- United States

- /

- Logistics

- /

- NasdaqGS:CHRW

How Intelligent Trailer Tracking Could Reshape C.H. Robinson Worldwide's (CHRW) Competitive Edge

Reviewed by Sasha Jovanovic

- C.H. Robinson Worldwide recently unveiled its Asset Management System within the Drop Trailer Plus program, integrating real-time GPS and operational data to enhance trailer visibility and management for shippers and carriers.

- Analysts have also maintained a positive outlook, anticipating earnings growth in the third quarter of 2025, which reflects the company’s ongoing strategic execution despite recent revenue challenges.

- We'll explore how the launch of intelligent trailer technology could shape C.H. Robinson Worldwide's investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

C.H. Robinson Worldwide Investment Narrative Recap

To see value in C.H. Robinson Worldwide, an investor needs to believe that the company’s ongoing investments in technology and automation can drive efficiency and margin strength, making up for revenue volatility and intensifying competition in global logistics. The recent launch of the Asset Management System is a positive step for operational visibility, but in the short term, the biggest catalyst remains execution on digital and automation initiatives, while the key risk continues to be increasing competition from digitally enabled freight brokers, this news does not materially change those factors.

Among recent company announcements, the rollout of the Always-on Logistics Planner further underscores C.H. Robinson’s focus on building out proprietary AI and automation capabilities across its service offering. By combining granular supply chain data and automated planning, these tools aim to support productivity gains and may influence both the company’s competitive position and margin resilience, particularly as technology differentiation remains an important catalyst for future results.

Yet, with smaller brokers increasingly able to access advanced digital tools and automate their services, investors should be aware that...

Read the full narrative on C.H. Robinson Worldwide (it's free!)

C.H. Robinson Worldwide's narrative projects $18.4 billion in revenue and $677.2 million in earnings by 2028. This requires 2.6% yearly revenue growth and a $142.9 million earnings increase from $534.3 million today.

Uncover how C.H. Robinson Worldwide's forecasts yield a $126.32 fair value, in line with its current price.

Exploring Other Perspectives

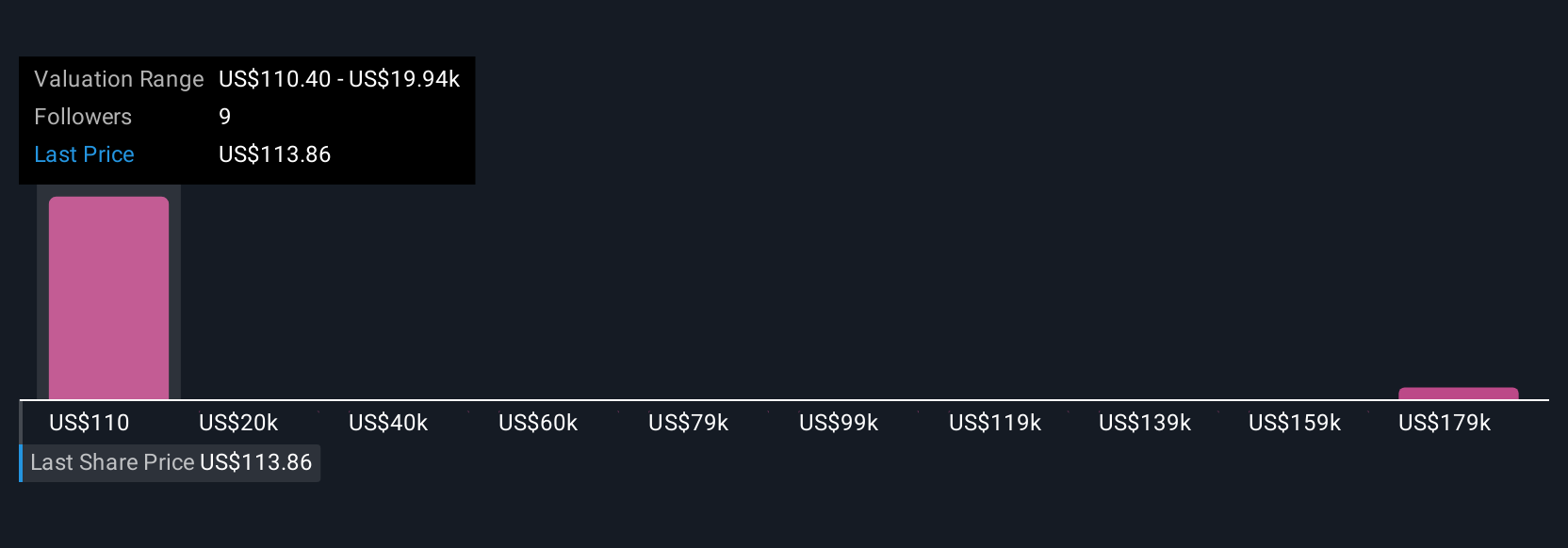

Fair value estimates from the Simply Wall St Community span from US$71,300 to US$198,416 across 3 unique perspectives. While many investors focus on advanced automation for margin growth, technology commoditization may pose ongoing headwinds for C.H. Robinson’s future performance.

Explore 3 other fair value estimates on C.H. Robinson Worldwide - why the stock might be worth 44% less than the current price!

Build Your Own C.H. Robinson Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your C.H. Robinson Worldwide research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free C.H. Robinson Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate C.H. Robinson Worldwide's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHRW

C.H. Robinson Worldwide

Provides freight transportation and related logistics and supply chain services in the United States and internationally.

Solid track record established dividend payer.

Market Insights

Community Narratives