- United States

- /

- Telecom Services and Carriers

- /

- NYSE:LUMN

Is There Now an Opportunity in Lumen After 17% Rally in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Lumen Technologies stock? You are definitely not alone. Investors have been watching its recent moves closely, trying to figure out if now is the right time to jump in or sit tight. Lumen’s share price has been on a bit of a roller coaster lately, nudging up 0.3% over the past week, and showing a strong 7.2% gain in the last month. Year to date, it's up a remarkable 17.3%, enough to catch anyone’s attention, especially considering it managed a 6.1% rise in the past 12 months despite falling back over three and five years. Notably, some of this renewed optimism is tied to market chatter around telecom infrastructure investment, which has shifted risk perceptions and prompted a fresh look at players like Lumen.

Of course, when the market moves, everyone wants to know if the action is justified. Is Lumen really undervalued, or is the latest run just a blip? By crunching the numbers across six key valuation checks, Lumen scores a 3, which means it is undervalued in exactly half of the metrics we watch. That balanced result suggests there is more under the surface than the price moves alone reveal.

Next, we will break down the valuation approaches that matter most in assessing Lumen’s true worth. Stick around, because we will also explore an even smarter way to weigh value that could make all the difference in how you see the stock.

Why Lumen Technologies is lagging behind its peers

Approach 1: Lumen Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a standard way to value businesses by projecting future cash flows and then discounting those figures back to today's value. In essence, it helps investors understand what a company is really worth based on expected future earnings, not just recent price movements.

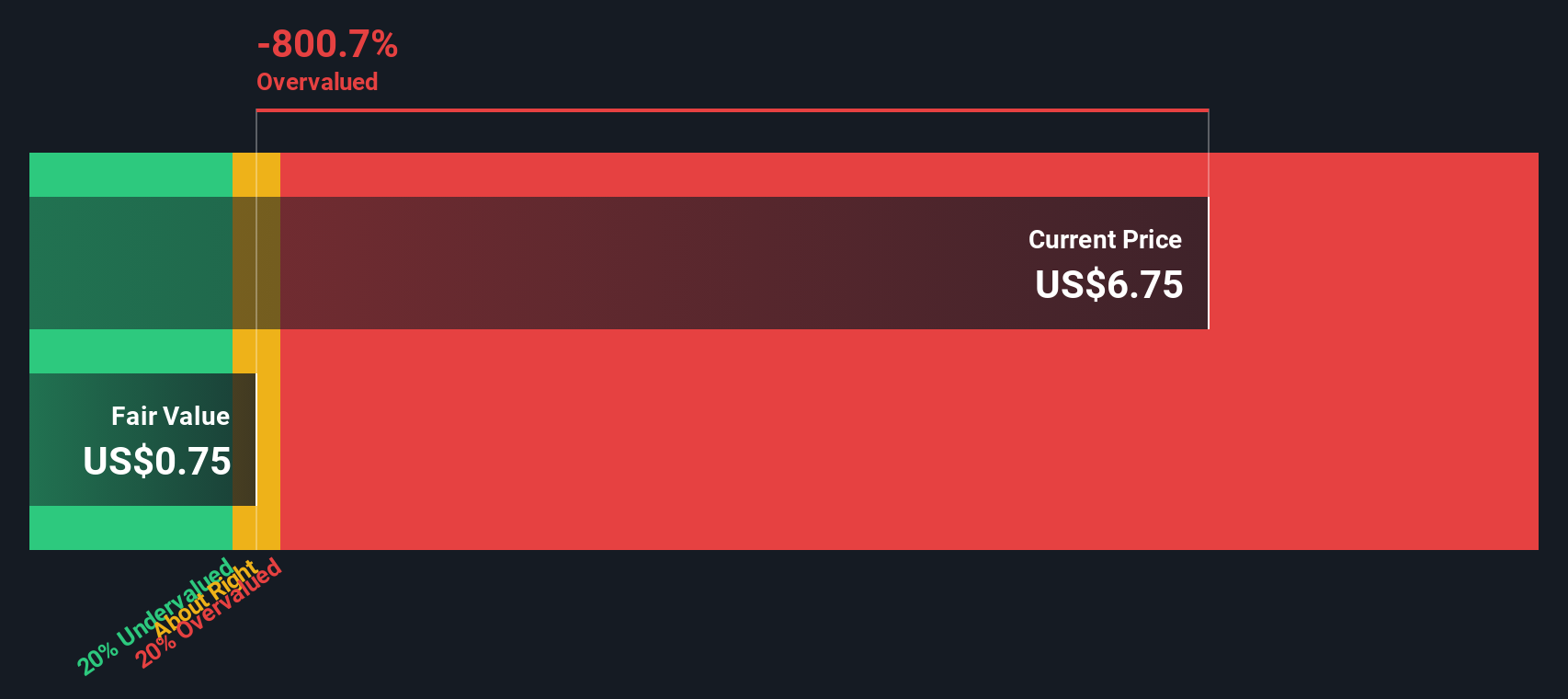

For Lumen Technologies, the DCF analysis uses a 2 Stage Free Cash Flow to Equity model. Currently, the company is generating around $1.44 billion in Free Cash Flow (FCF). However, projections tell a challenging story: analysts estimate Lumen’s FCF will drop to $116 million by the end of 2029, and the next five years show declines rather than robust growth. Beyond what analysts forecast, further projections are extrapolated, but the near-term figures are what matter most for a realistic valuation.

Based on this DCF model, the intrinsic value per share comes out to about $0.76. Compared with the current share price, that figure signals a steep disconnect. According to this method, the stock is overvalued by around 766%.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lumen Technologies may be overvalued by 765.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Lumen Technologies Price vs Sales (P/S)

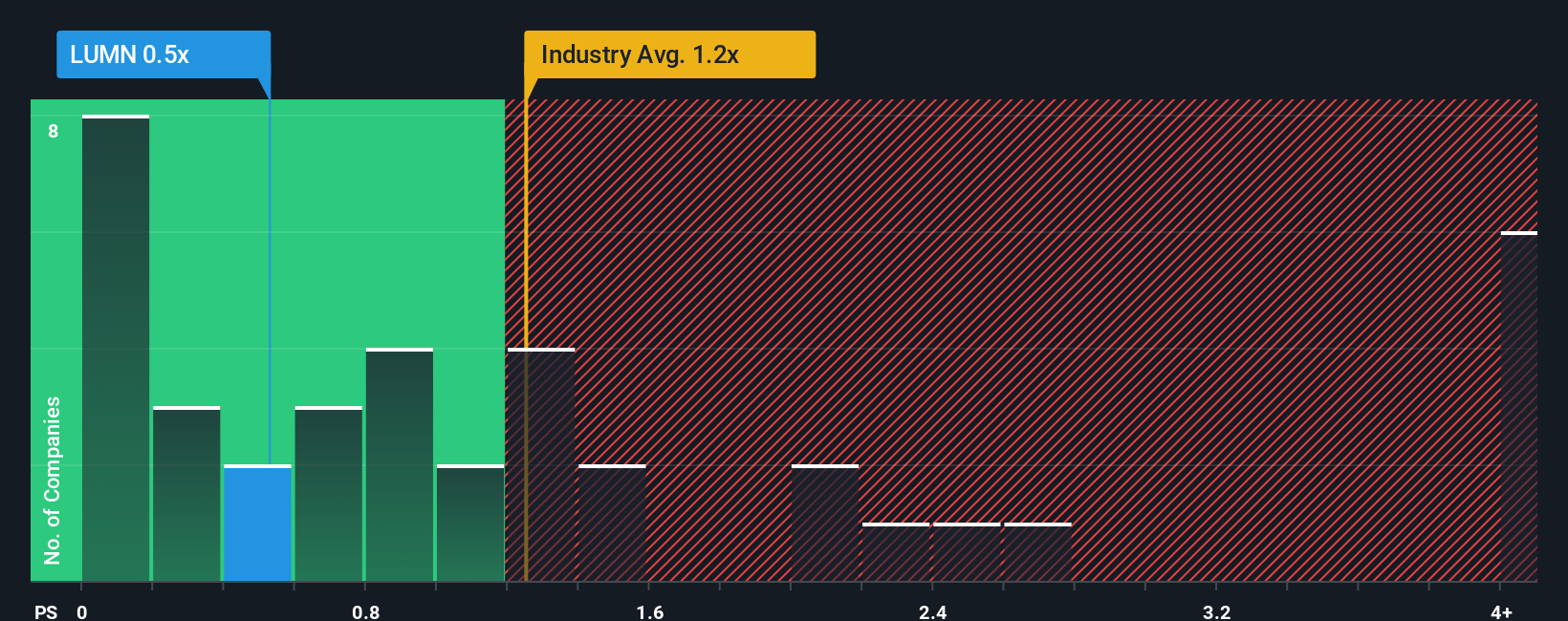

The Price-to-Sales (P/S) ratio is often a good choice when valuing companies that are not currently profitable or have volatile earnings. For companies like Lumen Technologies, which has experienced inconsistent profits, the P/S ratio provides a clearer comparison based on revenue instead of earnings that might swing dramatically year to year.

Typically, a “normal” or “fair” P/S multiple should reflect the company’s growth prospects and the level of risk in its business. Fast-growing companies or those with more stable operations often merit a higher P/S, while businesses facing greater uncertainty tend to be valued at lower multiples by the market.

Right now, Lumen trades at a P/S ratio of 0.53x. This is well below the Telecom industry average of 1.25x and also much lower than the peer group average of 5.89x. At first glance, it appears the market is pricing Lumen at a steep discount to its sector and competitors.

Instead of just comparing to averages, Simply Wall St’s proprietary “Fair Ratio” takes a more sophisticated approach. It factors in Lumen’s earnings growth, profit margin, unique risks, company size, and industry outlook. This makes it a better benchmark for valuation, since relying on broad averages can be misleading. Individual company fundamentals often diverge from the group.

Lumen’s “Fair Ratio” for P/S stands at 0.96x, which is slightly above its actual P/S. Since the difference between the fair and actual P/S ratios is less than 0.10, the stock appears fairly valued by this method and is trading roughly where it should be in the current environment.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lumen Technologies Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply a concise story or viewpoint that connects your ideas about a company, such as what you expect for its future earnings, margins, and growth, to a financial forecast and a clear fair value estimate. Narratives put you in the driver’s seat, letting you apply your perspective behind the numbers instead of relying solely on formulas or market consensus. On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to articulate their outlook and instantly see how their thesis stacks up, compare their calculated Fair Value with the real-time share price, and guide buy or sell decisions accordingly. Because Narratives are dynamic, they update automatically as new information or results are announced, helping you keep your story for Lumen Technologies relevant and realistic. For example, one Narrative for Lumen might project a bullish turnaround, setting fair value as high as $8.33 if you believe next-gen network contracts will spark lasting growth. Another Narrative projects a more cautious scenario, with fair value as low as $2.00, reflecting concerns over debt and shrinking legacy businesses. This demonstrates how the same data can support very different investment decisions depending on your story.

Do you think there's more to the story for Lumen Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUMN

Lumen Technologies

A networking company, provides integrated products and services to business and mass customers in the United States and internationally.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives