Key Takeaways

- Structural AI-driven automation and digital tools are enabling sustained margin expansion, headcount decoupling, and earnings growth beyond analyst expectations.

- Robust tech innovation, resilient contract wins, and disciplined capital strategies position C.H. Robinson for long-term leadership and shareholder value creation in evolving supply chains.

- Rising industry automation, limited business diversification, shifting global trade, mounting regulatory pressures, and technology democratization collectively threaten C.H. Robinson's margins, growth, and relevance.

Catalysts

About C.H. Robinson Worldwide- Provides freight transportation and related logistics and supply chain services in the United States and internationally.

- While analyst consensus views AI-driven automation as a source of incremental margin expansion and process efficiency, most are dramatically underestimating the scale and durability of operating leverage from C.H. Robinson's structural transformation; management asserts both ongoing evergreen productivity gains and step-function breakthroughs from agentic AI will drive margins materially higher and make double-digit earnings growth sustainable even in soft markets.

- Analysts broadly agree that C.H. Robinson's ability to decouple headcount growth from shipment volume with digital tools is impressive, but consensus still assumes some eventual plateau; in reality, management sees no foreseeable limit, indicating automation and continuous process improvement will eliminate former structural headcount constraints and enable significant incremental margin expansion as volumes return.

- C.H. Robinson is uniquely positioned for the long-term structural shift to supply chain resilience and complexity, as customers increasingly seek flexible global 3PL partners amid ongoing trade disruption, sustained customs volatility, and climate-related events-factors that drive high-margin service adoption, long-term contract wins, and more predictable recurring revenue.

- The rapid scaling and global deployment of Navisphere and differentiated self-serve digital tools both deepen customer reliance and enable C.H. Robinson to monetize tech-enabled value-added services at higher margins, capturing a growing share of global e-commerce logistics and last-mile fulfillment spend.

- The company's strong balance sheet, elevated cash generation, and disciplined capital deployment create significant optionality, with expanding share repurchases, prudent M&A, and the potential for incremental investments in fintech and adjacent logistics solutions, all supporting higher future EPS growth and long-term shareholder value compounding.

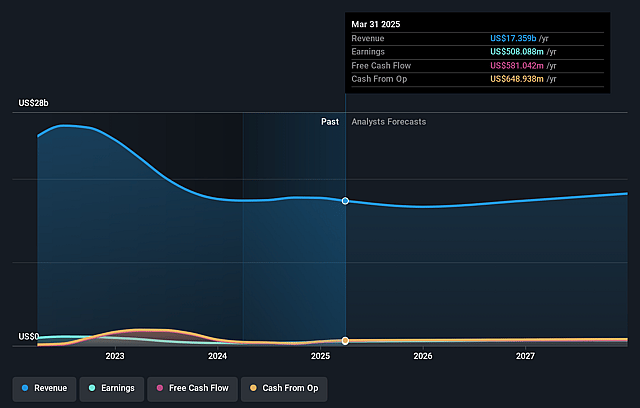

C.H. Robinson Worldwide Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on C.H. Robinson Worldwide compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming C.H. Robinson Worldwide's revenue will grow by 4.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.1% today to 3.9% in 3 years time.

- The bullish analysts expect earnings to reach $770.3 million (and earnings per share of $6.74) by about September 2028, up from $534.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 25.6x on those 2028 earnings, down from 27.9x today. This future PE is greater than the current PE for the US Logistics industry at 16.6x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.37%, as per the Simply Wall St company report.

C.H. Robinson Worldwide Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing rise of automation and AI-enabled start-ups in freight brokerage is intensifying industry commoditization, which threatens to erode C.H. Robinson's competitive advantage and compress pricing power, potentially shrinking long-term net margins and impacting future profitability.

- The company remains highly concentrated in its core North American truckload brokerage business, despite continuous references to growth and productivity within NAST; a failure to materially diversify exposes C.H. Robinson to pronounced freight cycle downturns and heightened earnings volatility.

- Reshoring, nearshoring, and shifting global trade patterns-including persistent uncertainty around tariffs, trade deals, and weaker-than-expected long-haul US import volumes-create structural headwinds for growth in C.H. Robinson's Global Forwarding segment and risk stagnating company-wide revenue expansion.

- As sustainability imperatives accelerate and regulatory pressures around labor and carbon emissions grow, asset-based or more tech-driven competitors could respond faster with green solutions; C.H. Robinson's reliance on a broker-based, non-asset model and legacy operations may leave it disadvantaged, risking loss of market share and escalating operating costs.

- The democratization of brokerage technology enables increasing shipper disintermediation and empowers smaller brokers and shippers to bypass traditional intermediaries; this evolution could shrink C.H. Robinson's intermediary role and sustainable revenue pool as customers move toward direct shipper-carrier arrangements or use self-serve digital tools.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for C.H. Robinson Worldwide is $136.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of C.H. Robinson Worldwide's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $136.0, and the most bearish reporting a price target of just $71.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $19.6 billion, earnings will come to $770.3 million, and it would be trading on a PE ratio of 25.6x, assuming you use a discount rate of 7.4%.

- Given the current share price of $126.05, the bullish analyst price target of $136.0 is 7.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.