The United States market has shown a positive trend, climbing 1.6% in the last week and rising 12% over the past year, with earnings projected to grow by 14% annually. In this environment, identifying stocks that are potentially undervalued can offer investors opportunities to capitalize on future growth while benefiting from current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Quaker Chemical (NYSE:KWR) | $105.85 | $210.37 | 49.7% |

| KBR (NYSE:KBR) | $55.45 | $108.68 | 49% |

| Horizon Bancorp (NasdaqGS:HBNC) | $15.69 | $30.69 | 48.9% |

| Flowco Holdings (NYSE:FLOC) | $19.17 | $37.91 | 49.4% |

| Curbline Properties (NYSE:CURB) | $23.62 | $47.17 | 49.9% |

| Constellation Brands (NYSE:STZ) | $192.91 | $385.37 | 49.9% |

| Array Technologies (NasdaqGM:ARRY) | $7.265 | $14.21 | 48.9% |

| FinWise Bancorp (NasdaqGM:FINW) | $14.85 | $29.22 | 49.2% |

| TransMedics Group (NasdaqGM:TMDX) | $122.10 | $238.94 | 48.9% |

| Mobileye Global (NasdaqGS:MBLY) | $15.72 | $31.08 | 49.4% |

Here we highlight a subset of our preferred stocks from the screener.

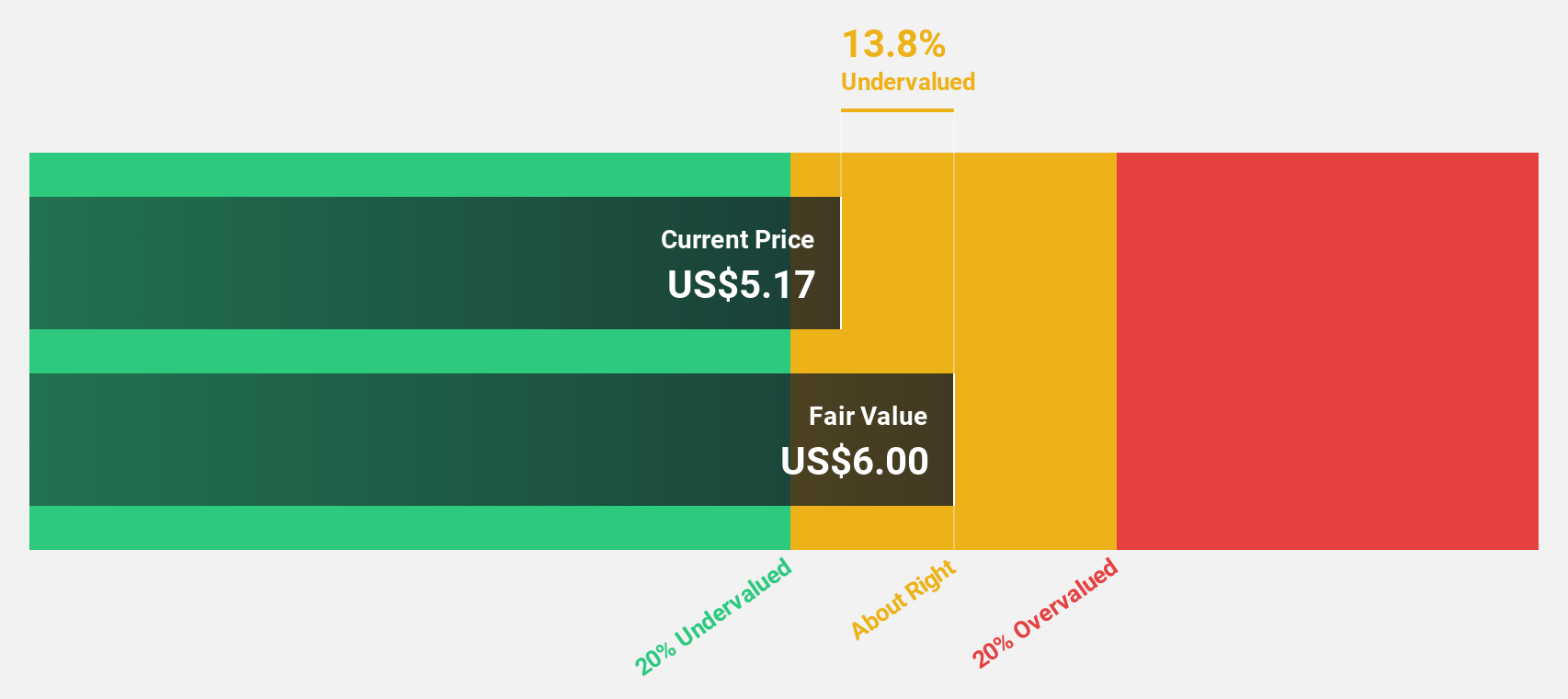

Grab Holdings (NasdaqGS:GRAB)

Overview: Grab Holdings Limited operates as a superapp provider in Southeast Asia, offering a range of services including transportation, food delivery, and digital payments across countries such as Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam; it has a market cap of approximately $20.72 billion.

Operations: The company's revenue segments include Mobility at $1.08 billion, Deliveries at $1.56 billion, and Financial Services at $273 million.

Estimated Discount To Fair Value: 37.5%

Grab Holdings is trading at US$5.08, below its estimated fair value of US$8.13, presenting a potential undervaluation based on cash flows. The company recently reported a net income of US$10 million for Q1 2025, turning profitable from a previous net loss. While expected revenue growth is moderate at 14.1% annually, earnings are forecasted to grow significantly at over 40% per year, suggesting strong future cash flow potential despite low return on equity forecasts.

- The growth report we've compiled suggests that Grab Holdings' future prospects could be on the up.

- Dive into the specifics of Grab Holdings here with our thorough financial health report.

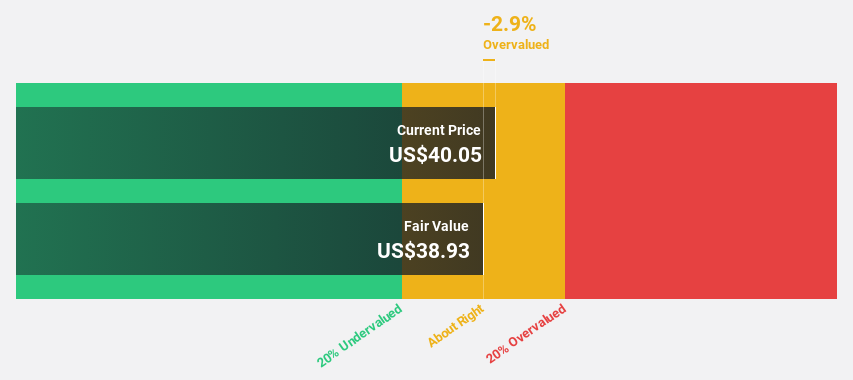

Sarepta Therapeutics (NasdaqGS:SRPT)

Overview: Sarepta Therapeutics, Inc. is a commercial-stage biopharmaceutical company specializing in RNA-targeted therapeutics and gene therapies for rare diseases, with a market cap of approximately $3.58 billion.

Operations: The company's revenue primarily comes from its activities in discovering, developing, manufacturing, and delivering therapies, totaling $2.23 billion.

Estimated Discount To Fair Value: 43.5%

Sarepta Therapeutics is trading at US$37.94, significantly below its estimated fair value of US$67.11, indicating potential undervaluation based on cash flows. Despite a volatile share price and revised revenue guidance for 2025 between US$2.3 billion to US$2.6 billion, the company shows strong growth prospects with earnings expected to increase by 48% annually and profitability anticipated within three years, driven by advancements in their gene therapy portfolio including ELEVIDYS for Duchenne muscular dystrophy.

- The analysis detailed in our Sarepta Therapeutics growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Sarepta Therapeutics' balance sheet health report.

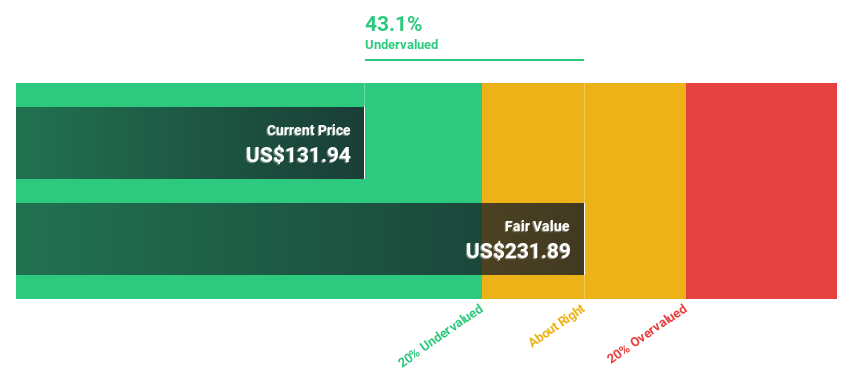

Jabil (NYSE:JBL)

Overview: Jabil Inc. offers manufacturing services and solutions globally, with a market cap of approximately $18.01 billion.

Operations: Jabil's revenue segments include Electronics Manufacturing Services at $21.98 billion and Diversified Manufacturing Services at $14.79 billion, reflecting its global reach in providing comprehensive manufacturing solutions.

Estimated Discount To Fair Value: 26%

Jabil is trading at US$167.44, below its estimated fair value of US$226.34, pointing to potential undervaluation based on cash flows. While earnings are forecast to grow significantly at 30.3% annually, profit margins have decreased from last year due to large one-off items affecting results. The company's high debt level is a concern, but strategic initiatives like the launch of advanced transceivers and board appointments bolster its growth trajectory in technology sectors.

- Insights from our recent growth report point to a promising forecast for Jabil's business outlook.

- Navigate through the intricacies of Jabil with our comprehensive financial health report here.

Next Steps

- Delve into our full catalog of 170 Undervalued US Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBL

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives