Last Update 16 Nov 25

Fair value Increased 1.26%CHRW: Operating Margin Expansion And Cost Discipline Will Drive Resilience Amid Freight Headwinds

The analyst consensus price target for C.H. Robinson Worldwide increased from $150.31 to $152.20. Analysts cited operating margin expansion, profit growth, and a more defensive business model as factors supporting improved expectations, despite near-term challenges in freight markets.

Analyst Commentary

Recent Street research reflects a dynamic mix of optimism and caution among analysts covering C.H. Robinson Worldwide. Following the latest round of earnings and company outlook updates, several firms have adjusted their price targets and ratings, providing insight into both the company’s strengths and the risks present in the current environment.

Bullish Takeaways

- Bullish analysts are encouraged by ongoing operating margin expansion and improved profitability. They view these as signs of solid execution and resilience, even as the broader freight market remains challenged.

- Strategic initiatives and a focus on cost discipline are seen as positioning the company defensively in a volatile environment. This contributes to its status as a top sector pick for some investors.

- There is recognition that normalized pricing, regulatory tightening, and potential macroeconomic catalysts may support a rebound in demand. These factors could lay the groundwork for further earnings growth in the coming quarters.

- Raised long-term operating income targets and a constructive management tone suggest confidence in sustained, albeit measured, growth despite current market softness.

Bearish Takeaways

- Bearish analysts point to valuation concerns, citing significant share appreciation already realized since the prior quarter. This may limit further upside in the near term.

- Persistent softness in the truckload and freight markets, along with only modest improvement in sector conditions, could constrain short-term performance and delay a meaningful recovery.

- Cautious estimates and expectations for only gradual margin improvement reflect ongoing uncertainty around demand and pricing power in the logistics and transportation sector.

What's in the News

- C.H. Robinson Worldwide's Board of Directors increased the regular quarterly cash dividend to $0.63 per share, effective January 2026 (Key Developments).

- The company raised its 2026 operating income guidance by $50 million, targeting a new range of $965 million to $1.04 billion despite ongoing market headwinds (Key Developments).

- Between July and September 2025, C.H. Robinson repurchased 958,100 shares for $112.18 million, bringing the total buyback to over 53 percent of the program initiated in 2007 (Key Developments).

- On October 28, 2025, the Board approved a $2 billion increase in the share buyback program (Key Developments).

- The introduction of the Agentic Supply Chain platform uses advanced AI agents to create smarter and more resilient logistics. This aims to provide customers with faster planning, cost savings, and increased supply chain visibility (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from $150.31 to $152.20, reflecting modest upward revisions in expectations.

- Discount Rate has increased from 7.46 percent to 7.76 percent, suggesting a heightened perception of risk or changing market conditions.

- Revenue Growth expectations have edged up from 4.43 percent to 4.51 percent, signaling a marginally stronger growth outlook.

- Net Profit Margin is projected to improve from 3.89 percent to 4.04 percent, indicating anticipated gains in profitability.

- Future P/E Ratio has decreased from 31.87x to 29.31x, which suggests a more attractive valuation based on forward earnings estimates.

Key Takeaways

- AI-driven automation and digital tools are boosting margins, efficiency, and customer retention while supporting scalable growth and market share gains.

- Investments in integrated, data-rich logistics and global expansion position the company to benefit from outsourcing trends and increased supply chain complexity.

- Exposure to trade policy risks, rising technology-driven competition, and dependence on volatile customs revenue threaten sustainable margins and future earnings stability.

Catalysts

About C.H. Robinson Worldwide- Provides freight transportation and related logistics and supply chain services in the United States and internationally.

- Acceleration in AI-driven automation across the full lifecycle of shipments is driving evergreen productivity and efficiency gains, enabling the company to decouple headcount from volume growth and deliver sustained gross margin and operating margin expansion, supporting higher long-term earnings and net margins.

- Scaling of proprietary digital capabilities and deployment of automated, self-serve logistics tools improves data-driven pricing, rapid quote response, and customer supply chain visibility, leading to market share gains and higher wallet share, positively impacting future revenue growth.

- The increasing complexity of global supply chains, driven by tariff volatility and trade uncertainties, is elevating customer demand for integrated, data-rich solutions-areas where C.H. Robinson is investing and expanding-resulting in strong customer retention and a more resilient recurring revenue base.

- Expansion of advanced automation and real-time optimization tools to global forwarding operations is expected to unlock additional productivity and gross margin gains outside the core North American business, supporting further top-line growth and improved overall margins.

- Persistent industry shift toward outsourcing logistics and supply chain management, alongside customer "flight to quality" amid volatility, positions C.H. Robinson to capture incremental market share and deliver above-market revenue and earnings growth as demand recovers.

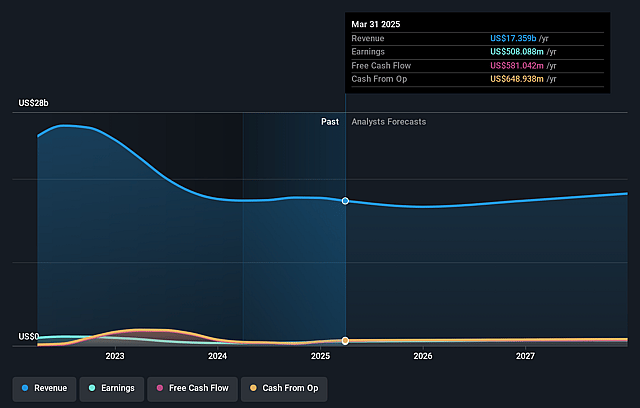

C.H. Robinson Worldwide Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming C.H. Robinson Worldwide's revenue will grow by 2.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.1% today to 3.7% in 3 years time.

- Analysts expect earnings to reach $677.2 million (and earnings per share of $5.82) by about September 2028, up from $534.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.1x on those 2028 earnings, down from 27.9x today. This future PE is greater than the current PE for the US Logistics industry at 16.6x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.37%, as per the Simply Wall St company report.

C.H. Robinson Worldwide Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing uncertainty and volatility in global trade policy, including elevated tariffs and trade negotiations, is making planning and forecasting more difficult for C.H. Robinson and its customers, which could dampen net revenue growth and drive unpredictable earnings volatility if these trade frictions persist or worsen.

- There is increasing democratization of freight brokerage technology-smaller brokers now have easier access to advanced digital tools, which could intensify competition, limit differentiation based on technology, and potentially erode C.H. Robinson's market share and gross margin over time.

- While current profitability gains are supported by process automation and AI-driven workforce reductions, any failure to keep pace with rapid advances in AI, agentic AI, or autonomous supply chain technology (especially if rivals out-innovate C.H. Robinson) could lead to higher operational costs and compress net margins in the longer term.

- Strong recent financial results are partly reliant on the elevated complexity in customs and tariffs, which may be transitory rather than structural; any simplification of global trade or resolution of tariff disputes could reduce the high-margin customs revenue stream, negatively impacting future operating income and earnings quality.

- C.H. Robinson's non-asset-based model limits its control over underlying carrier quality and cost structure; during elongated industry downturns or tightening regulatory environments (e.g., emissions, labor standards), this exposes the company to greater rate volatility and cost inflation that could compress net margins and reduce earnings resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $117.56 for C.H. Robinson Worldwide based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $136.0, and the most bearish reporting a price target of just $71.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $18.4 billion, earnings will come to $677.2 million, and it would be trading on a PE ratio of 25.1x, assuming you use a discount rate of 7.4%.

- Given the current share price of $126.05, the analyst price target of $117.56 is 7.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.