- United States

- /

- Healthcare Services

- /

- NasdaqGM:AIRS

US Growth Companies With High Insider Ownership And 53% Earnings Growth

Reviewed by Simply Wall St

The U.S. stock market has recently seen modest gains, with the S&P 500 and Nasdaq Composite inching higher amid investor anticipation of major tech earnings reports and potential interest rate cuts from the Federal Reserve. In this environment, identifying growth companies with high insider ownership can be particularly rewarding, as these firms often exhibit strong alignment between management and shareholder interests, driving robust earnings growth.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.9% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 24.7% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.6% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.3% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.3% | 98.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 39% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Let's explore several standout options from the results in the screener.

PureCycle Technologies (NasdaqCM:PCT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PureCycle Technologies, Inc. (NasdaqCM:PCT) focuses on producing recycled polypropylene (PP) and has a market cap of $1.28 billion.

Operations: PureCycle Technologies, Inc. generates revenue primarily from the production of recycled polypropylene (PP).

Insider Ownership: 11.1%

Earnings Growth Forecast: 53.7% p.a.

PureCycle Technologies is a growth company with significant insider ownership, focusing on recycling polypropylene waste. Despite a net loss of US$85.61 million in Q1 2024, its revenue is forecast to grow 50% annually, outpacing the market. Recent developments include FDA approval for food-contact applications and successful trials with MiniFIBERS and Beverly Knits. However, the company faces legal challenges with a proposed US$12 million class action settlement pending approval in October 2024.

- Click here to discover the nuances of PureCycle Technologies with our detailed analytical future growth report.

- The valuation report we've compiled suggests that PureCycle Technologies' current price could be inflated.

AirSculpt Technologies (NasdaqGM:AIRS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AirSculpt Technologies, Inc., through its subsidiaries, offers body contouring procedure services in the United States and has a market cap of approximately $273.46 million.

Operations: The company generates revenue primarily from direct medical procedure services, amounting to $197.72 million.

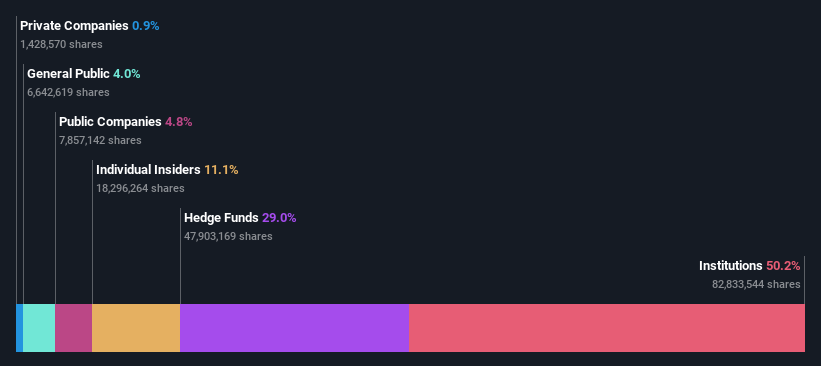

Insider Ownership: 26%

Earnings Growth Forecast: 53.4% p.a.

AirSculpt Technologies, a growth company with high insider ownership, has shown promising financial performance by reporting US$6.03 million in net income for Q1 2024 compared to a net loss last year. Despite being dropped from multiple Russell indexes on July 1, its revenue is forecast to grow 11.9% annually, outpacing the US market's average growth rate. However, the company's share price has been highly volatile and interest payments are not well covered by earnings.

- Get an in-depth perspective on AirSculpt Technologies' performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that AirSculpt Technologies is trading behind its estimated value.

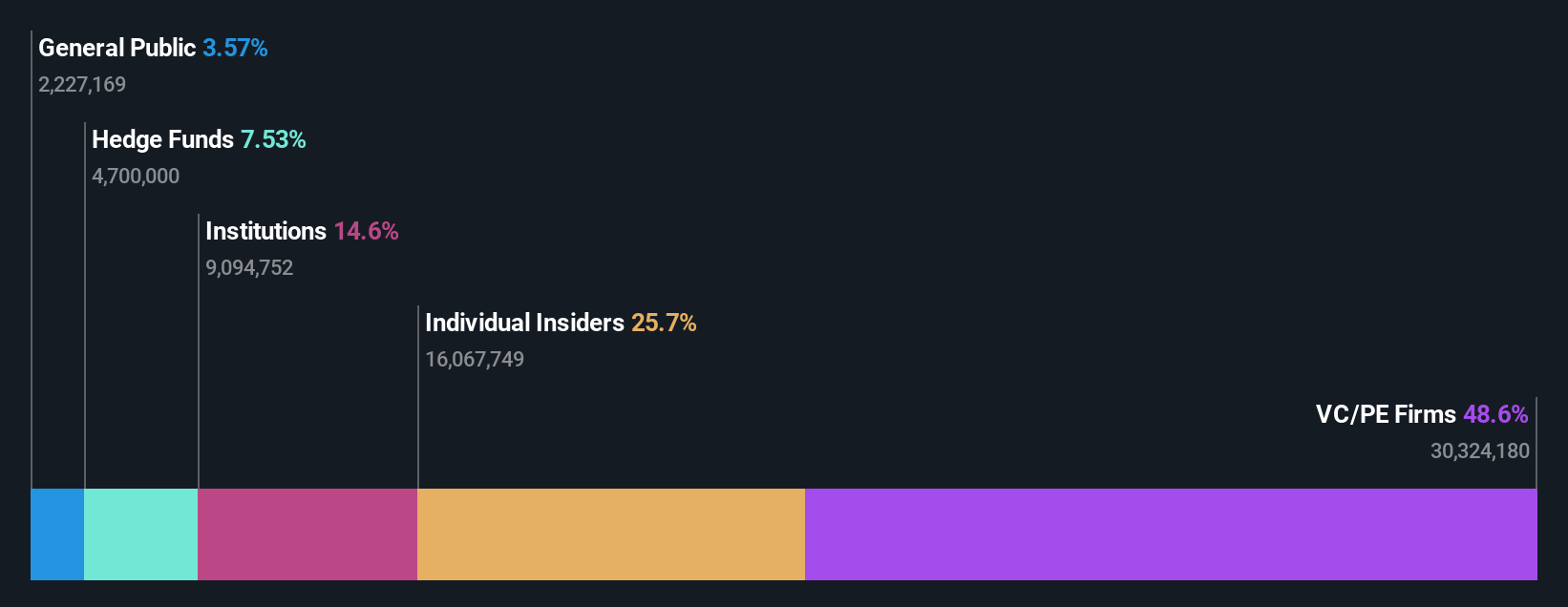

Allegiant Travel (NasdaqGS:ALGT)

Simply Wall St Growth Rating: ★★★★☆☆

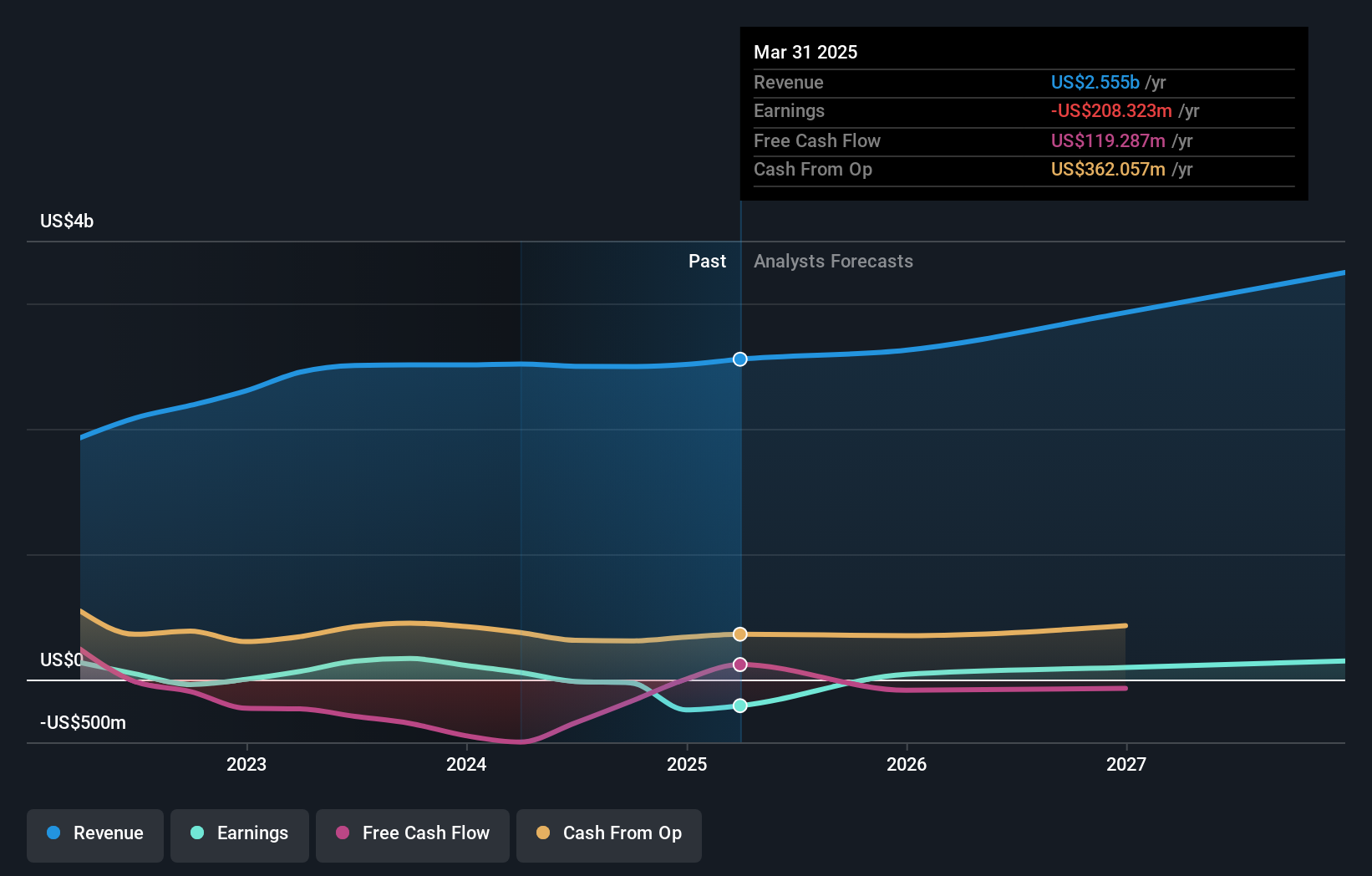

Overview: Allegiant Travel Company, with a market cap of $932.53 million, is a leisure travel company that offers travel services and products to residents of under-served cities in the United States.

Operations: Allegiant Travel's revenue segments include $2.49 billion from its airline operations and $26.77 million from the Sunseeker Resort.

Insider Ownership: 17%

Earnings Growth Forecast: 43% p.a.

Allegiant Travel's earnings are forecast to grow significantly at 43% annually, outpacing the US market. Despite a high debt level and recent drops from multiple Russell indexes, its revenue is expected to grow faster than the market at 9% per year. The company's P/E ratio of 15.9x is below the US market average, indicating potential value. Recent insider buying suggests confidence in future performance despite a low forecasted return on equity of 9.2%.

- Unlock comprehensive insights into our analysis of Allegiant Travel stock in this growth report.

- Our valuation report here indicates Allegiant Travel may be overvalued.

Taking Advantage

- Discover the full array of 184 Fast Growing US Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AIRS

AirSculpt Technologies

Focuses on operating as a holding company for EBS Intermediate Parent LLC that provides body contouring procedure services in the United States.

Moderate growth potential and slightly overvalued.