- United States

- /

- Insurance

- /

- NYSE:ASIC

US Market's Hidden Gems: 3 Promising Small Caps

Reviewed by Simply Wall St

As the major U.S. stock indices, including the Dow, S&P 500, and Nasdaq, reach new all-time highs bolstered by developments like Nvidia's partnership with OpenAI, investors are increasingly looking beyond large-cap stocks to uncover opportunities in the small-cap sector. In this vibrant market environment where economic indicators and broader sentiment continue to evolve, identifying a good stock often involves finding those small-cap companies that exhibit strong fundamentals and potential for growth amidst these dynamic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Elron Ventures | 5.70% | 13.72% | 25.56% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Euroseas (ESEA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Euroseas Ltd. offers ocean-going transportation services globally and has a market cap of $438.19 million.

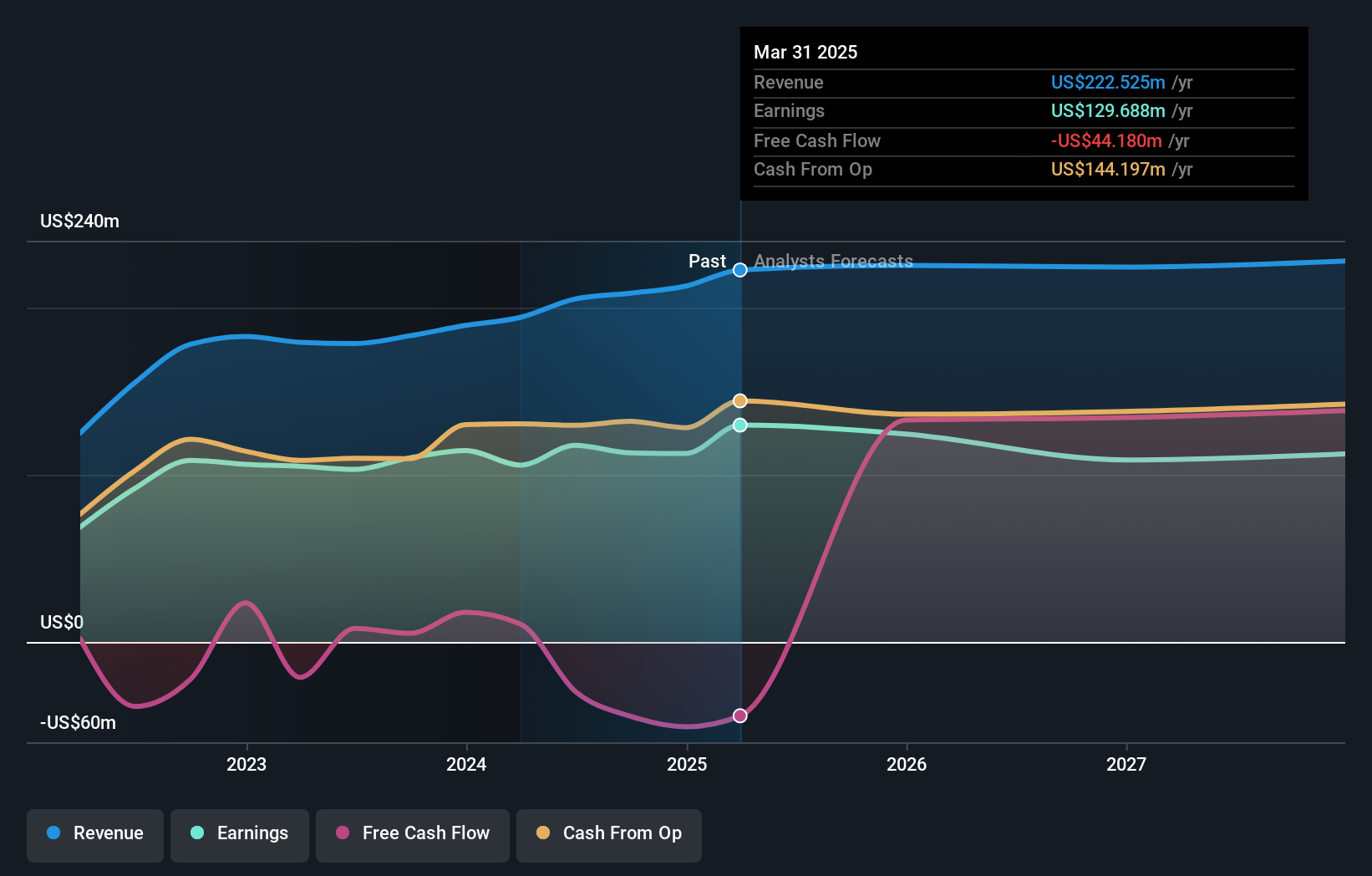

Operations: Euroseas Ltd. generates revenue primarily from its transportation-shipping segment, amounting to $221.03 million.

Euroseas, a small player in the shipping industry, presents an intriguing profile with its current trading at 75.6% below estimated fair value and satisfactory net debt to equity ratio of 31.5%. Over the past five years, it has significantly reduced its debt to equity from 269.7% to 56.4%, demonstrating financial prudence. The company has recently secured a new time charter contract for M/V Jonathan P at $25,000 daily, boosting charter coverage and contributing approximately $5.65 million to EBITDA over the minimum period. However, analysts anticipate challenges ahead with potential revenue declines and shrinking profit margins from 58.3% to 45.1%.

Northrim BanCorp (NRIM)

Simply Wall St Value Rating: ★★★★★★

Overview: Northrim BanCorp, Inc. is the bank holding company for Northrim Bank, offering commercial banking products and services to businesses and professional individuals, with a market cap of $501.46 million.

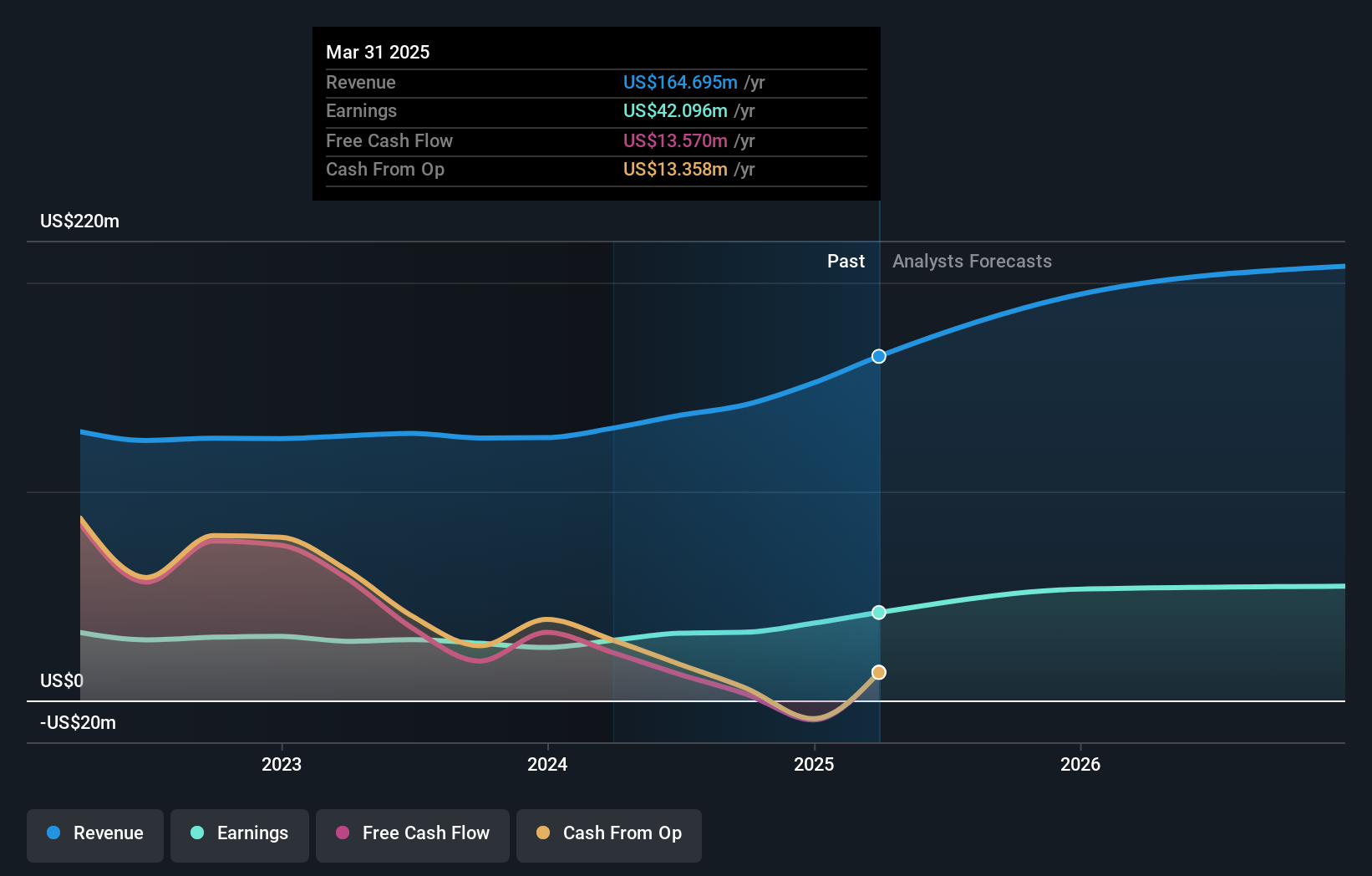

Operations: Northrim BanCorp generates revenue primarily from Community Banking, contributing $121.89 million, followed by Home Mortgage Lending at $35.57 million and Specialty Finance at $6.39 million.

Northrim BanCorp, a financial entity with total assets of US$3.2 billion and equity of US$290.2 million, showcases a robust profile in the banking sector. Total deposits stand at US$2.8 billion against loans amounting to US$2.2 billion, highlighting its solid deposit base as a primary funding source. The bank maintains an allowance for bad loans at 0.5% of total loans, indicating prudent risk management practices with low non-performing loan levels. Recently added to multiple Russell indices, Northrim's stock split and leadership transition underscore strategic growth moves while trading below estimated fair value suggests potential investment appeal.

Ategrity Specialty Insurance Company Holdings (ASIC)

Simply Wall St Value Rating: ★★★★★★

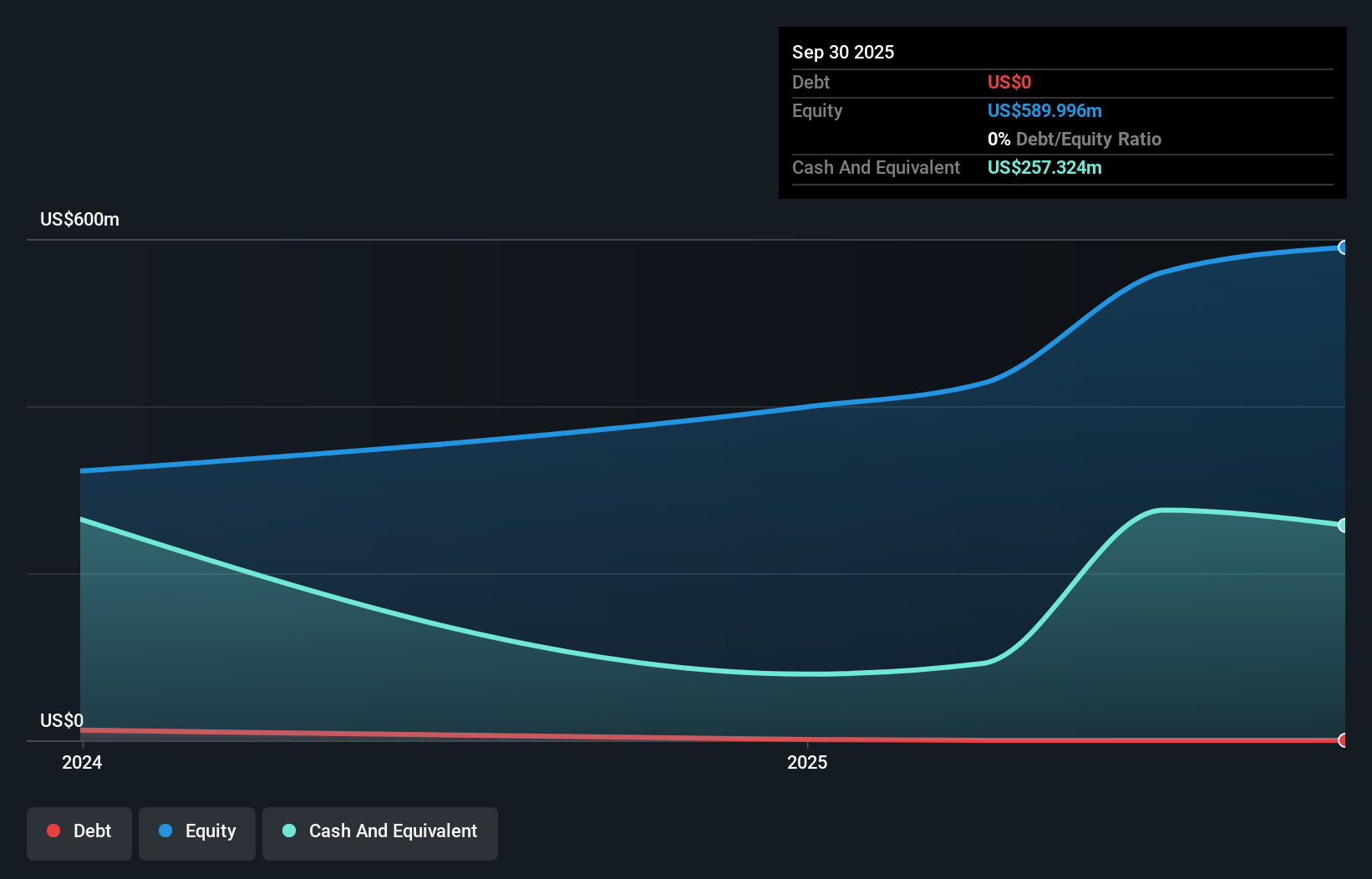

Overview: Ategrity Specialty Insurance Company Holdings, with a market cap of $988.25 million, offers excess and surplus lines insurance and reinsurance products to small and medium-sized businesses in the United States through its subsidiaries.

Operations: ASIC generates revenue primarily from its insurance business, totaling $378.30 million. The company has a market cap of $988.25 million.

Ategrity Specialty Insurance Company Holdings, a nimble player in the insurance sector, is making waves with its impressive financial performance. Over the past year, earnings surged by 109%, outpacing the industry average of 6%. The company operates debt-free and trades at nearly half below its estimated fair value. Recent additions to multiple indices like Russell 2000 and S&P TMI underscore its growing recognition. With high-quality earnings and positive free cash flow of US$107 million as of September 2025, Ategrity seems well-positioned for continued growth in a competitive landscape.

- Take a closer look at Ategrity Specialty Insurance Company Holdings' potential here in our health report.

Understand Ategrity Specialty Insurance Company Holdings' track record by examining our Past report.

Where To Now?

- Dive into all 286 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASIC

Ategrity Specialty Insurance Company Holdings

Through its subsidiaries, provides excess and surplus lines insurance and reinsurance products to small and medium-sized businesses in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)