- United States

- /

- Transportation

- /

- NasdaqGS:ARCB

A Fresh Look at ArcBest (ARCB) Valuation Following Citigroup’s Analyst Upgrade

Reviewed by Kshitija Bhandaru

ArcBest (ARCB) shares jumped after Citigroup upgraded its rating from Neutral to Buy and highlighted a more positive take on the company’s operational outlook. This shift has quickly sparked new investor interest.

See our latest analysis for ArcBest.

Citigroup’s vote of confidence comes after a challenging stretch for ArcBest, with the stock experiencing a 1-year total shareholder return of -33.65% and its share price down nearly 24% year-to-date. Despite this, momentum may be stirring as the upgrade follows management’s renewed focus on acquisitions and operational improvements. Investors seem keen to see if these strategic moves can turn the tide for long-term performance.

If news like this has you wondering what else is gaining attention, it’s a great opportunity to widen your scope and discover fast growing stocks with high insider ownership

After a tough year and a recent analyst upgrade, the crucial question becomes whether ArcBest’s valuation now signals an attractive entry point or if the market has already baked in expectations for future growth.Most Popular Narrative: 21% Undervalued

The current consensus narrative points to a fair value well above ArcBest's last close, highlighting a disconnect between analyst expectations and today's market price.

Broad deployment of AI-driven optimization tools, such as real-time route and dock management systems, are driving measurable productivity gains and cost savings. These advancements are expected to translate into improved net margins and operational earnings as automation and technology adoption intensify across the industry.

What high-impact forecasts explain this bold target? The playbook includes future profit margins, revenue growth, and a sharp change in earnings expectations, all anchoring the valuation. Curious which numbers tip the scales? Only the full narrative reveals the assumptions behind this fair value.

Result: Fair Value of $88.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing freight market softness and rising labor costs could quickly challenge these optimistic forecasts if industry conditions do not improve soon.

Find out about the key risks to this ArcBest narrative.

Another View: What Do Earnings Multiples Suggest?

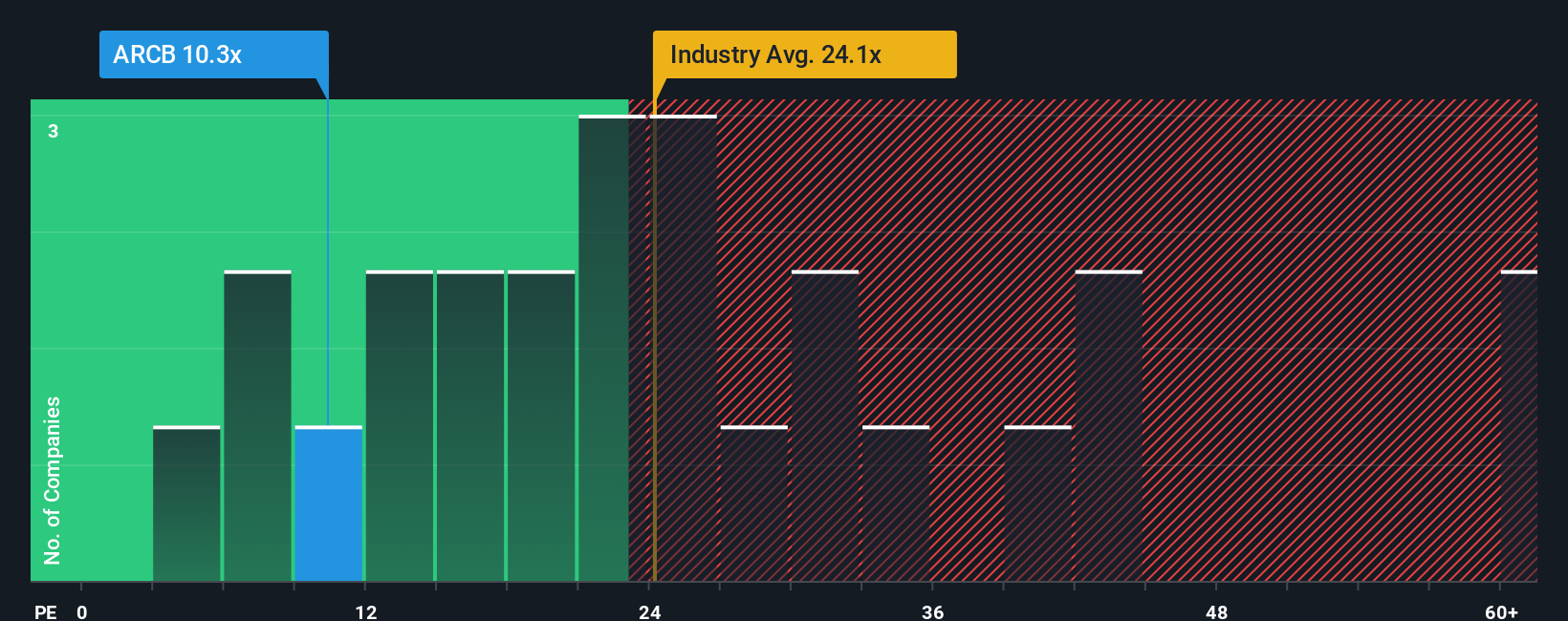

Looking at ArcBest's valuation through the lens of earnings multiples, the current price-to-earnings ratio of 10x stands out as a bargain compared to the US Transportation industry average of 24.9x and peer average of 27.6x. It is also below the fair ratio of 8.8x, suggesting the market is not factoring in much risk. Could this gap signal undervaluation, or does it reflect doubts about future growth momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ArcBest Narrative

If you think there's a different angle or want to dive deeper into the numbers yourself, it's easy to build your own analysis and perspective in just a few minutes. Do it your way

A great starting point for your ArcBest research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Smart investors constantly scan the market for the next edge, and you can, too. The Simply Wall Street Screener makes it effortless to find standout stocks and emerging themes you might otherwise miss.

- Tap into outsized yields and stability by checking out these 19 dividend stocks with yields > 3% which consistently deliver over 3% returns for income-focused investors.

- Uncover tomorrow’s market leaders by reviewing these 898 undervalued stocks based on cash flows that trade below their true worth, before they catch everyone’s attention.

- Position yourself at the forefront of financial innovation with these 79 cryptocurrency and blockchain stocks as digital currency and blockchain technology continue to develop rapidly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARCB

ArcBest

An integrated logistics company, provides ground, air, and ocean transportation solutions worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives