- United States

- /

- Transportation

- /

- NasdaqGS:CSX

CSX (CSX) and CN Team Up to Enhance Intermodal Service to Nashville

Reviewed by Simply Wall St

CSX (CSX) recently signed a Memorandum of Understanding with CN to develop a new intermodal service into Nashville, Tennessee. This initiative aims to bolster supply chain solutions with an all-rail alternative for container movement, enhancing speed, reliability, and sustainability. Despite this announcement, CSX's share price remained essentially flat over the past week, aligning with the broader market's modest 1.4% ascent and the record highs in the S&P 500 and Nasdaq. The company's recent agreement may have added weight to these broader market movements, reflecting its ongoing commitment to innovation and partnership in logistics.

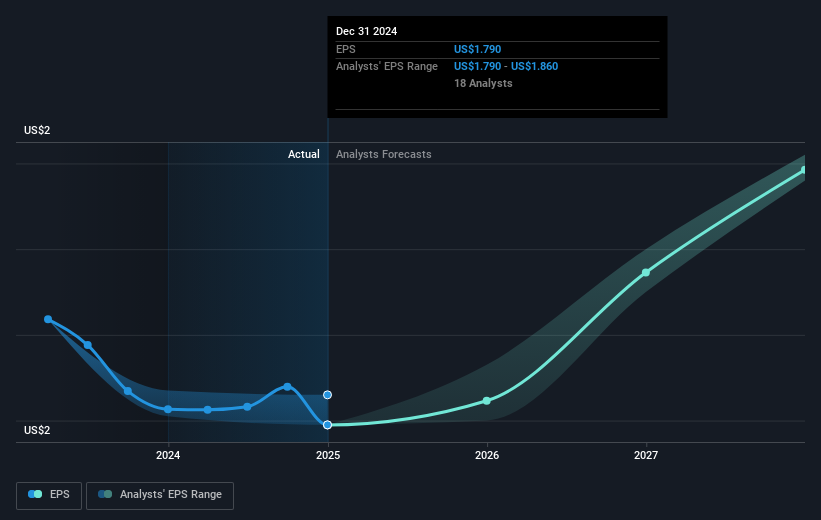

The recent collaboration between CSX and CN to enhance intermodal service might contribute positively to the company's revenue and earnings projections. With the completion of major projects like the Howard Street Tunnel, this partnership aligns with CSX's strategy of improving efficiency and expanding its logistics capabilities, potentially driving revenue growth and aiding in margin improvement. The expected recovery in industrial demand, particularly in sectors such as steel and automotive, could further support these forecasts, positioning CSX to capitalize on increased shipment volumes.

Over the past five years, CSX's total return, factoring in both share price gains and dividends, was 28.61%. This highlights a moderate growth trajectory, especially when considering the company's recent challenges and infrastructure improvements. Despite these efforts, CSX underperformed relative to the overall US Transportation industry in the last year, which returned 7.8% while the broader US Market achieved a 20% return.

With the current share price close to US$32.20, the market may perceive the company to be slightly undervalued in relation to the consensus analyst price target of US$37.92, indicating a potential upside of approximately 14.9%. However, this sentiment is balanced against the company's operational hurdles and macroeconomic uncertainties, necessitating careful consideration of how these factors may influence future performance relative to the projected targets.

Assess CSX's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Average dividend payer with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)