-enabled supply chain partner. This catalyst remains central to why the company could benefit despite headwinds in other logistics segments. Contrast this, however, with the persistent risk that increased customer concentration could mean...

Read the full narrative on Hub Group (it's free!)

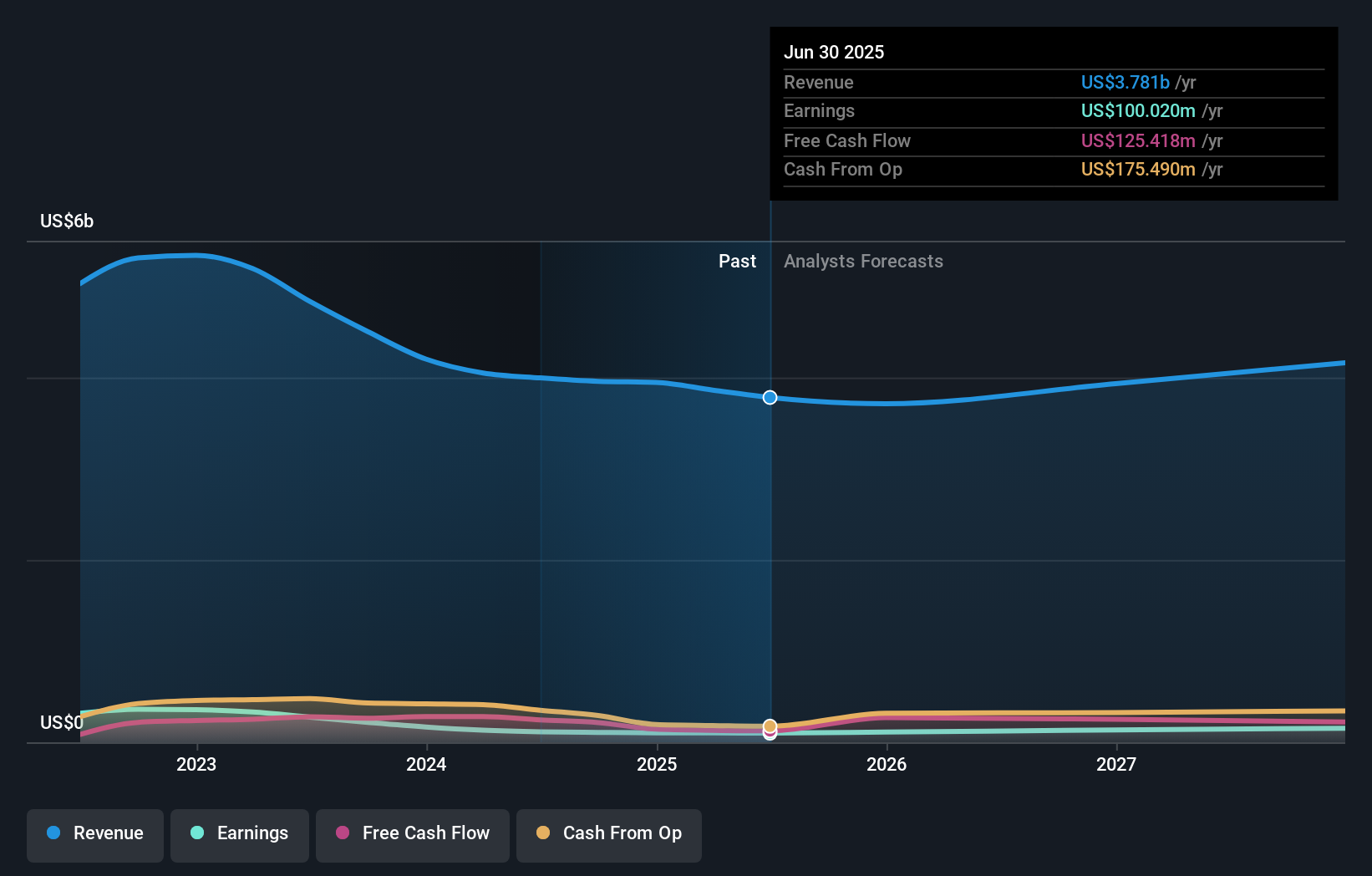

Hub Group's outlook anticipates $4.3 billion in revenue and $164.5 million in earnings by 2028. This scenario implies a 4.3% annual revenue growth rate and a $64.5 million increase in earnings from the current $100.0 million level.

Uncover how Hub Group's forecasts yield a $39.94 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have shared fair value estimates for Hub Group ranging from US$39.94 to US$60.32 based on three distinct viewpoints. As freight volumes and customer concentration evolve, you can find many more differing opinions to compare when considering Hub Group’s future performance.

Explore 3 other fair value estimates on Hub Group - why the stock might be worth as much as 74% more than the current price!

Build Your Own Hub Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hub Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Hub Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hub Group's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hub Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUBG

Hub Group

A supply chain solutions provider, offers transportation and logistics management services in North America.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives