Undiscovered Gems in the United States to Explore This October 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.2%, contributing to a substantial 32% increase over the past year, with earnings forecasted to grow by 16% annually. In this thriving environment, identifying stocks that combine strong fundamentals with potential for growth can uncover promising opportunities worth exploring.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| QDM International | 36.42% | 107.08% | 78.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Apogee Enterprises (NasdaqGS:APOG)

Simply Wall St Value Rating: ★★★★★★

Overview: Apogee Enterprises, Inc. specializes in providing architectural products and services for building enclosures and offers glass and acrylic solutions for preservation and enhanced viewing across the United States, Canada, and Brazil, with a market cap of approximately $1.71 billion.

Operations: Apogee Enterprises generates revenue primarily through its Architectural Framing Systems and Architectural Services segments, contributing $553.30 million and $397.99 million respectively. The Architectural Glass segment adds $363.96 million, while the Large-Scale Optical segment contributes $94.16 million to the overall revenue stream.

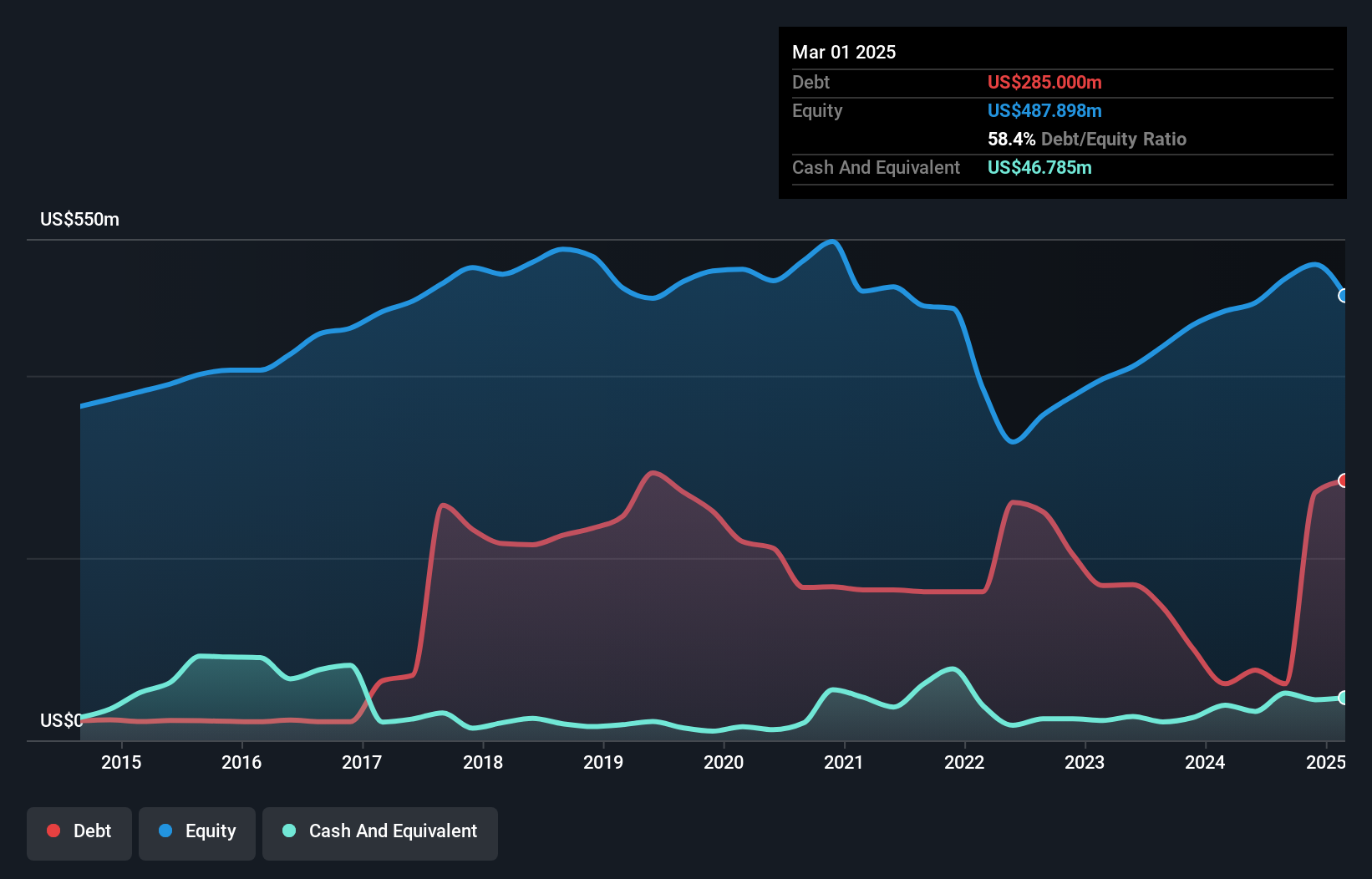

Apogee Enterprises, a small-cap player in the building industry, shows promising financial health with a debt-to-equity ratio dropping from 54.2% to 12.2% over five years and an impressive EBIT coverage of interest payments at 39.5x. Its price-to-earnings ratio stands at 16.2x, below the US market average of 18.2x, suggesting potential value for investors. Despite recent insider selling and earnings growth lagging behind industry rates, Apogee's free cash flow remains positive and robust buyback activity underscores confidence in its stock value.

- Dive into the specifics of Apogee Enterprises here with our thorough health report.

Understand Apogee Enterprises' track record by examining our Past report.

IDT (NYSE:IDT)

Simply Wall St Value Rating: ★★★★★★

Overview: IDT Corporation offers communications and payment services across the United States, the United Kingdom, and internationally, with a market capitalization of approximately $1.18 billion.

Operations: IDT Corporation generates revenue through its primary segments: Traditional Communications ($899.60 million), Fintech ($120.70 million), Net2phone ($82.30 million), and National Retail Solutions (NRS) ($103.10 million). The Traditional Communications segment is the largest contributor to its revenue streams, followed by Fintech and NRS.

IDT Corporation stands out with its debt-free status, trading at 72.7% below estimated fair value, and showing impressive earnings growth of 59.2% over the past year, far surpassing the Telecom industry’s -18.2%. The company reported a net income increase to US$64.45 million from US$40.49 million last year, alongside a basic EPS rise to US$2.55 from US$1.59. Despite significant insider selling recently, IDT repurchased 94,314 shares for US$3.4 million this year as part of an ongoing buyback program initiated in 2016.

- Delve into the full analysis health report here for a deeper understanding of IDT.

Explore historical data to track IDT's performance over time in our Past section.

Moove Lubricants Holdings (NYSE:MOOV)

Simply Wall St Value Rating: ★★★★☆☆

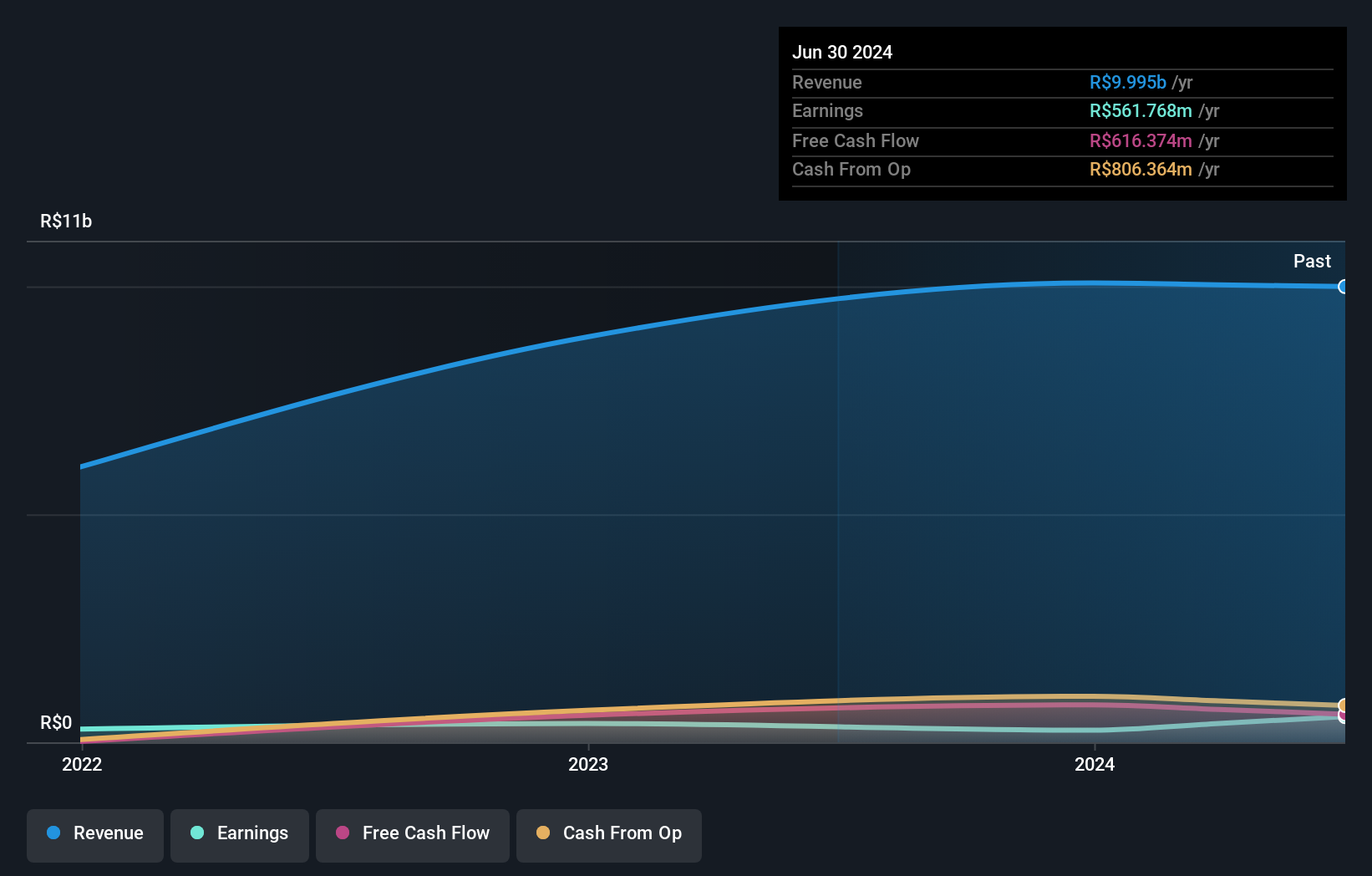

Overview: Moove Lubricants Holdings operates in the formulation, manufacturing, distribution, marketing, selling, and servicing of lubricant products across South America, North America, and Europe with a market cap of $1.78 billion.

Operations: Moove Lubricants Holdings generates revenue primarily from its operations in South America (R$4.66 billion), Europe (R$2.97 billion), and North America (R$2.36 billion).

Moove Lubricants Holdings, a smaller player in the market, has shown impressive earnings growth of 65% over the past year, outpacing the broader Chemicals industry which saw a -4.8% change. Despite its high net debt to equity ratio of 143.4%, Moove's interest payments are well-covered by EBIT at 8.5 times coverage, indicating sound financial management. The company recently filed for a $100 million IPO, suggesting potential expansion plans on the horizon.

- Take a closer look at Moove Lubricants Holdings' potential here in our health report.

Learn about Moove Lubricants Holdings' historical performance.

Key Takeaways

- Click this link to deep-dive into the 221 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IDT

IDT

Provides communications and payment services in the United States, the United Kingdom, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives