- United States

- /

- Transportation

- /

- NasdaqGS:CSX

CSX (CSX) Valuation Update: Opportunity or Fully Priced After Latest Pullback?

Reviewed by Simply Wall St

The recent dip in CSX (CSX) stock has caught the eye of many investors wondering if there is more to the story. With shares falling by over 1% in the last session, some are asking whether this movement signals new risk for the railway giant, or if it is a routine bout of volatility. The change is not tied to any major announcement or headline, making the situation even more interesting for those evaluating potential entry points.

Over the past year, CSX has delivered moderate gains, posting an 8% total return and outpacing its industry peers in the past three months with a 17% rally. That recent momentum suggests investors are starting to see value, or perhaps pricing in better prospects ahead. Even so, the lack of a clear trigger this time stands out, especially as the company continues to report steady revenue and net income growth despite a mixed economic backdrop.

So, is CSX now offering a genuine long-term buying opportunity after its recent run, or has the market already accounted for all the potential growth in its share price?

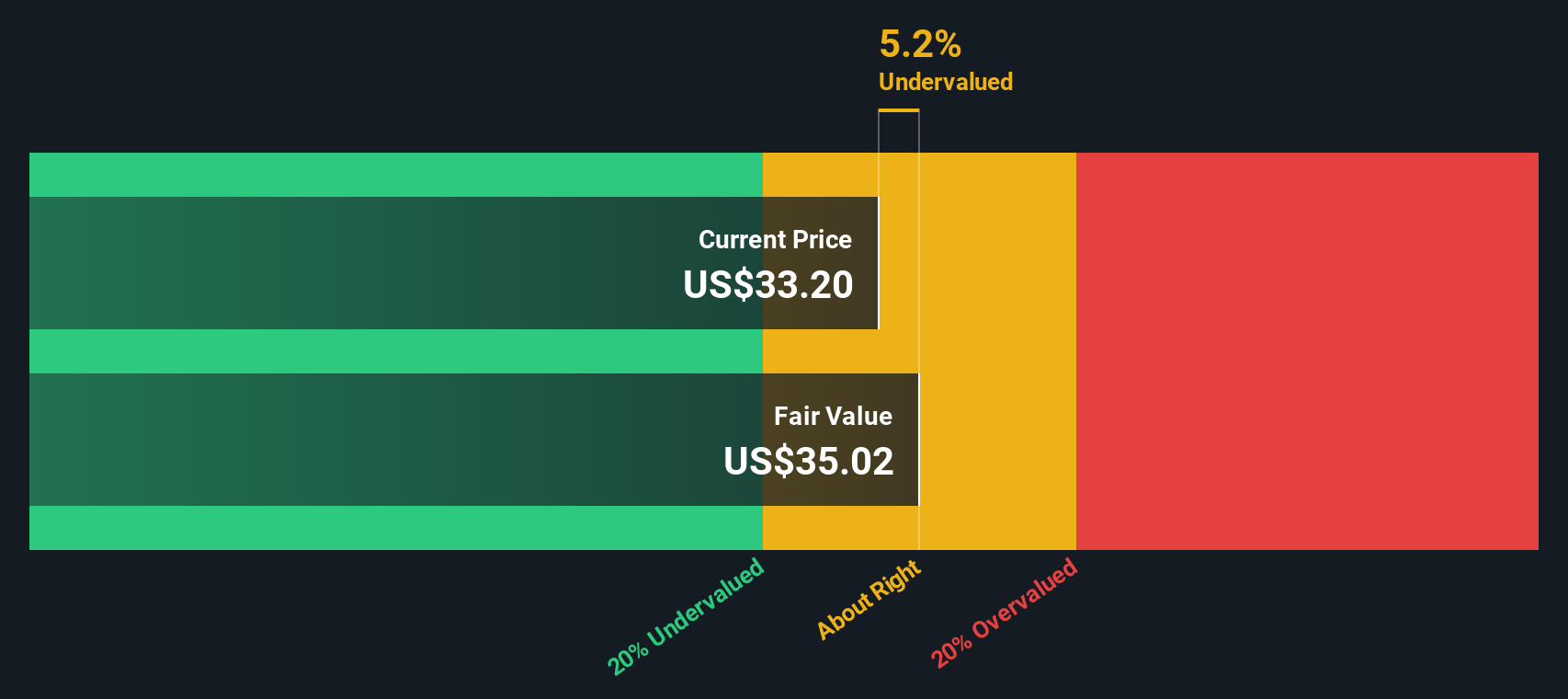

Most Popular Narrative: 6% Undervalued

According to community narrative, CSX is currently viewed as around 6% undervalued, based on detailed analysis of its projected earnings and efficiency improvements.

CSX's completion of major infrastructure projects, such as the Howard Street Tunnel and Blue Ridge subdivision rebuild, is expected to improve network fluidity. This should lead to increased operational efficiency and service reliability, which could enhance revenue and margin growth. The anticipated recovery in industrial production, particularly in sectors like steel and auto, may drive increased volume and revenue because CSX is well-positioned to capture this demand with its extensive network covering key industrial regions.

Want to know the secret behind this seemingly modest undervaluation? One key forecast anchors it all, but there is more beneath the surface. The narrative focuses on ongoing efficiency upgrades and a future profit calculation that may surprise you. What bold assumptions power this target, and why do they matter for the next step in share price? The detailed analysis and critical growth drivers may change your view of CSX's potential.

Result: Fair Value of $38.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, risks such as severe weather and commodity market volatility could quickly challenge the optimistic narrative surrounding CSX’s continued growth and efficiency gains. Find out about the key risks to this CSX narrative.Another View: SWS DCF Model Offers a Different Perspective

While analysts see modest upside based on expected earnings growth, our DCF model tells a slightly different story. It suggests the stock is closer to fair value than the narrative implies. Could a different approach change your outlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CSX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CSX Narrative

If you want to test these assumptions, or believe a different angle could reveal something new, you have the tools to build your own CSX story in just a few minutes. do it your way.

A great starting point for your CSX research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Uncover opportunities beyond CSX with investment strategies designed to put you ahead of the curve. Use these actionable screeners to focus your research where it matters most. Stay ahead of trends, spot resilient companies, and build a portfolio with an edge. Missing these could mean leaving returns on the table.

- Maximize your yield potential and secure steady income by targeting dividend stocks with yields > 3%.

- Outsmart the market by finding undervalued stocks based on cash flows that could be positioned for a rebound before they catch the crowd’s attention.

- Tap into tomorrow’s breakthroughs by focusing on healthcare AI stocks driving innovation in medicine and biotech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives