Why IHS Holding (IHS) Is Up 5.9% After Turning Profitable and Raising 2025 Revenue Guidance

Reviewed by Simply Wall St

- IHS Holding Limited recently reported a shift to net profit for the second quarter and first half of 2025, alongside revising its full-year 2025 revenue guidance upward to US$1.70 billion–US$1.73 billion.

- This turnaround in earnings performance marks a departure from significant net losses in the previous year, highlighting ongoing improvements in operational efficiency and revenue quality.

- We will examine how IHS Holding's boosted revenue outlook and profitability transformation could reshape its investment narrative and future prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

IHS Holding Investment Narrative Recap

To be a shareholder in IHS Holding, you need to believe in the enduring demand for shared communications infrastructure across emerging markets, especially as mobile data usage and next-generation wireless rollouts accelerate in regions like Nigeria and Brazil. The recent swing to net profitability and an upward revision in revenue guidance could bolster confidence in near-term earnings momentum, but the most important catalyst remains resilient tenancy growth, while persistent currency risk, particularly Naira weakness, still poses the biggest short-term threat to reported financials. The impact of recent results and guidance upgrades is positive for sentiment, but does not materially change the ongoing currency exposure risk.

Among the latest announcements, the renewal of all Nigerian Master Lease Agreements with MTN Nigeria until December 2032, covering approximately 13,500 tenancy contracts, stands out. This renewal is especially relevant since customer concentration risk and contract stability are major drivers of revenue visibility and margin strength, directly addressing what many see as a key catalyst for the company's recurring cash flows and potential for improved capital discipline.

However, despite growing profitability, investors should be aware of how continued, sharp Naira depreciation could quickly erode local-currency revenue gains and...

Read the full narrative on IHS Holding (it's free!)

IHS Holding's outlook anticipates $2.0 billion in revenue and $257.6 million in earnings by 2028. This reflects a 4.1% annual revenue growth rate and a $146.7 million increase in earnings from the current $110.9 million.

Uncover how IHS Holding's forecasts yield a $8.96 fair value, a 27% upside to its current price.

Exploring Other Perspectives

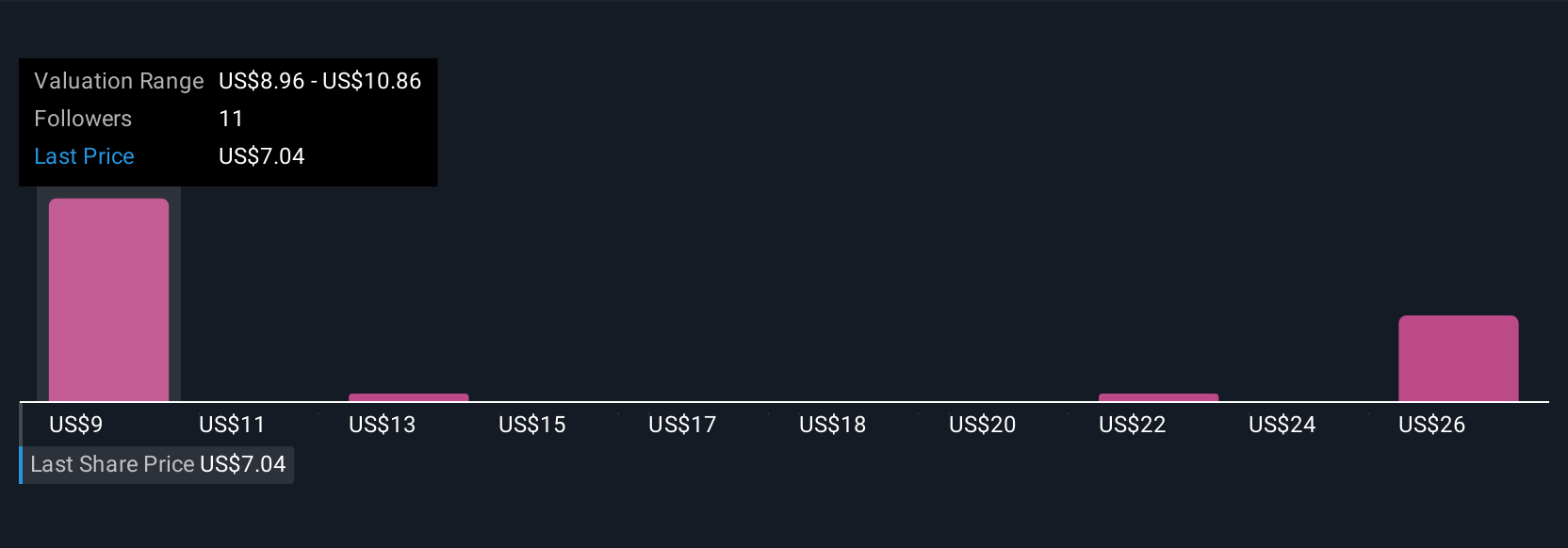

Five private investors in the Simply Wall St Community estimate IHS Holding's fair value between US$8.96 and US$28.15 per share. The persistent risk of currency devaluation in core markets makes it vital to understand why opinions differ so widely on future performance.

Explore 5 other fair value estimates on IHS Holding - why the stock might be worth over 3x more than the current price!

Build Your Own IHS Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IHS Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free IHS Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IHS Holding's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IHS

IHS Holding

Develops, owns, and operates shared communications infrastructure in Nigeria, Sub-Saharan Africa, the Middle East and North Africa, and Latin America.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives