- United States

- /

- Transportation

- /

- NasdaqGS:CSX

CSX (CSX) And BNSF Announce New Coast-To-Coast Intermodal Services Across The U.S.

Reviewed by Simply Wall St

In recent developments, CSX (CSX) announced new intermodal services connecting various U.S. locations, highlighting its efforts to streamline freight transport. This move, along with potential mergers explored in collaboration with Goldman Sachs, comes amid a quarter where the company's stock rose 16%. Despite a decline in sales and net income in Q2 2025, the introduction of new services and ongoing share buybacks could have bolstered investor confidence. Moreover, with market optimism fueled by potential Federal Reserve interest rate cuts, CSX's performance aligns with broader positive market movements, such as the Dow reaching record highs.

We've identified 1 warning sign for CSX that you should be aware of.

The launch of new intermodal services and potential mergers aligns with CSX's narrative of enhancing operational efficiency and expanding service offerings through major infrastructure projects. These initiatives are crucial for CSX's revenue growth, improving network fluidity and boosting volume capacity, potentially aiding in recovery from the recent decline in sales and net income. Although analysts foresee challenges, such as severe weather impacts and volatile commodity markets, the ongoing improvements, like the Howard Street Tunnel, are expected to bolster CSX's service reliability and attract increased customer volumes.

Over the past five years, CSX achieved a total shareholder return of 50.85%, indicating substantial long-term gains despite recent challenges. However, in the past year, CSX underperformed compared to the US market return of 15.1% and matched the US Transportation industry return of 7.6%. This longer-term success suggests that CSX has navigated adverse conditions previously and could continue to create shareholder value as strategic projects come to fruition.

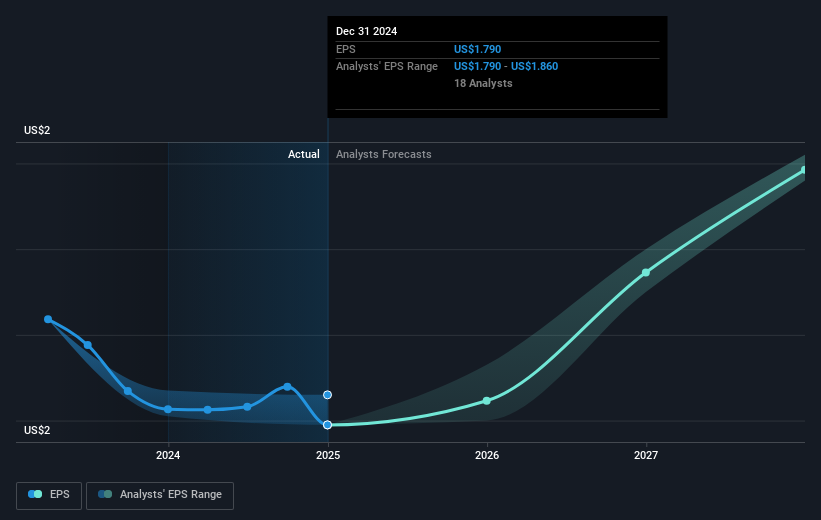

The current share price of US$35.87 sits slightly below the consensus analyst price target of US$38.28, reflecting a cautious market outlook on the company. Analysts anticipate revenue growth of 3.7% annually, with earnings expected to reach US$3.9 billion by August 2028. However, the share buybacks suggest management's confidence in its valuation, potentially offering support to the stock price. If CSX delivers on its growth promises, the anticipated price target could be within reach, driven by improved operational efficiencies and industrial recovery.

Learn about CSX's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSX

CSX

Provides rail-based freight transportation services in the United States and Canada.

Average dividend payer with limited growth.

Similar Companies

Market Insights

Community Narratives